Embed powerful invoicing. Help your clients get paid on time

Revenue collection is the biggest pain for businesses – help your clients get paid 3x faster with a robust invoicing workflow. Compliant invoices, reminders, payment links, cash advance, and more. Integrate with 2 developers in 2 weeks

Get demo

Backed by

execs from

Dozens of platforms trust Monite:

SMEs struggle with revenue collection

-

87% of SMEs are consistently paid late

Disrupting cash flow and limiting opportunities to reinvest revenue.

-

48% of SMEs lose or miss invoices constantly

Directly resulting in loss of revenue.

-

50% of SMEs spend 7+ hours per week chasing late payments

Distracting employees from their core business operations

-

12% of SMEs hire someone to chase late payments full-time

Wasting resources on FTEs that could be strategically invested in staff who drive business growth

-

SMEs waste 3.6 h/week on manual reconciliation

Leading to unnecessary costs and potential inaccuracies due to human error

-

71% of SMEs have disconnected invoicing and accounting systems

Resulting in excess manual work and a lack of real-time financial insight

How adding invoicing supercharges

revenue

-

Payment fees

Let users pay within your interface and earn up to 1% per invoice

-

SaaS fees

Charge 15-150$/mo for AP Automation functionality

-

Revenue share

Upsell customers with BNPL/financing and get a revenue share

Features

Offer all the features your clients

need

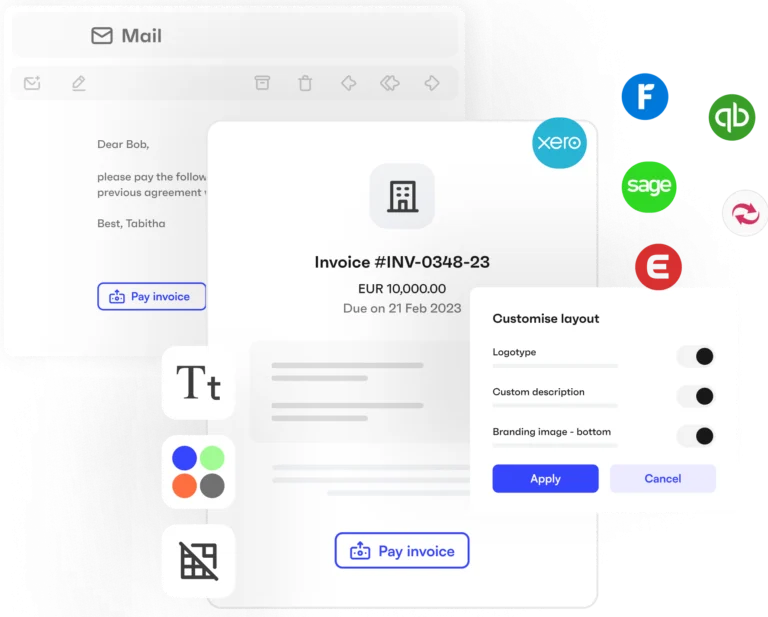

Customizable invoices

Your clients can create their own design or pick templates, colors, and upload their logo

