Run AP/AR workflows

To fully own payments

The most broken part of B2B payments are AP/AR

workflows leading to a payment. Automate them to own the

full payments flow. Embed AP/AR workflows via Monite in

2-3 weeks

Backed by

execs from

Dozens of platforms trust Monite:

Features

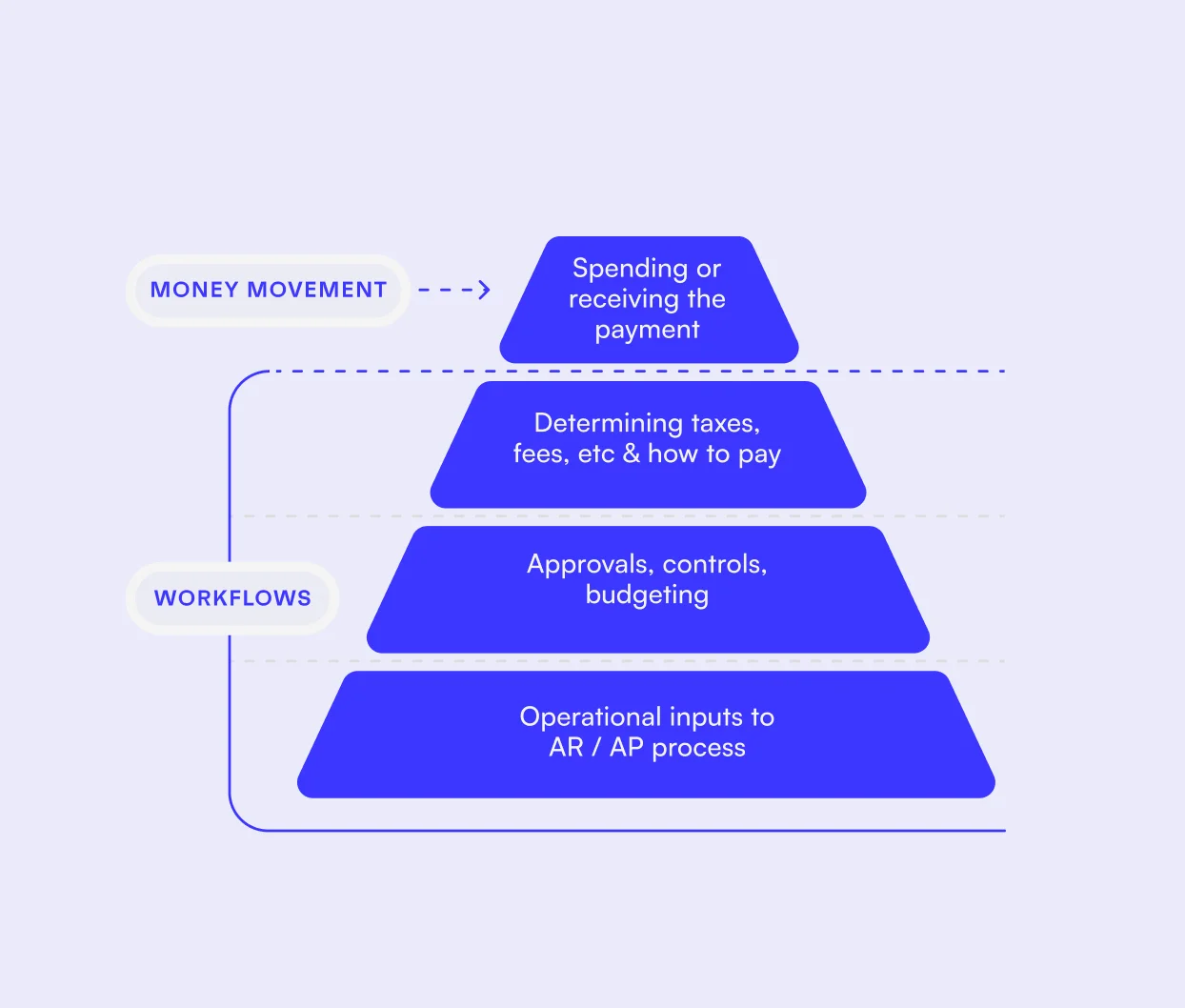

B2B payments issues happen before

the transaction

Getting B2B payments right means setting up the right processes early. Your customers

often struggle with these common issues in their accounts payable/receivable (AP/AR)

workflows:

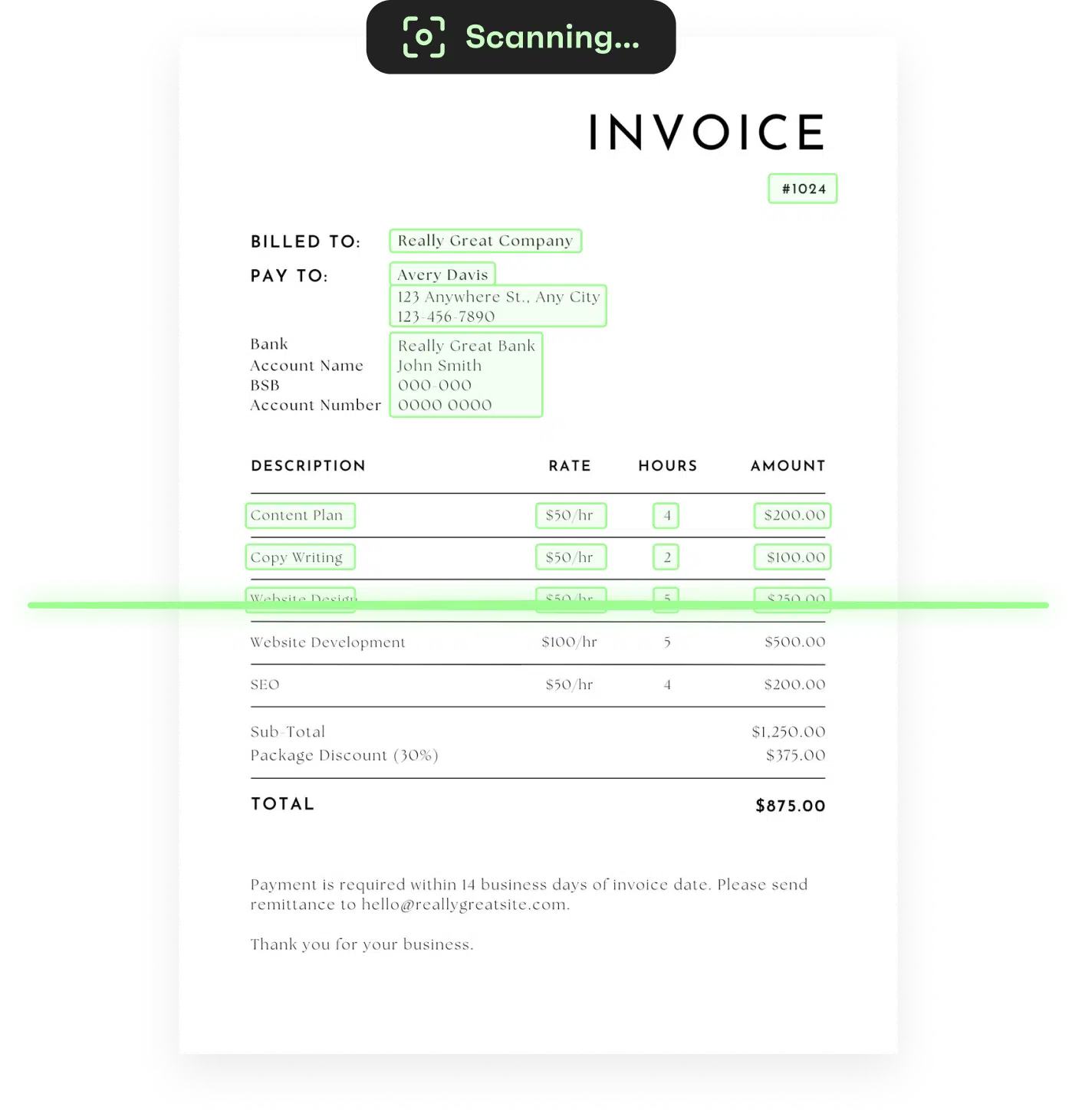

Complex Invoice Auditing

In B2B payments, auditing and checking invoices is tricky. Companies deal with lots of rules, easy-to-make mistakes, and high costs in this area.