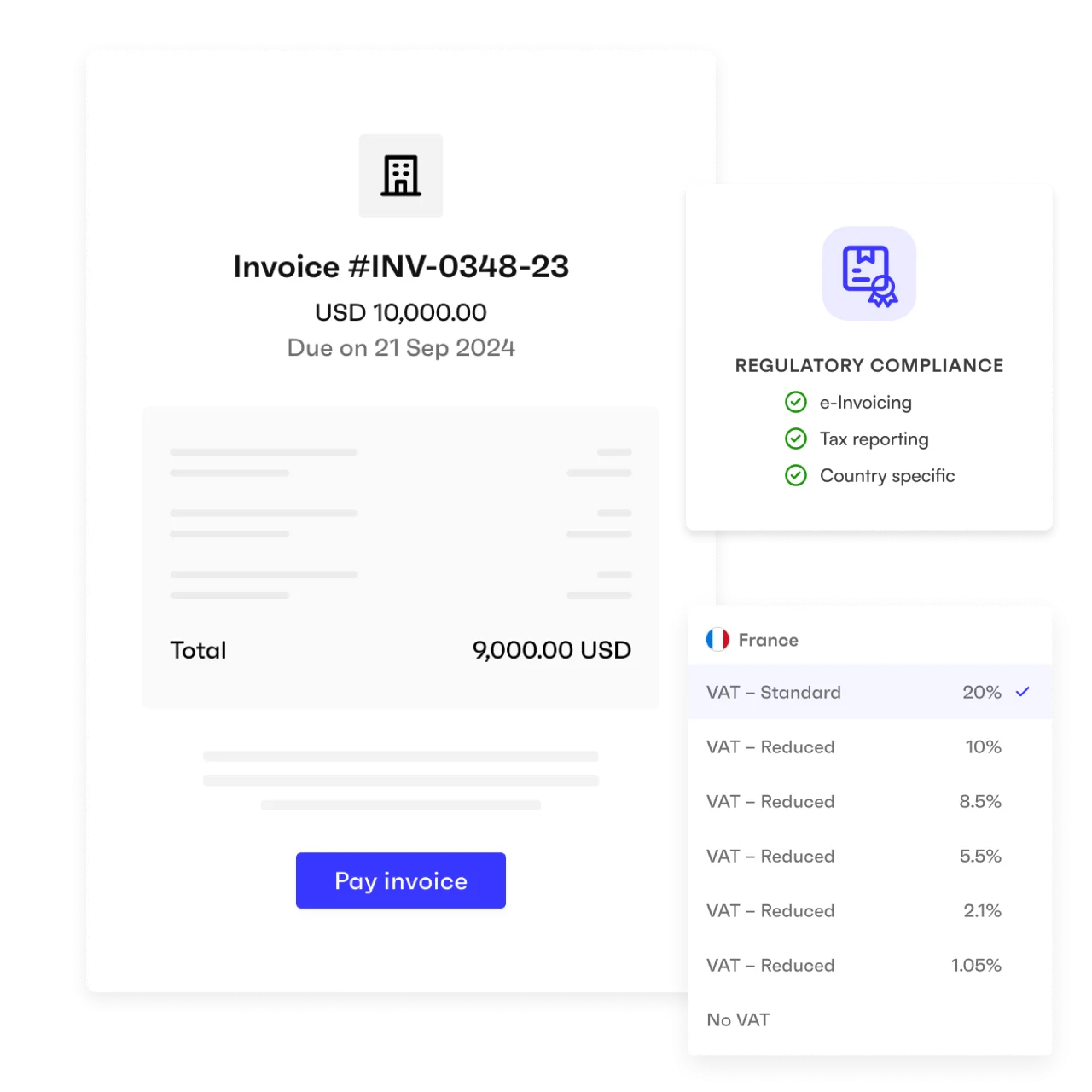

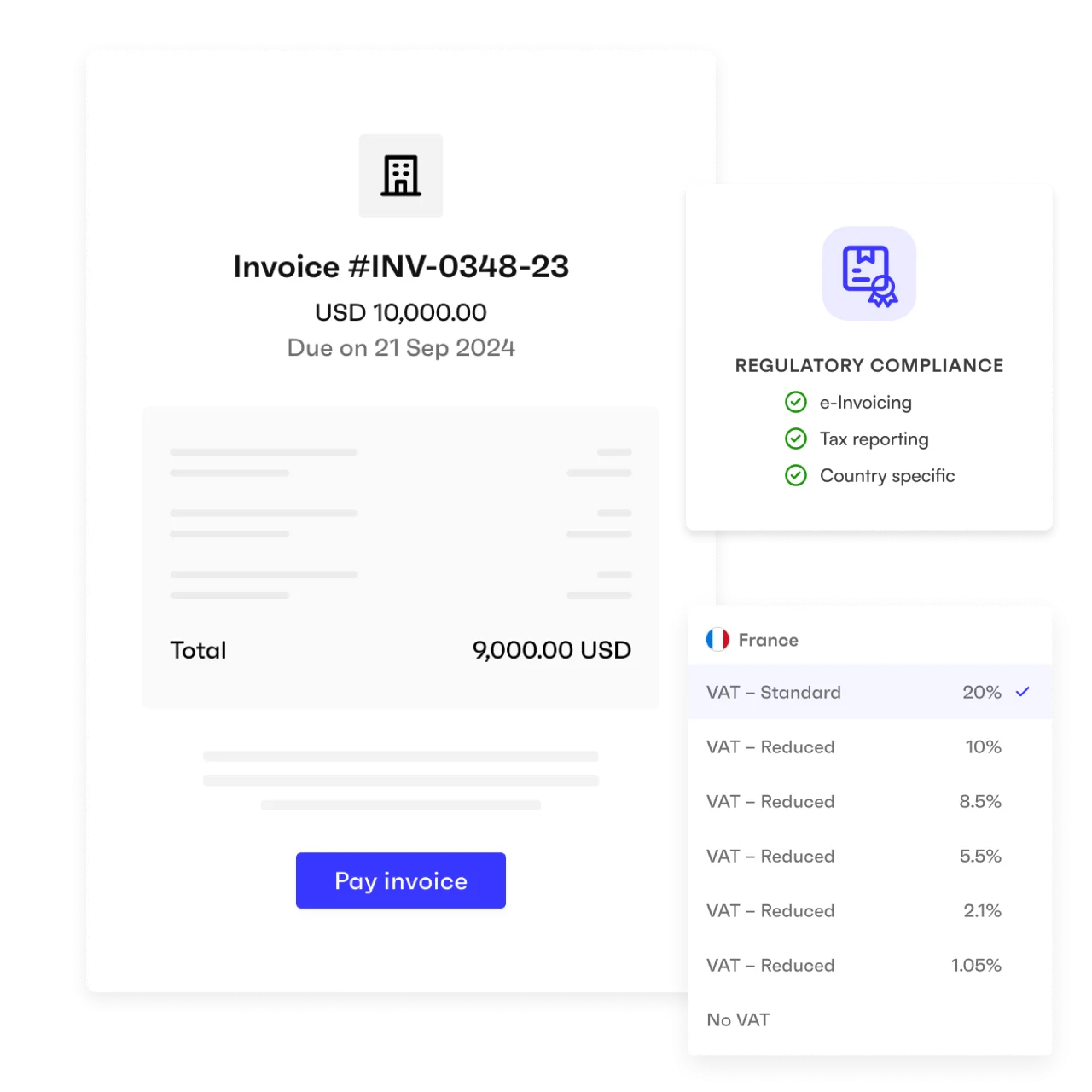

Fully compliant in 25+ regions

Regional compliance is covered for quotes and invoices. E-invoicing connectivity is included

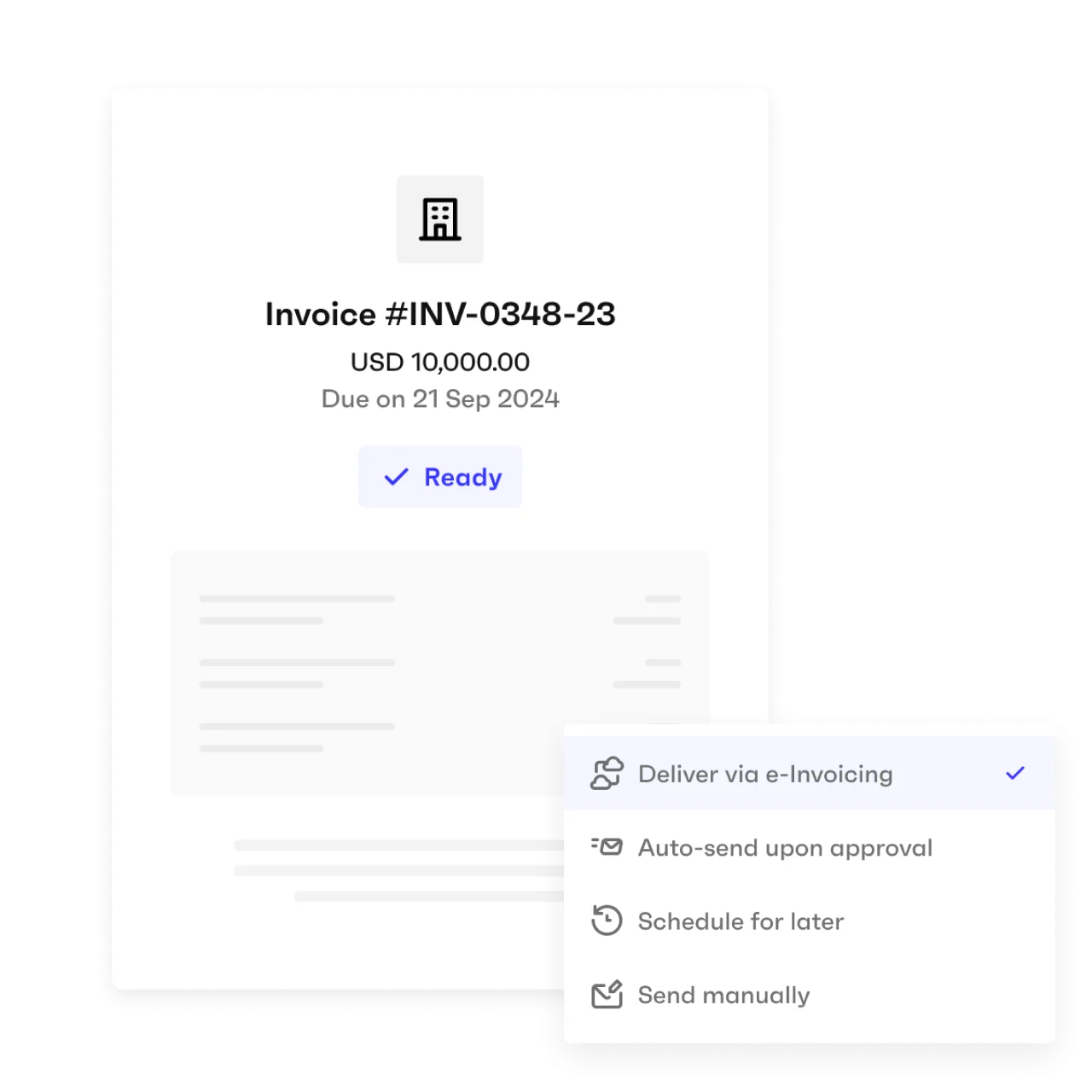

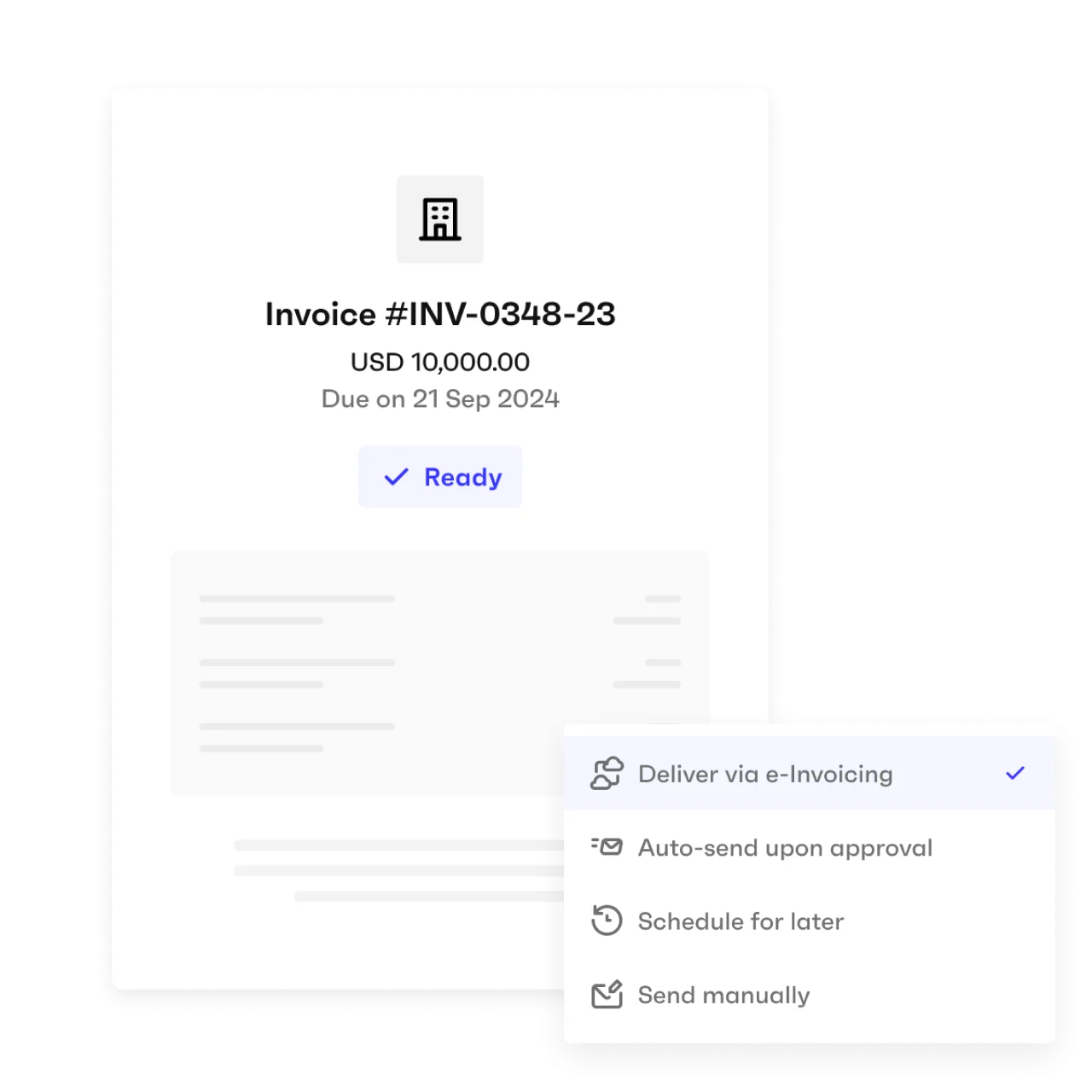

One-click send

Your clients can send invoices right when they complete jobs or schedule them for a specific date.