Variable Tax Rate Navigation

Taxes can change based on who’s buying, what the product is used for, and where it’s used. This means an item can have different tax rates in different situations.

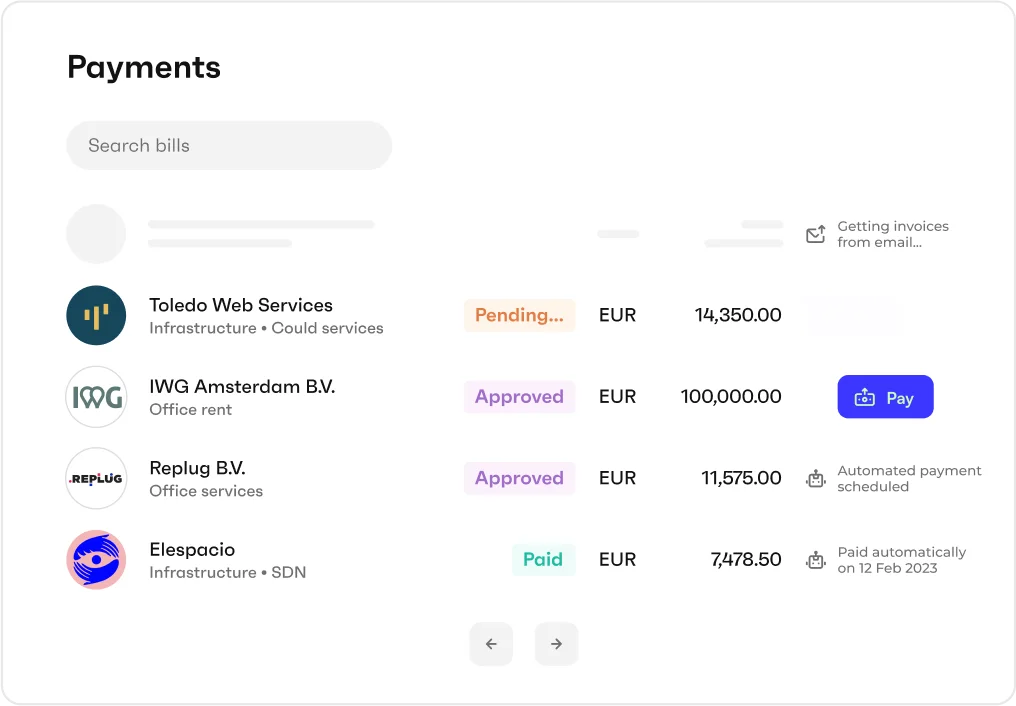

Rigorous Payment Approval

Ensuring smooth payments involves rigorous checks to prevent purchases that haven’t been approved, are too expensive, or don’t have expenses recorded properly.

Complex Invoice Auditing

In B2B payments, auditing and checking invoices is tricky. Companies deal with lots of rules, easy-to-make mistakes, and high costs in this area.

Variable Tax Rate Navigation

Taxes can change based on who’s buying, what the product is used for, and where it’s used. This means an item can have different tax rates in different situations.

Rigorous Payment Approval

Ensuring smooth payments involves rigorous checks to prevent purchases that haven’t been approved, are too expensive, or don’t have expenses recorded properly.

Matt Brown

Early stage investor at Matrix Partners

Tailored AP/AR solutions

Perfect fit for POS, FX, and BNPL Providers

Whether you want to growing finance volumes or capture more B2B payments, it starts with simplifying

invoice auditing, the ability to adapt to varying tax rates and sophisticated payment approval workflows.