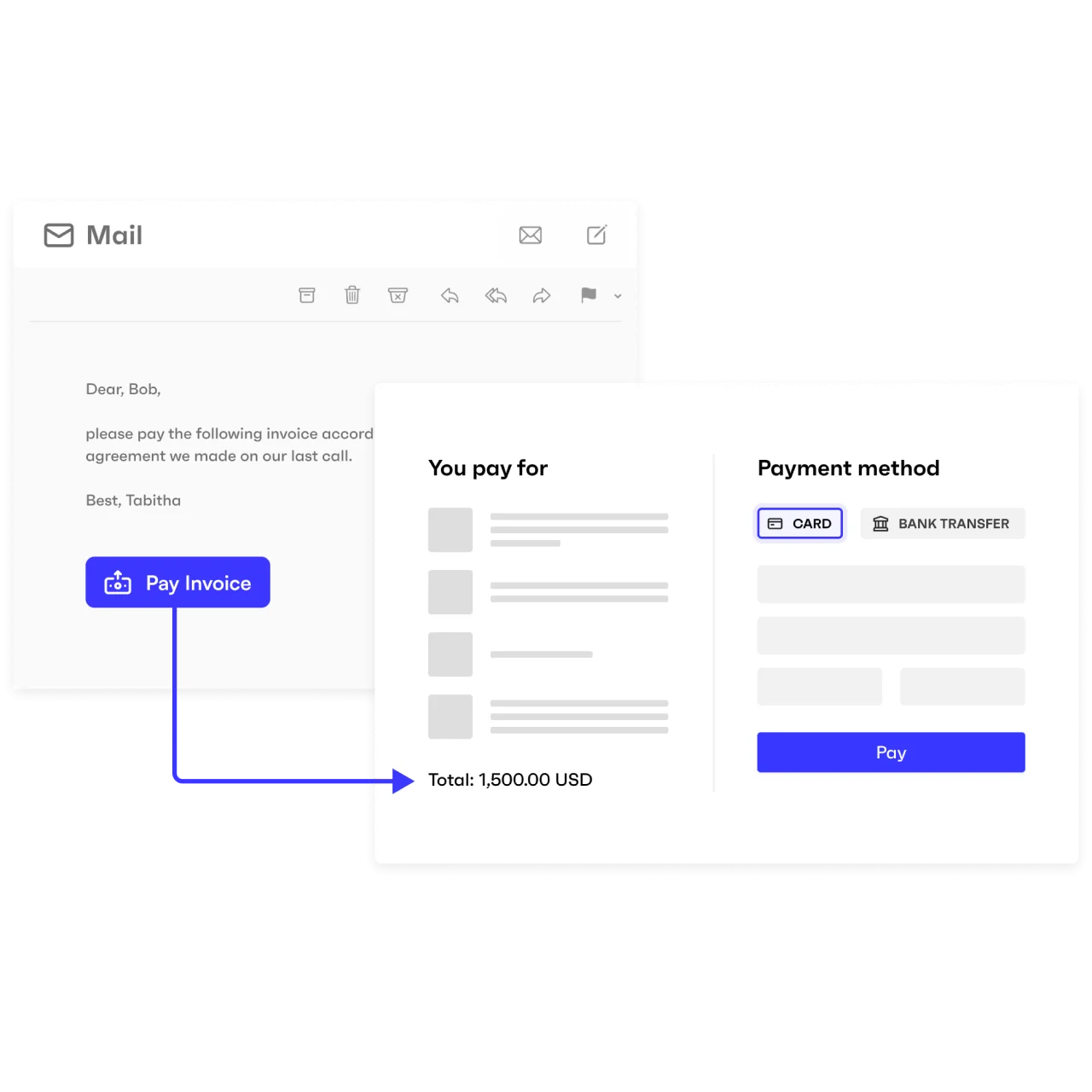

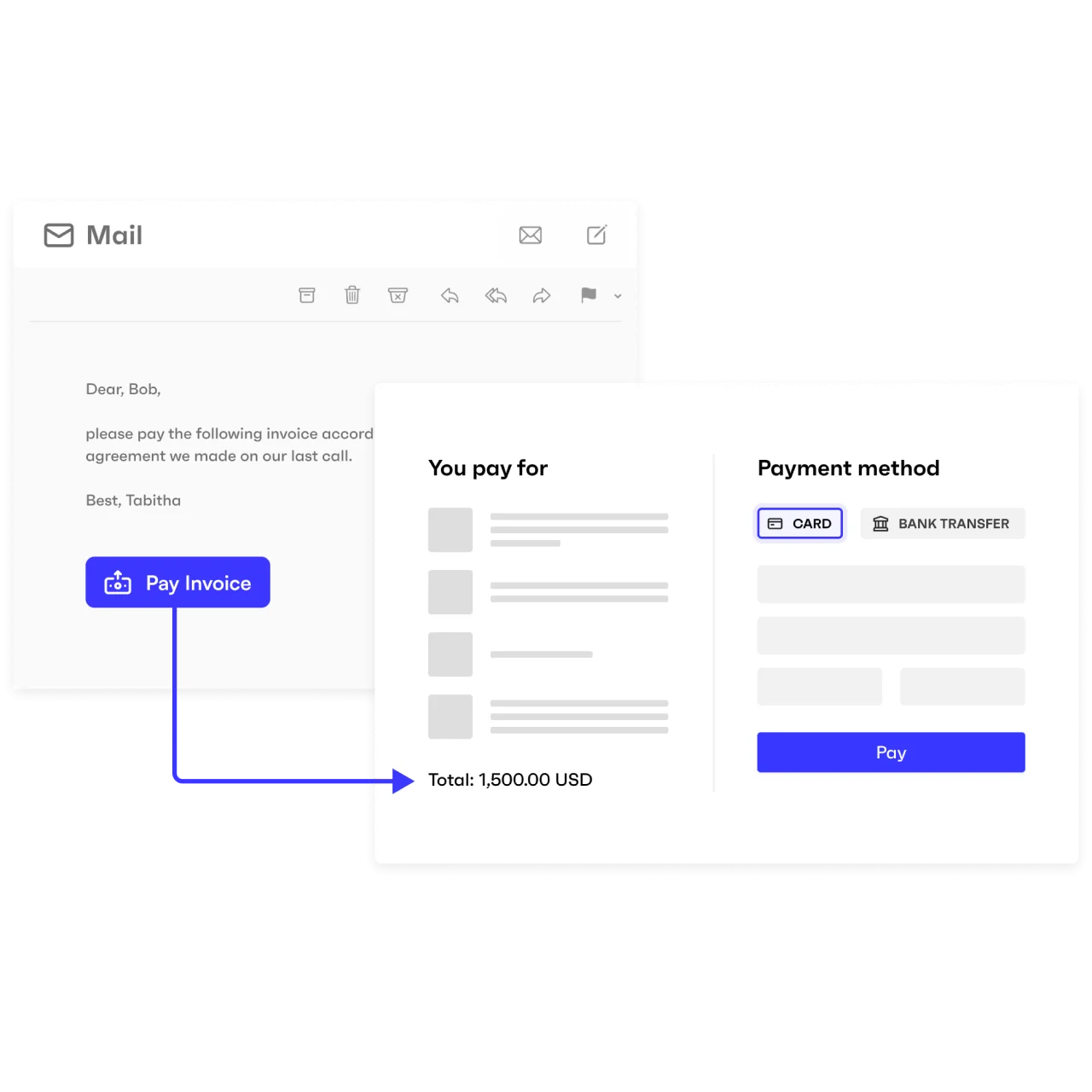

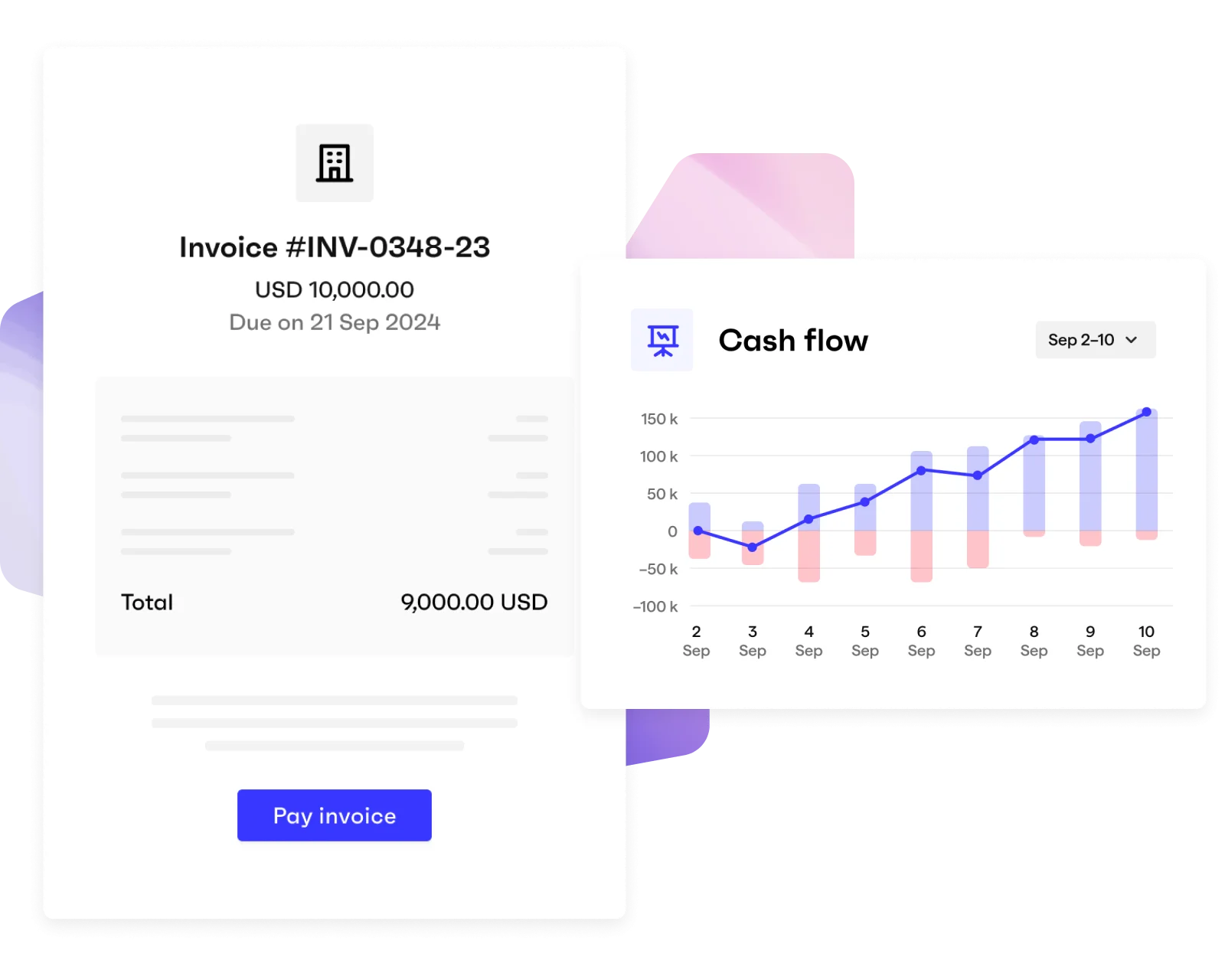

Getting paid fast

Every invoice is sent with a payment link that can be paid online by card, bank transfer, or other methods

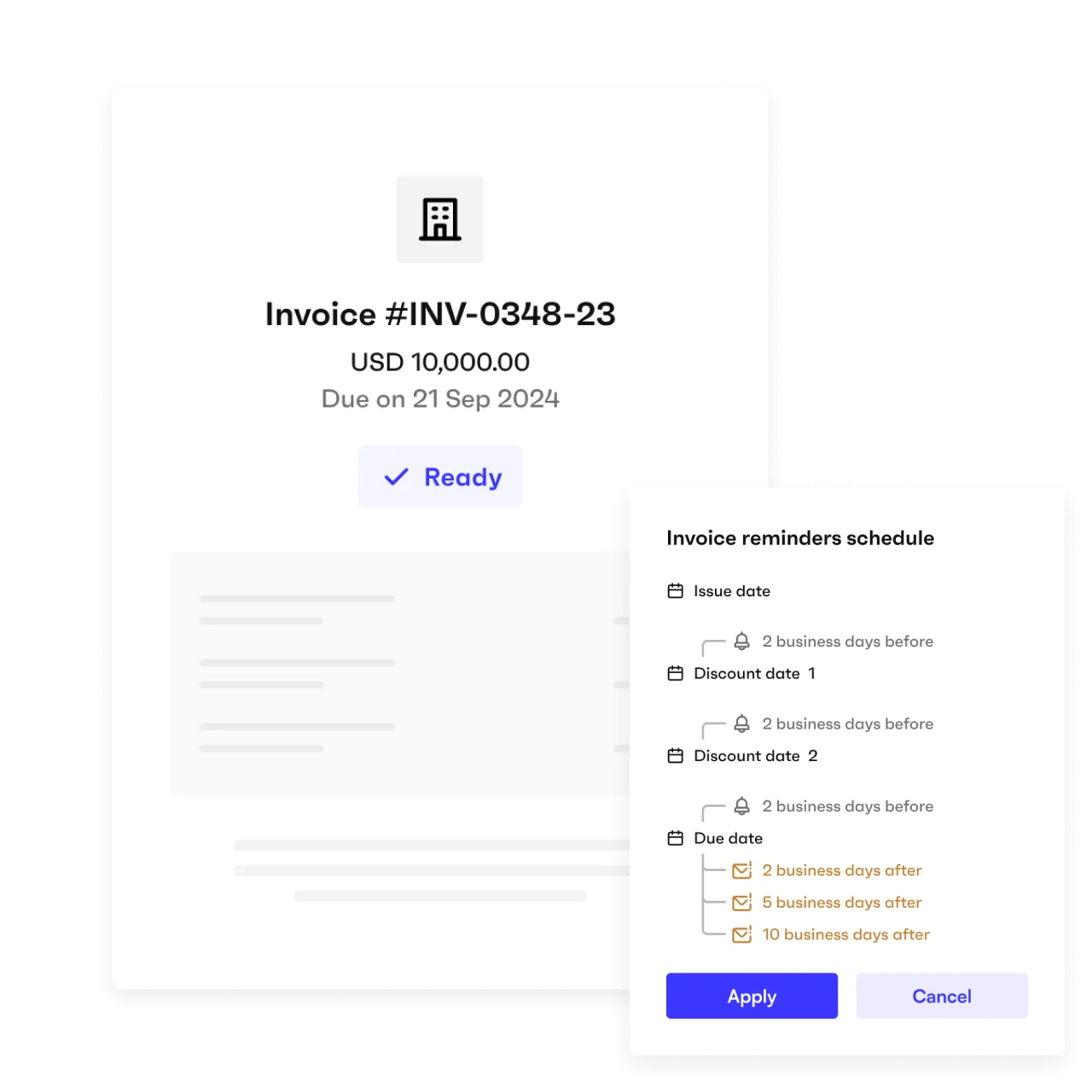

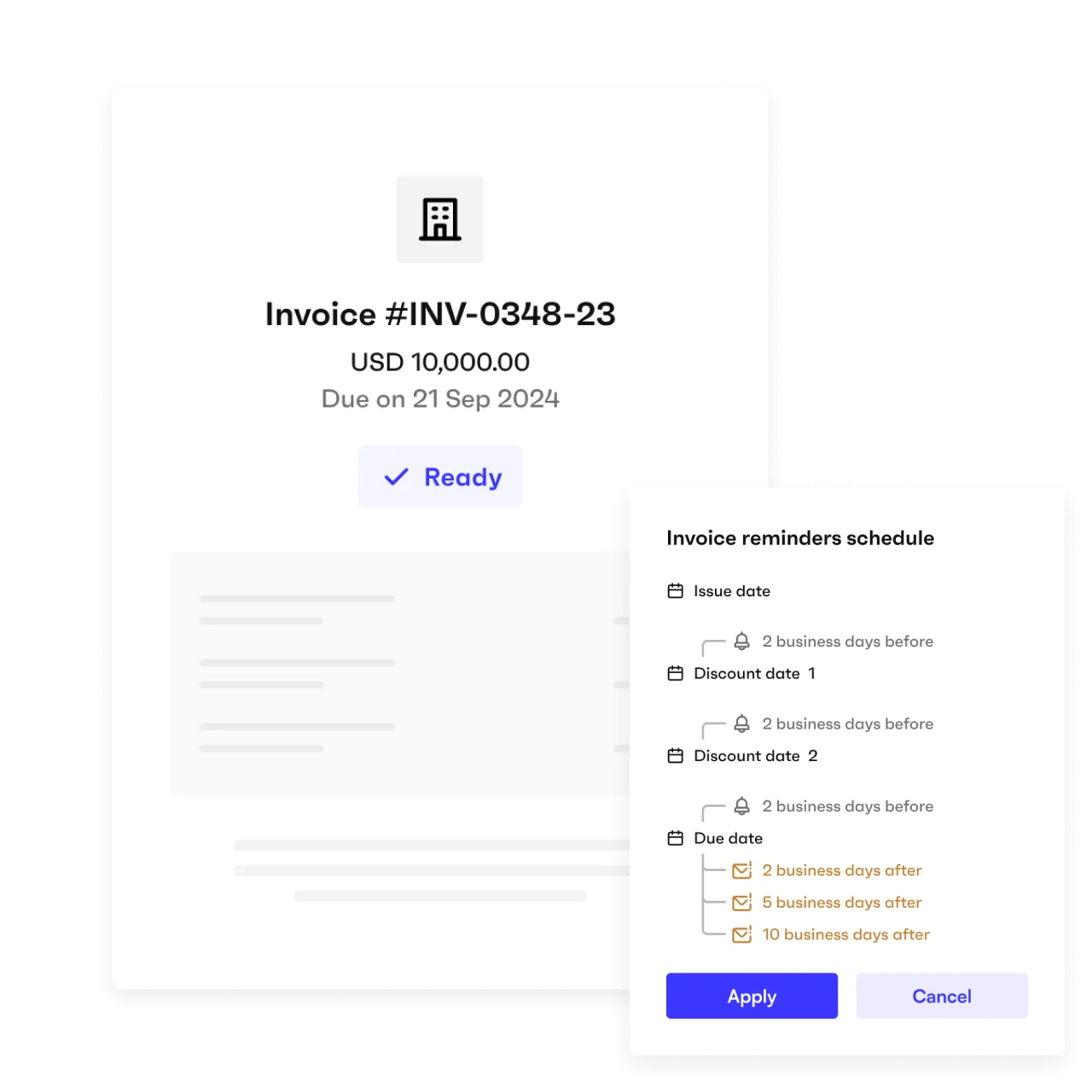

Automated reminders

Your customers can set up automatic reminders to stop chasing unpaid invoices.