-

POS & Acquiring

Centralize revenue management for your clients by adding B2B invoicing functionality

-

FX Providers

Capture more supplier payments by offering AP Automation to clients. Reduce payment fail rate by always having the invoice first

-

BNPL providers

Grow the financing volume – instead of uploading bills SMBs can manage all bills on your platform

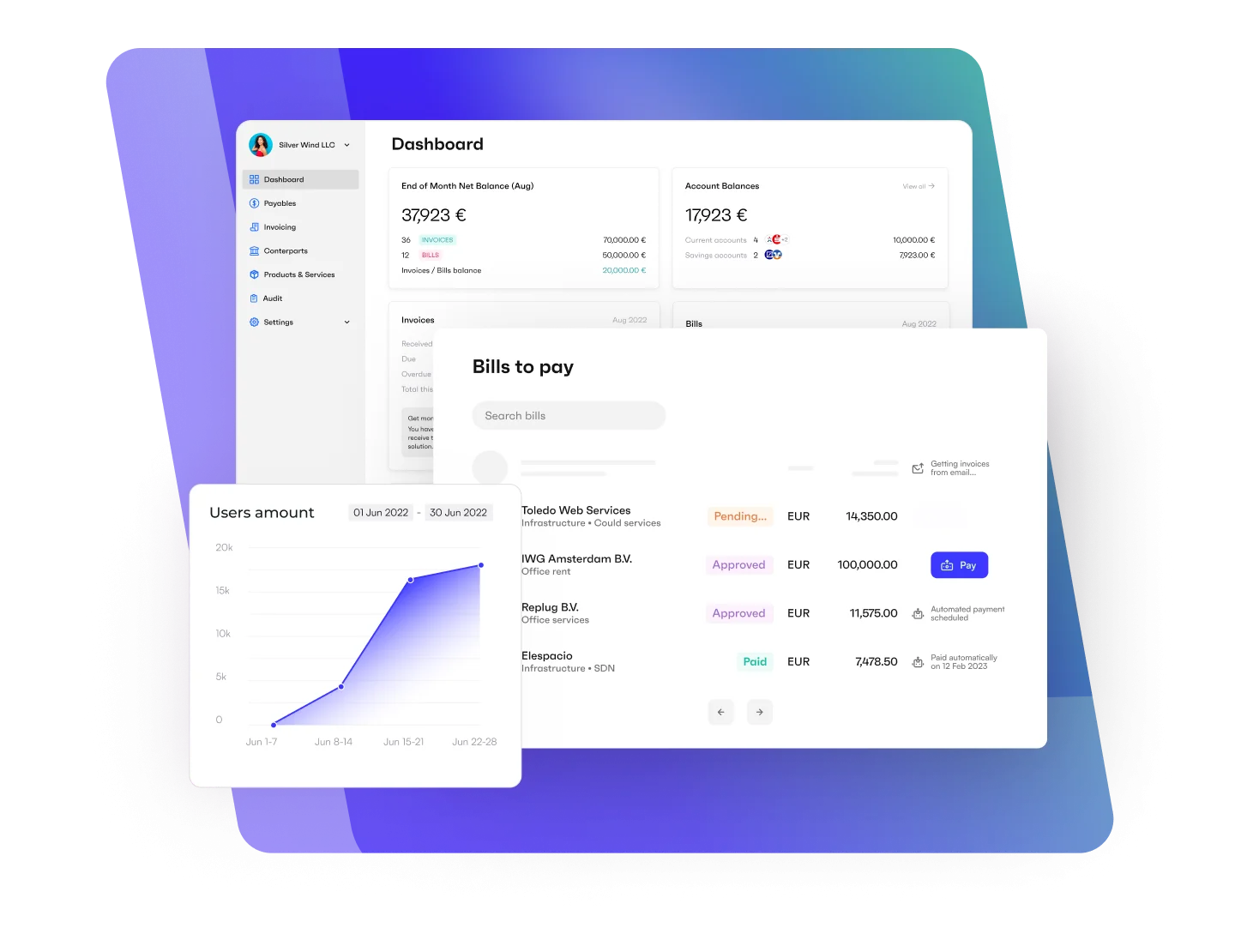