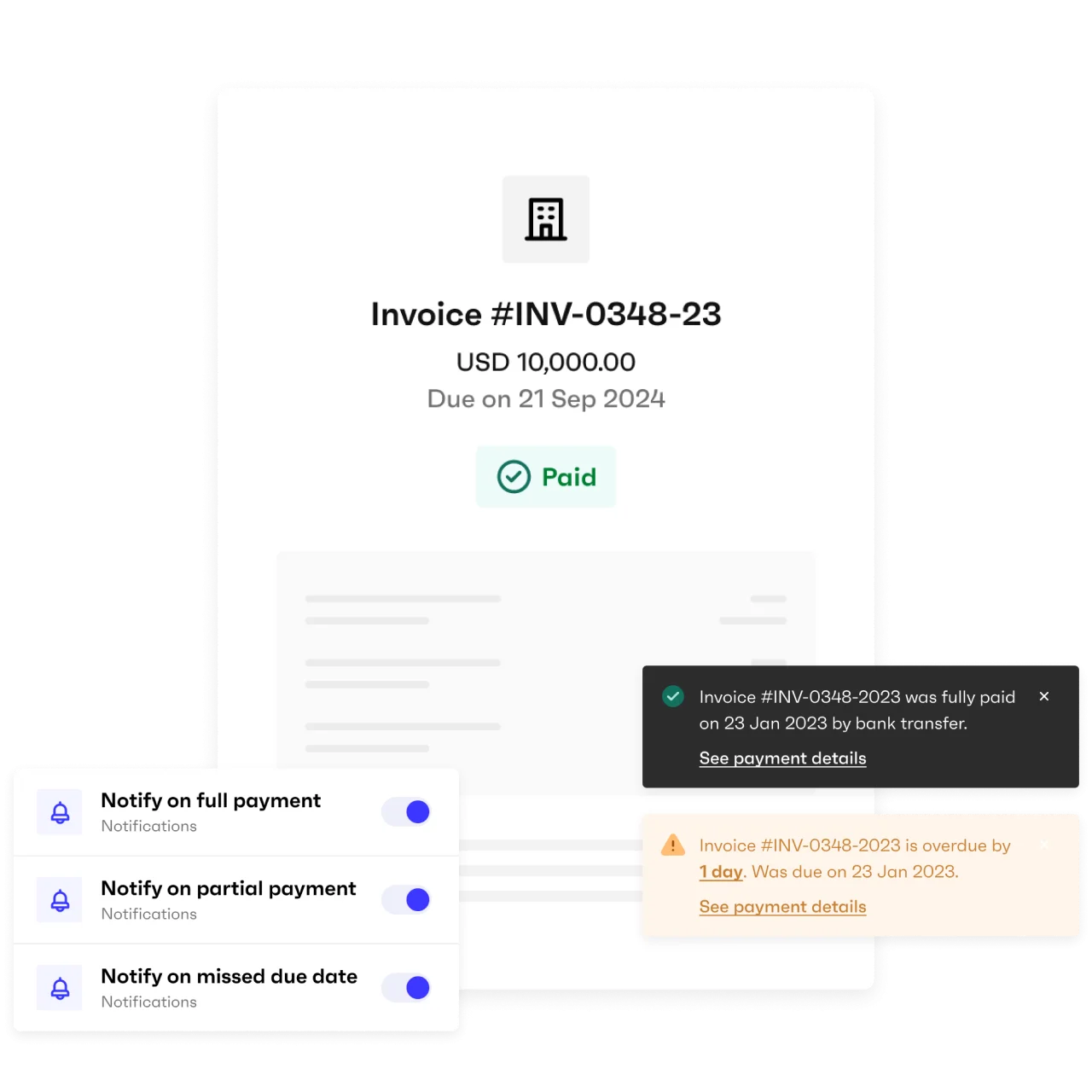

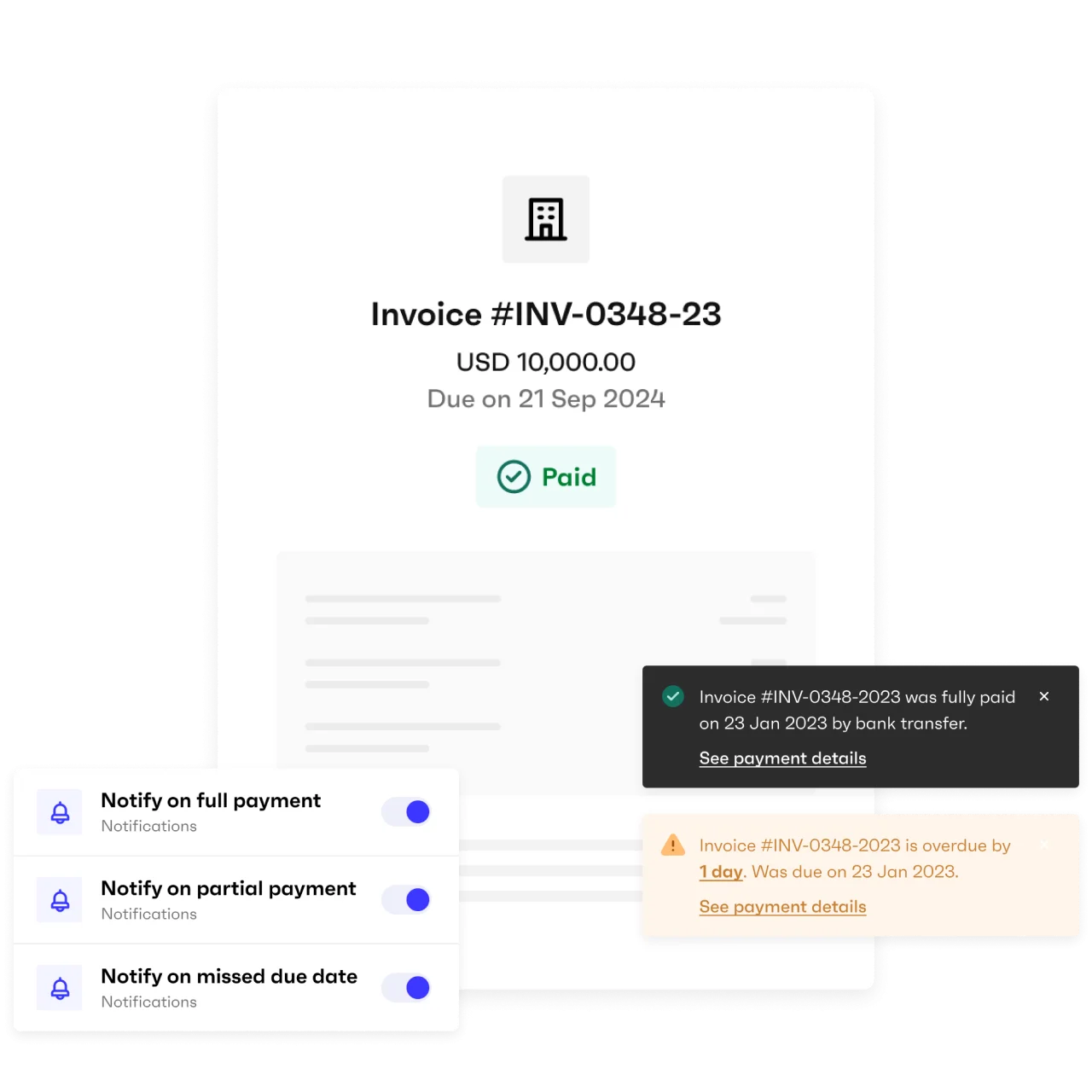

Notifications for important events

Notify clients when invoices are paid, past due, and more

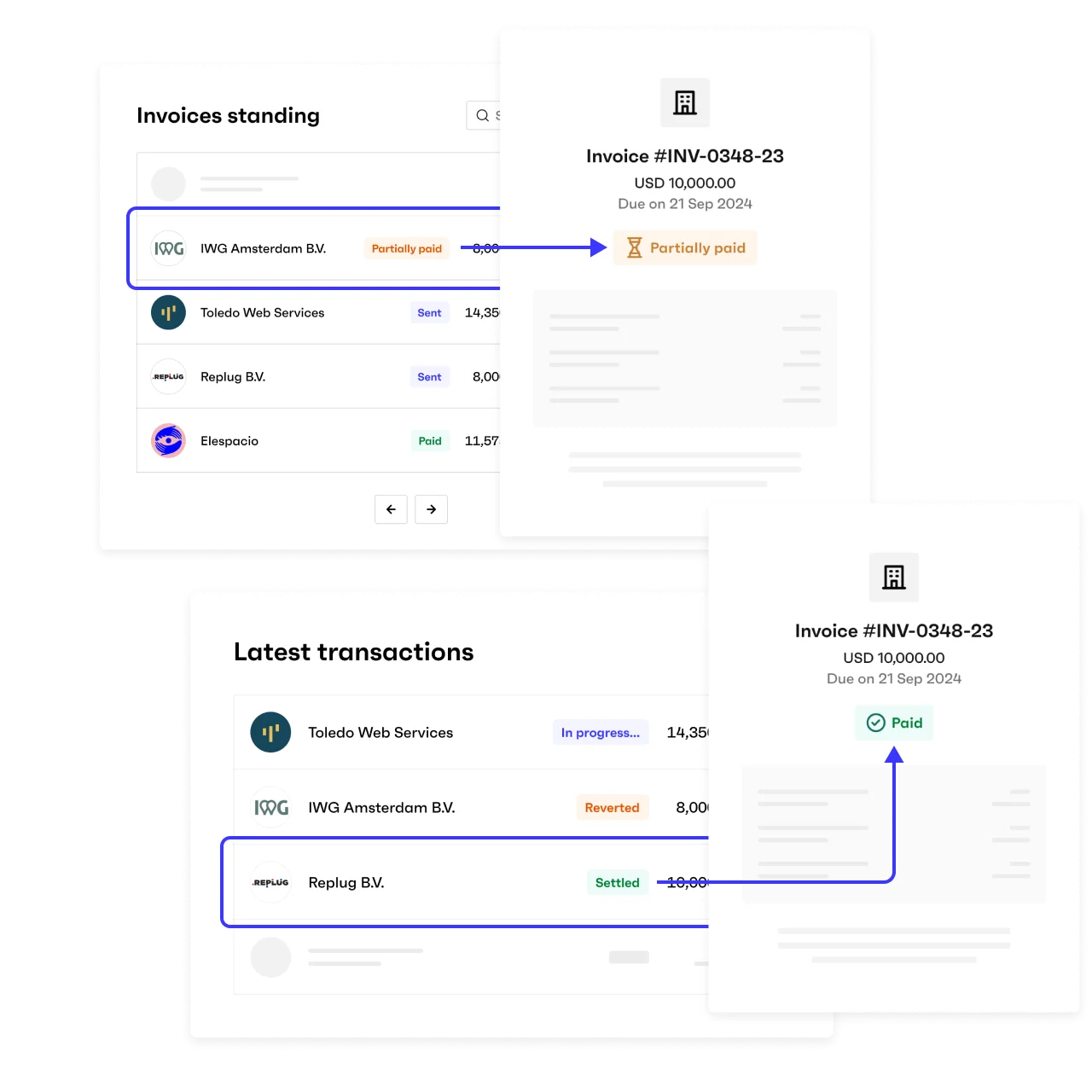

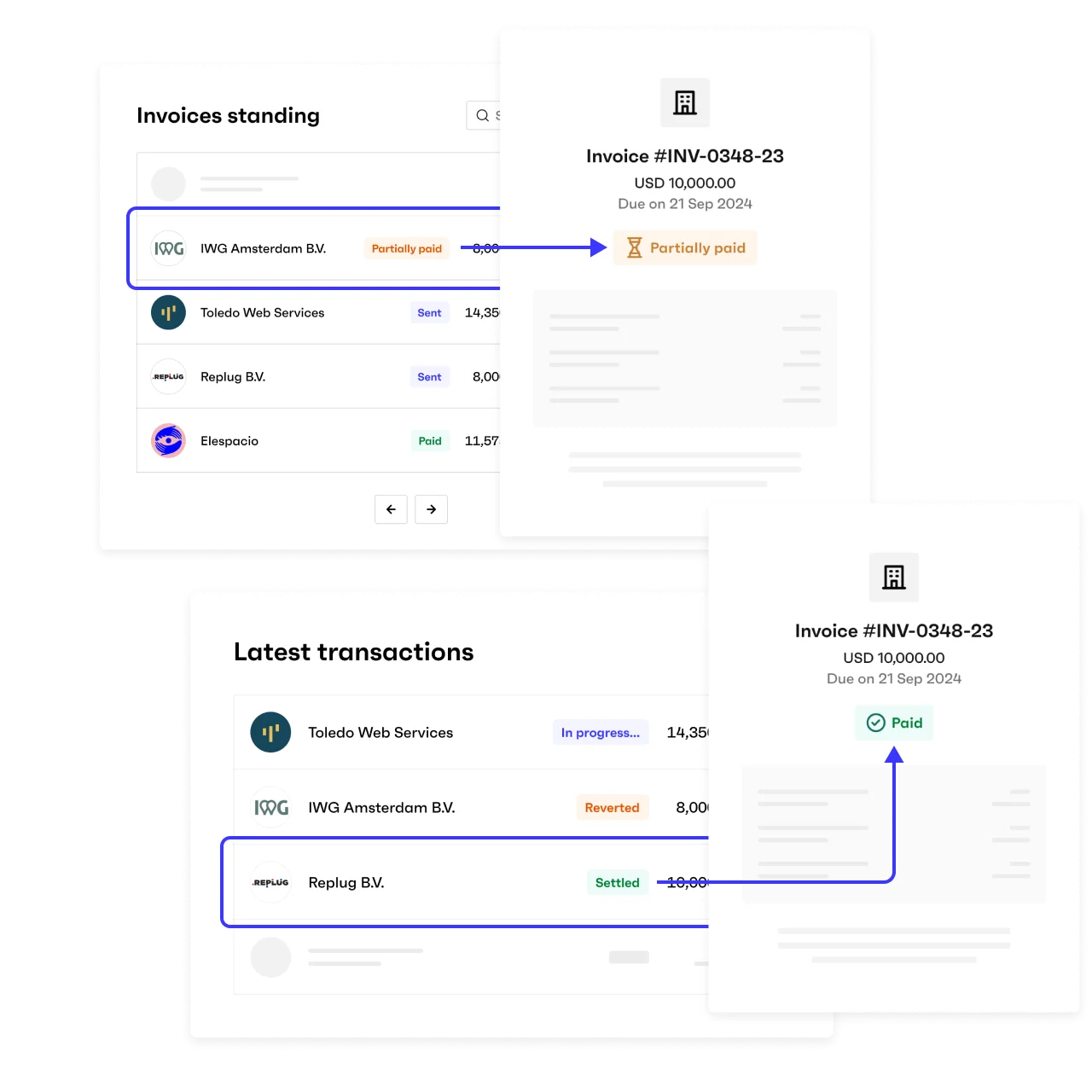

Automatic payment detection & reconciliation

Once an invoice is paid, it’s auto-reconciled for accounting. Full & partial payments are supported