Get customers paid in hours

instead of days — and earn on it

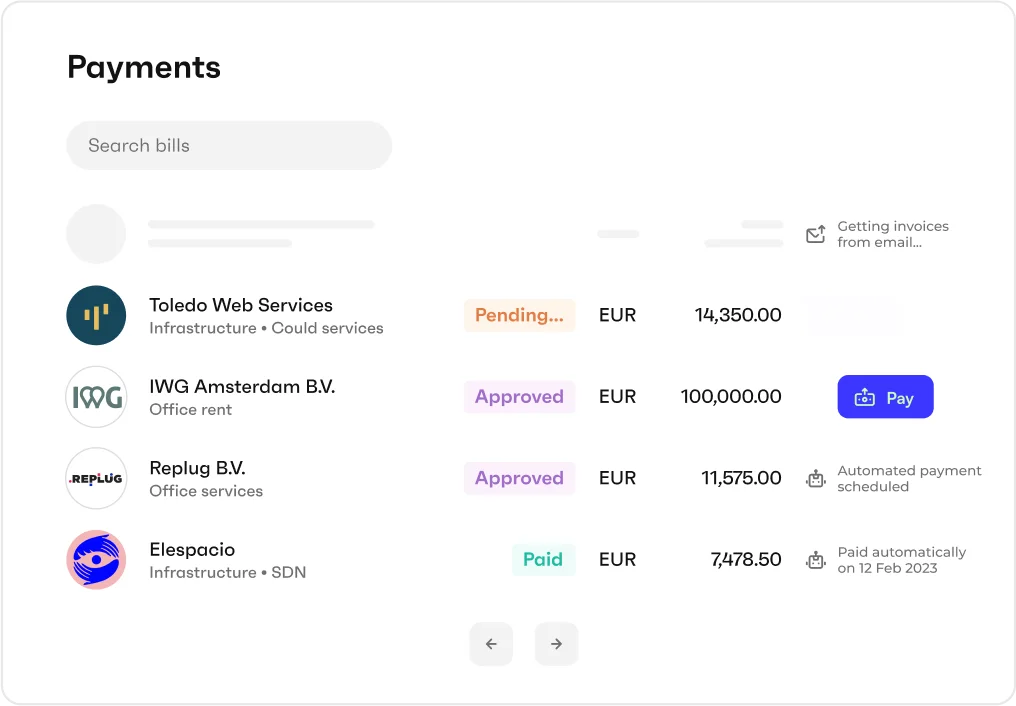

Simplify your clients’ financial operations by adding invoicing and payables automation to

your platform and increase your revenue.

A fully-fledged invoicing workflow that helps your clients get paid 3x faster. Compliant quotes, invoices, custom invoice designs, reminders, and payment links, plus accounting integrations

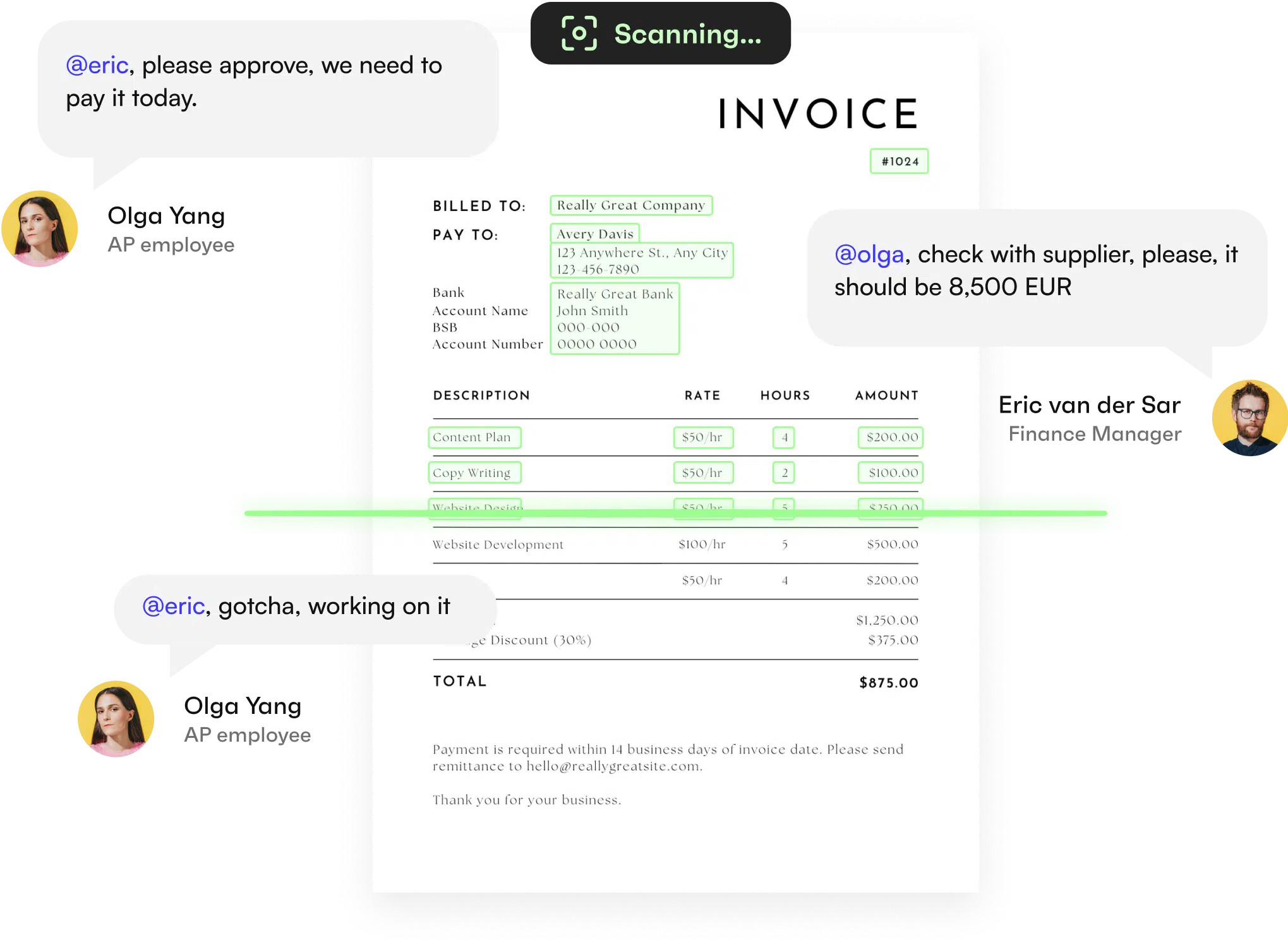

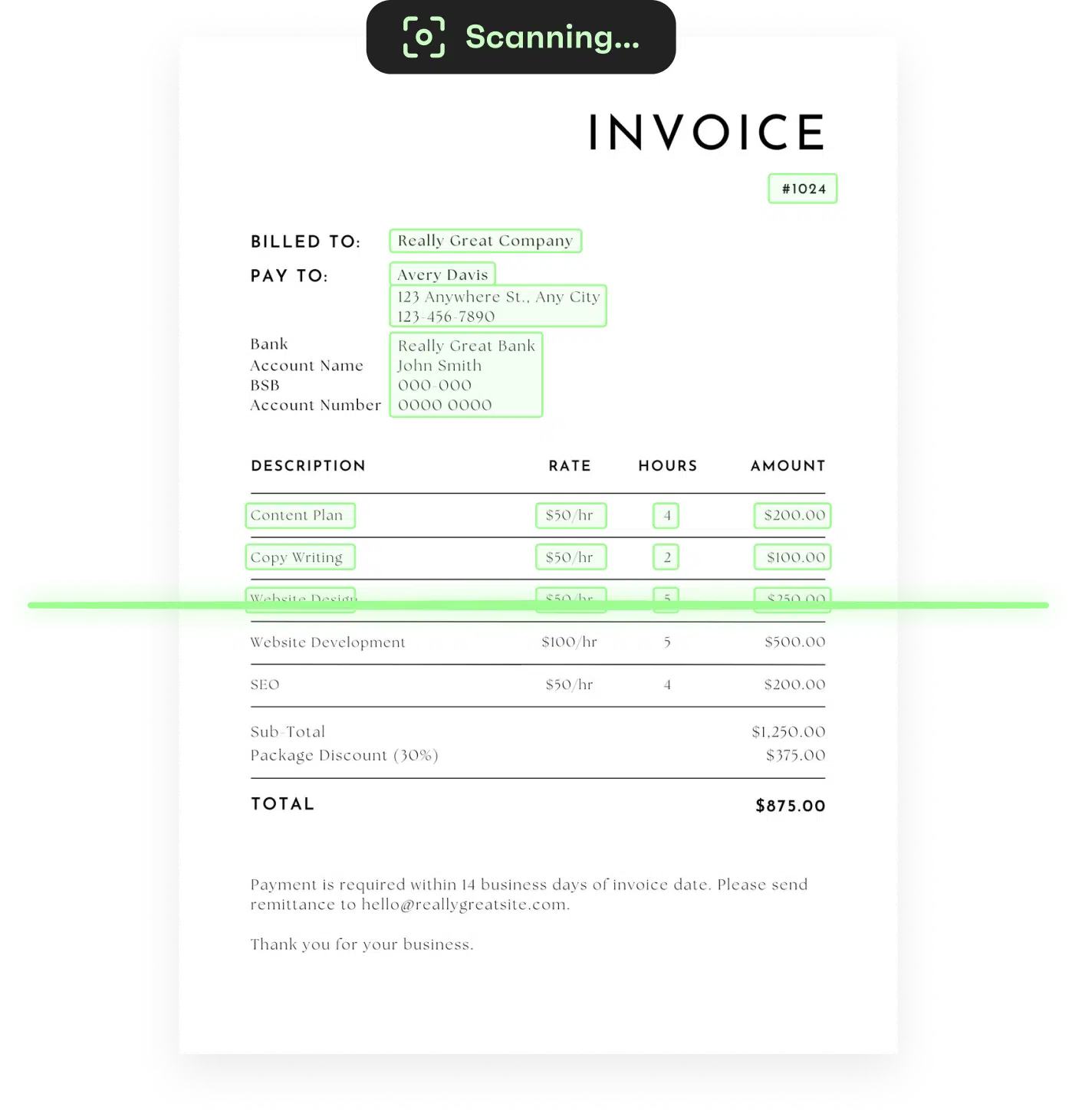

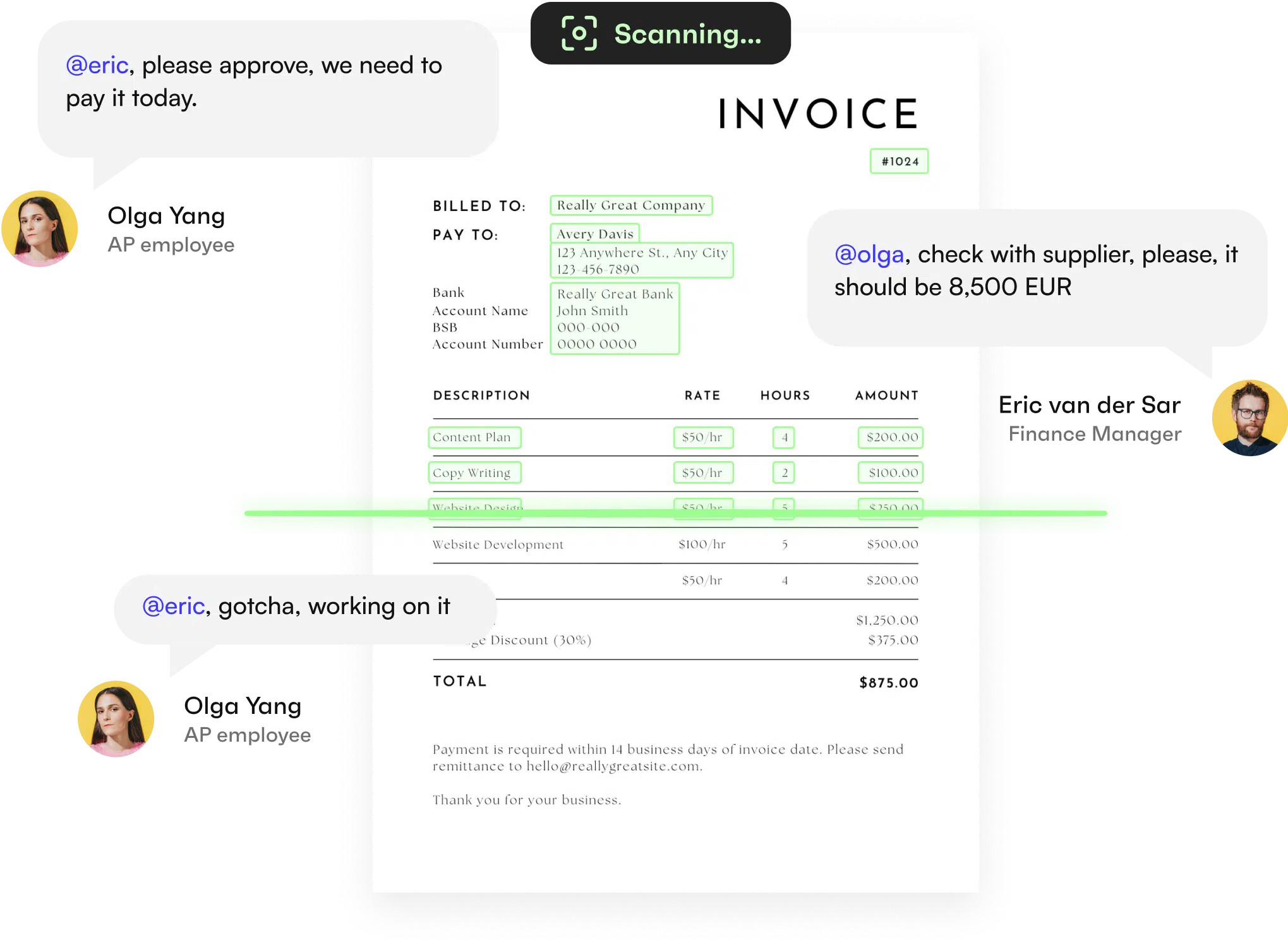

Learn moreLet your clients manage suppliers & bills in your interface with a world-class AP automation solution. Email collection, OCR, approval workflows, audit trails, discounts management, and bill payments in one click

Learn more

Integrate in 4 weeks

Instead of building for 2 years

-

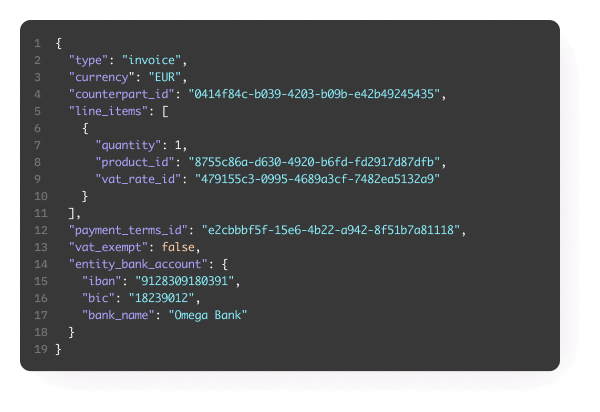

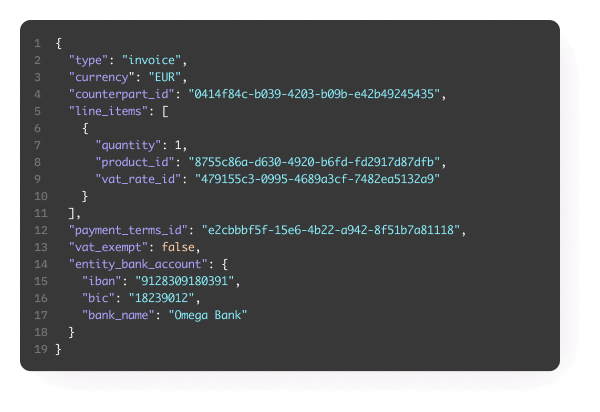

API-first

Build custom functionality using our modular, scalable and reusable software architecture

-

Maintenance covered

Integrate once, and new rolled out features work instantly

-

AP/AR expertise

Receive dedicated developer support so your team can build with confidence

Let users pay within your interface and

earn up to 0.6% per invoice.

AR/AP are core to our product, so we looked at multiple providers as well as building in-house. We chose Monite due to their product depth, quality of APIs, and fast development. Working with Monite has been a breeze – a robust API platform, knowledgeable team, and quick support at all times

Save development time

with modular API

A single access point for various capabilities. Construct solutions of

any complexity, test new features once we roll them out without the

need to re-integrate

REST API

Seamlessly launch AP, AR, and B2B payments in your product with our modular API, taking full control of user experience and workflows.

React SDK

Utilize ready-to-use UX blocks that natively integrate Monite’s business logic into your UI, with the flexibility to control branding and user experience.

Drop-in

Implement pre-built front-end components quickly – up and running in just 10 minutes.