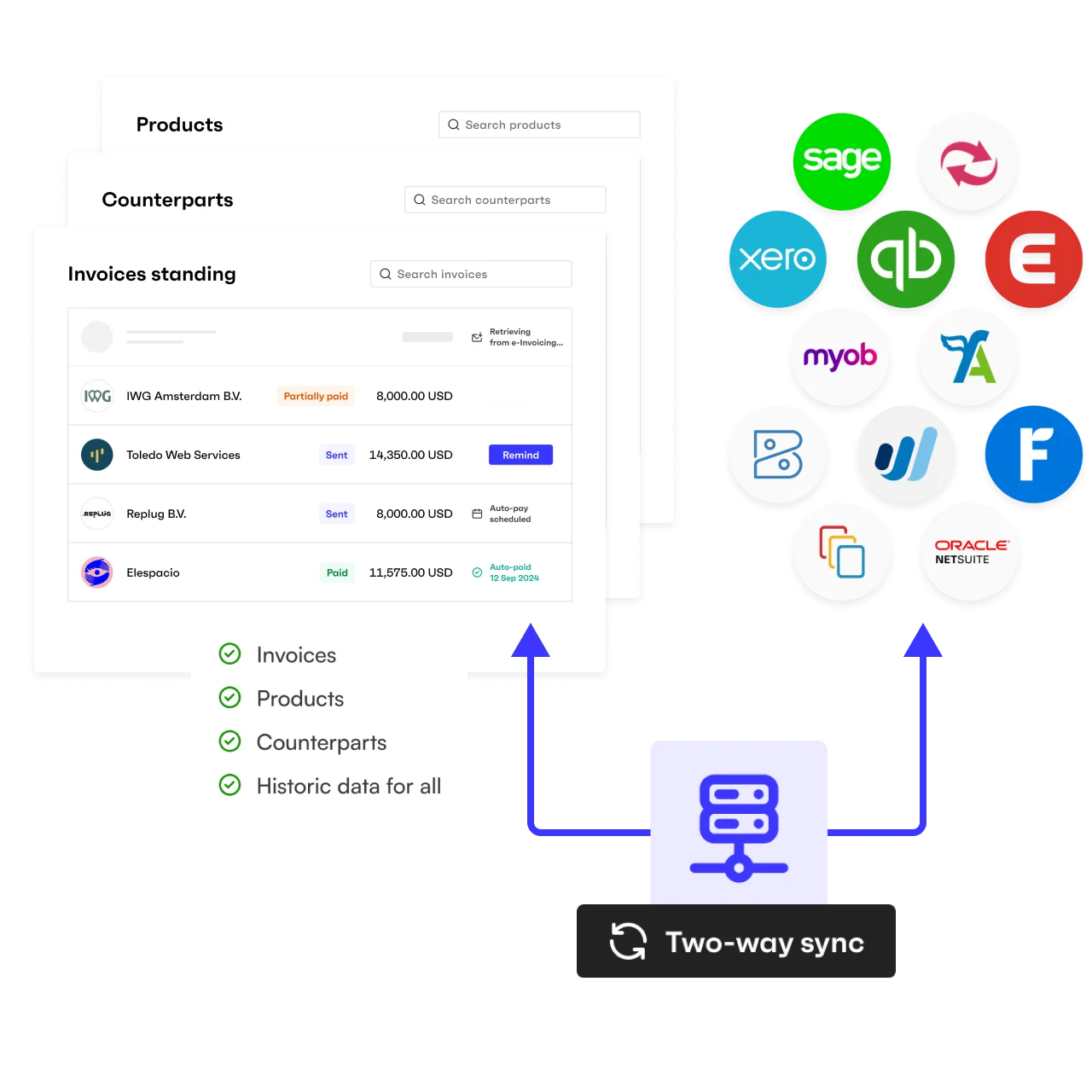

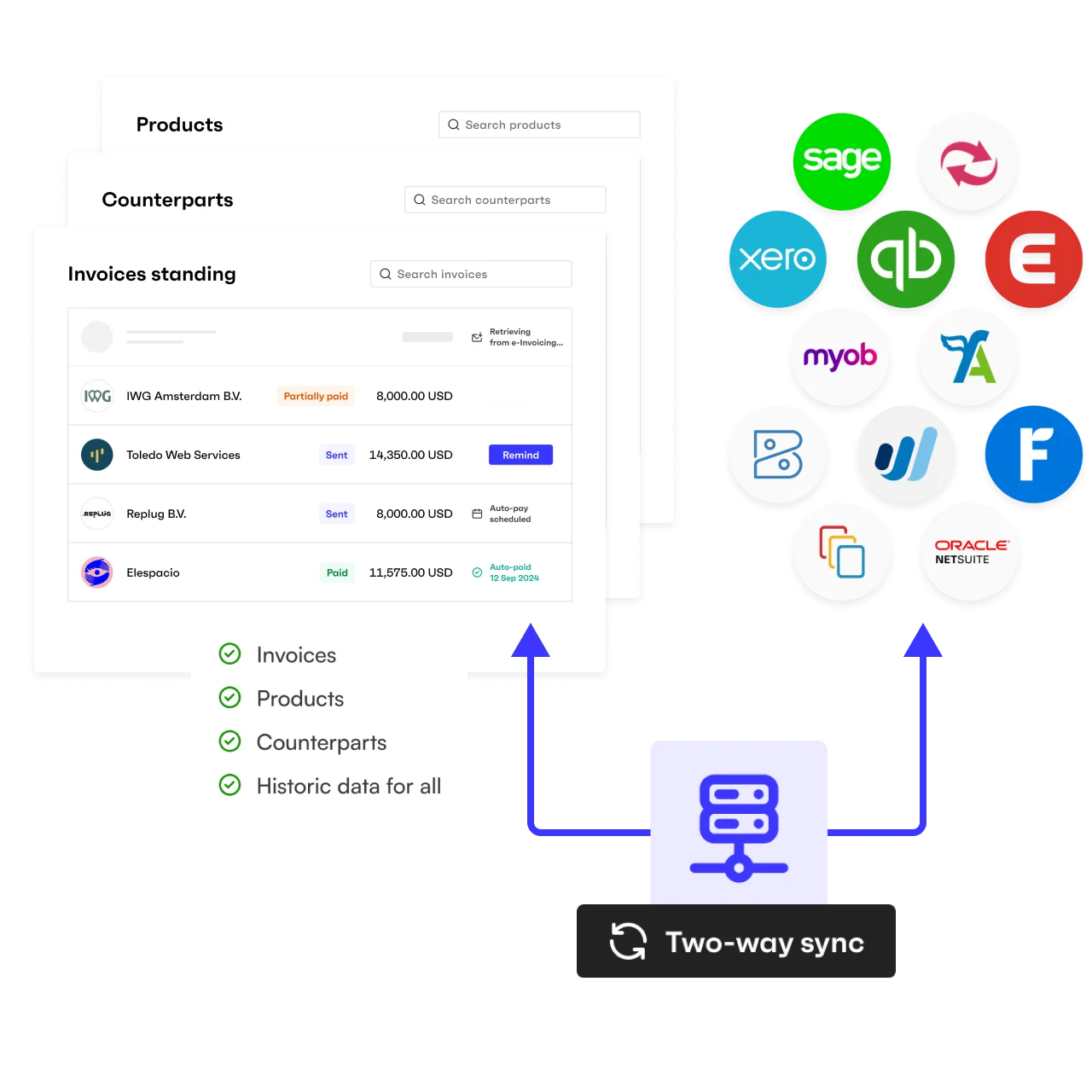

Full sync with accounting software

We support two-way sync with accounting platforms

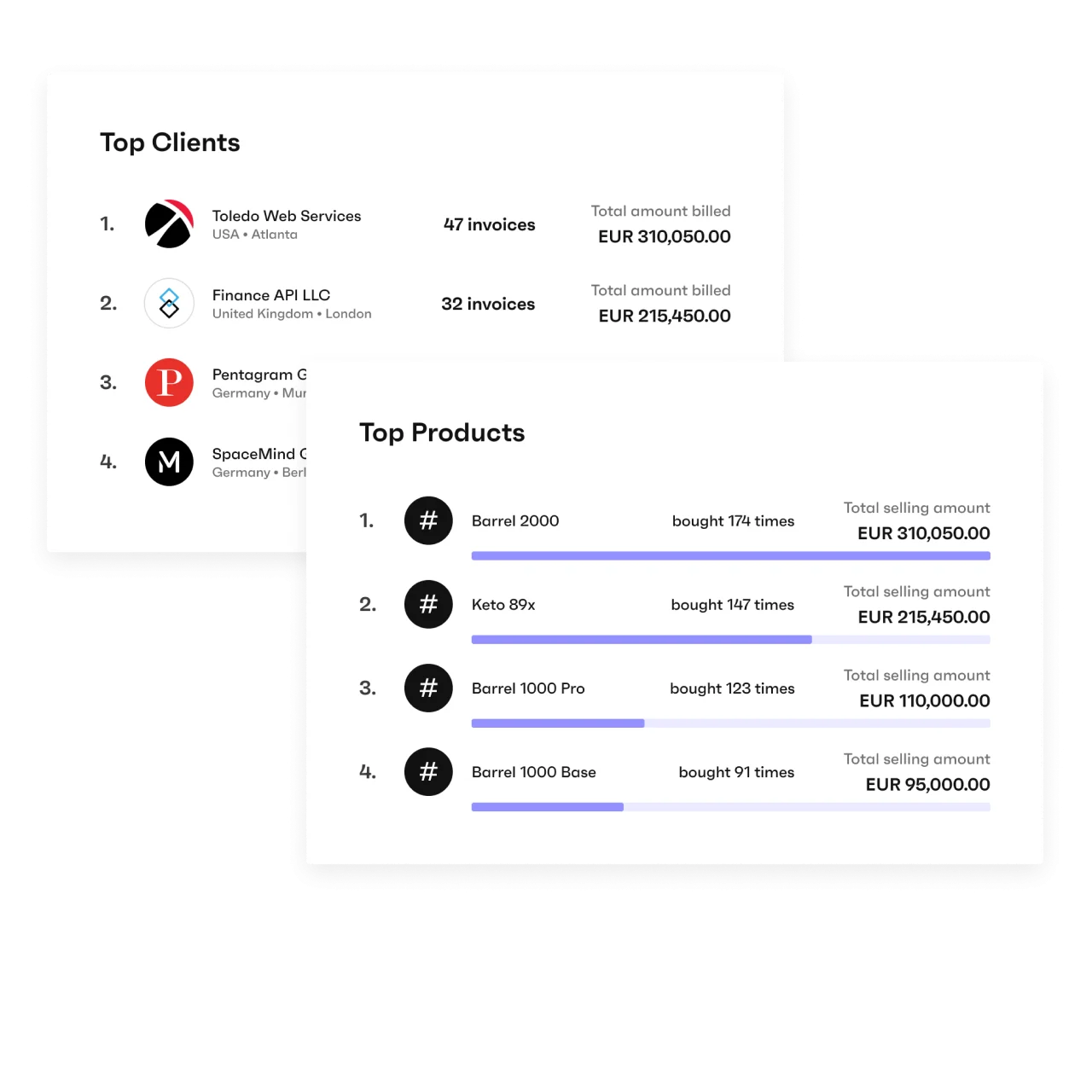

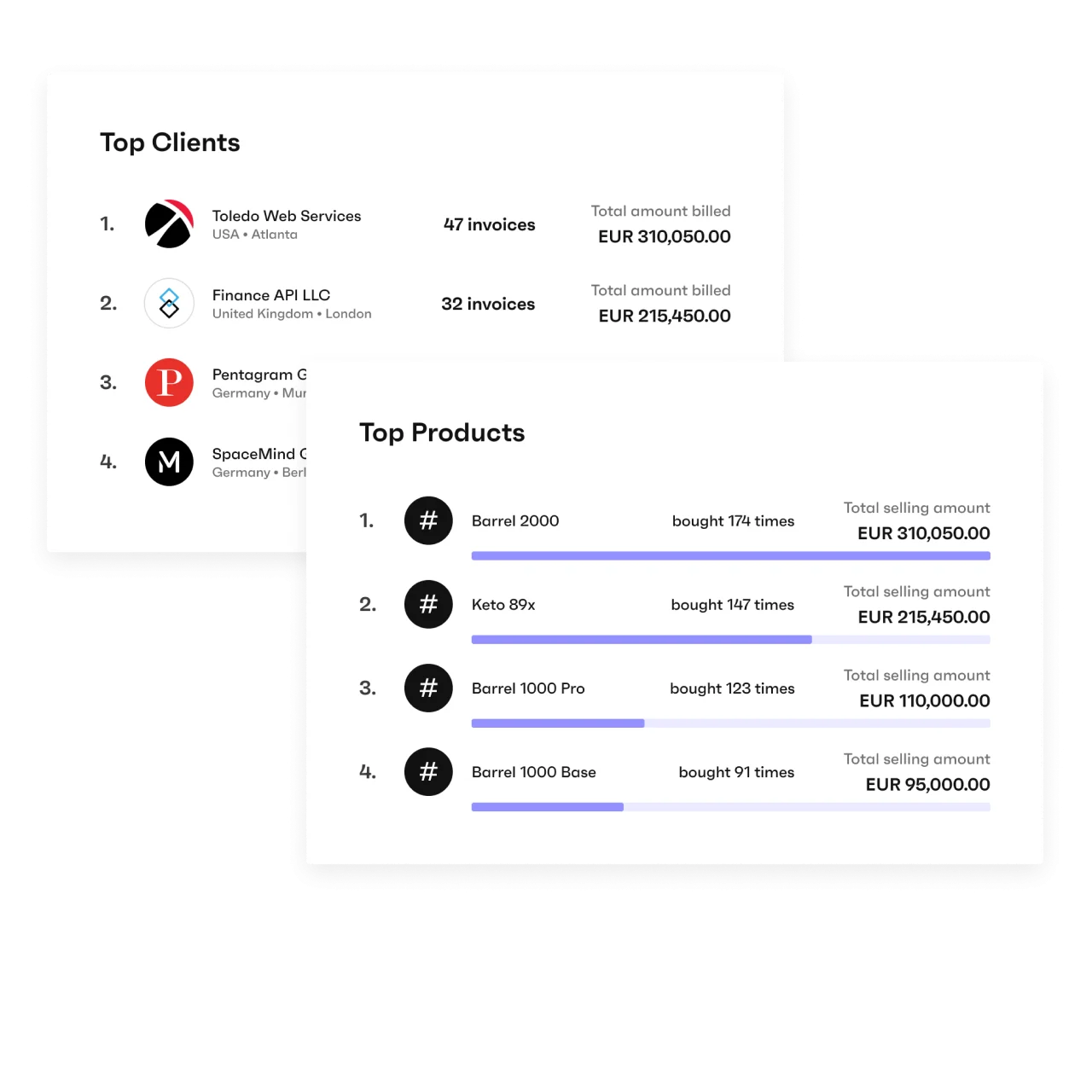

Clear cash flow analytics

Your customers can see their top clients, key problem areas, and more

Customizable invoices

Your clients can create their own design or pick templates, colors, and upload their logo

Fully compliant in 25+ regions

Regional compliance is covered for quotes and invoices. E-invoicing connectivity is included

One-click send

Your clients can send invoices right when they complete jobs or schedule them for a specific date.

Getting paid fast

Every invoice is sent with a payment link that can be paid online by card, bank transfer, or other methods

Automated reminders

Your customers can set up automatic reminders to stop chasing unpaid invoices.

Notifications for important events

Notify clients when invoices are paid, past due, and more

Automatic payment detection & reconciliation

Once an invoice is paid, it’s auto-reconciled for accounting. Full & partial payments are supported

Full sync with accounting software

We support two-way sync with accounting platforms

Clear cash flow analytics

Your customers can see their top clients, key problem areas, and more

Payments pre-integrated, Earn on each transaction

Monite aggregates the best payment providers to help your clients use any payment method

Learn more

How Mecena launched their Invoicing product in 5 weeks

Monite’s infrastructure lets us monetize payments, creating a new revenue stream, which helped us cut our customer payback period in half

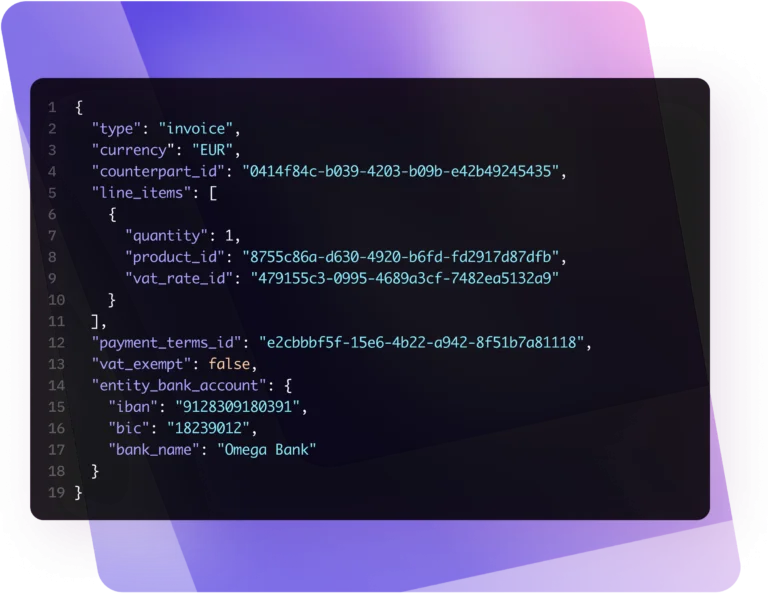

Robust Accounts Payable API designed for developers

A single access point to construct solutions of any complexity – test new features once we roll them out without the need to re-integrate

Integrate in 4 weeks instead of

building for 2 years

Building invoicing automation takes years and requires domain expertise. Monite does the

heavy lifting with our flexible API blocks. Integrate with full flexibility or ready built business

logic and front-end components

-

Rest API

Seamlessly launch AP, AR, and B2B payments in your product with our modular API, taking full control of user experience and workflows

-

React SDK

Utilize ready-to-use UX blocks that natively integrate Monite’s business logic into your UI, with the flexibility to control branding and user experience

-

Drop-in

Implement pre-built front-end components quickly – up and running in just 10 minutes