Understand the key pains SMEs have in Accounts Payable (AP) area and how you can solve it for them by adding AP functionality inside your platform.

What are Accounts Payable?

Accounts Payable (AP) are expenses and invoices that are yet to be paid by a business – e.g. an unpaid supplier invoice. In B2B transactions, these invoices often come with payment terms, making transactions more complex and extended in nature, requiring extensive tracking and maintenance.

For anyone running a business, there is always the sales side of things and the spending side of things. The spending side includes multiple aspects that could generally be split up into

| ±20% of expenses | ±10% of expenses | ±70% of expenses |

|---|---|---|

| Expenses that are paid on the spot – e.g. buying construction materials in a store with a credit card | Reimbursable expenses – e.g. reimbursing a sales person for a flight they paid themselves | Expenses or invoices that are yet to be paid – e.g. paying suppliers for goods |

This last part is exactly what Accounts Payable are – these are basically all outstanding payments the business needs to make. Usually, it’s as simple as payments to suppliers.

So, why do Accounts Payable even exist? In B2B (business-to-business) transactions, payment terms are typically more complex than simply paying cash up-front. Most transactions involve getting goods first and then paying for them 30/60/90 days later. Unrealized payments flow in and out – which means accurate tracking and accounting require increased effort and specialized software.

A simple AP process consists of:

- Ordering goods

- Receiving an invoice

- Checking the invoice for accuracy

- Getting approval for payment

- Making a payment

- Reconciling a payment

- Submitting the data into the business’ accounting software

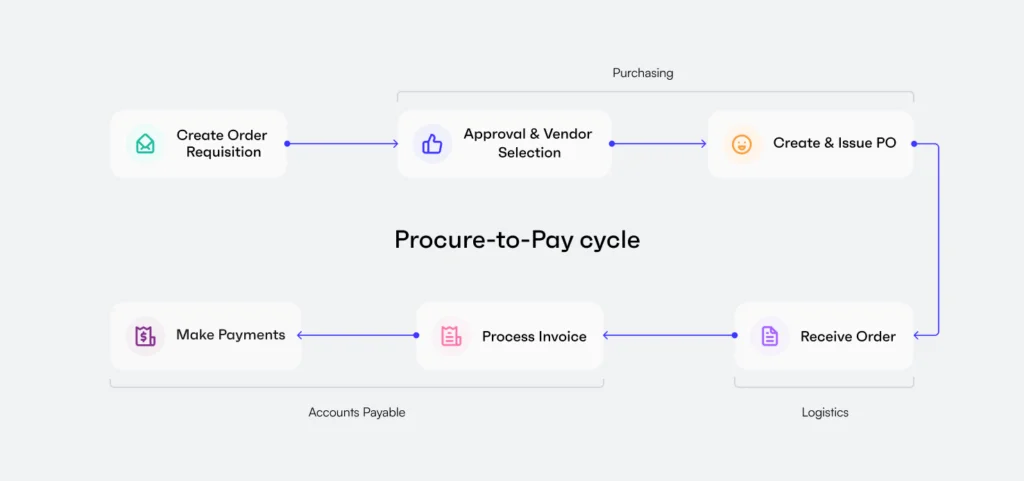

However, the above is just a simplification – in real life Accounts Payable process is often more complex than that. The full process is called Procure-to-Pay (P2P) – it is an end-to-end purchase process that includes order requisition, vendor selection, PO (purchase order) creation and submission to suppliers, receipt of goods/services, and processing of invoices for payments.

In simple terms, it’s exactly how real business works – it starts with vendor search and selection, then come purchase orders, and only then come invoices and payments, followed by reconciliation, accounting, and reporting.

Challenges in AP Management:

01

Lack of process:Many companies, especially SMEs, lack a well-established AP process, often resulting in a disorganized approach to financial management. A lack of unified tracking tools further complicates AP management.

02

Manual operations:Resource-intensive manual AP operations heavily rely on forms and spreadsheets, consuming substantial resources in terms of time, effort, and personnel. The manual nature of these processes increases the risk of errors and inefficiencies, leading to potential financial discrepancies, duplicate payments and losses.

03

Inadequate Approval Processes:The convoluted approval processes within many companies can be so intricate that even large corporations may inadvertently miss payments or fall victim to fraudulent activities. Even Finance teams at giants like Google and Facebook can be fooled by fraudulent invoices

How big is the struggle?

Account Payable and bill payments are an overlooked pain, many don’t realize how big it is. The numbers below shed some light on the scale of this problem for small businesses:

- $6-15 average cost per processed invoice depending on the SME size – SMEs waste tens of thousands of dollars per year on invoice processing.

- 82% of SMEs miss early payment discounts, resulting in lower margins and hurting the company’s cash position.

- 54% of SMEs pay their bills late regularly, due to inconsistent invoice formats and chasing approvals.

- Up to 10% in late payment fees, adding unexpected costs to the business.

- 47% of invoice approvals are slow, leading to suppliers being paid late and straining SME-vendor relationships.

- 23% of businesses lack visibility of outstanding liabilities, resulting in missed payments, late fees, and cash flow mismanagement.

How can AP Automation help?

In an effort to reduce the burden, SMEs are increasingly turning to specialized AP Automation software. Tech tools provide organizations with better control over their supplier relationships, payment processes, and the automation of critical internal tasks, leading to a wide range of significant advantages:

- Hundreds of Hours Saved: AP Automation software streamlines time-consuming manual tasks, freeing up valuable hours for your team to focus on strategic activities, innovation, and growth.

- Increased Process Efficiency: Automation enhances the efficiency of AP processes by reducing human error and expediting invoice processing and payment approvals.

- Reduction of Fraud and Inaccurate Invoices: Robust fraud detection algorithms and invoice validation mechanisms minimize the risk of falling victim to fraudulent activities or processing inaccurate invoices.

- Real-Time Visibility: Gain real-time insights into your financial transactions, supplier relationships, and payment statuses, allowing for informed decision-making and financial planning.

- Easy Compliance: Ensure compliance with financial regulations and company policies effortlessly through automated tracking and reporting, reducing the risk of costly errors or penalties.

- Better Visibility into Suppliers and Prices: AP Automation provides comprehensive supplier management tools, enabling you to evaluate supplier performance, negotiate better prices, and strengthen your supplier relationships.

- Better Spending Control: Tighten control over expenditures by setting spending limits, automating budget tracking, and gaining insights into spending patterns, ensuring financial responsibility across the organization.

- Avoidance of Late Payment Penalties: Eliminate late payment penalties by automating payment schedules and ensuring that payments are made on time, preserving your company’s financial reputation.

Why offer AP Automation to your business clients?

Businesses prefer to have a one-stop-shop solution to manage their business, so if they already manage a part of it with you, you might as well help them with AP Automation. Doing so enables you to earn more per client, drive more engagement, and become their core B2B payments provider – making you more competitive and allowing faster growth.

While AP Automation software is very useful, it’s expensive and requires integration into company’s processes, onboarding training, and more.

Also, a small business owner is already using a dozen tools to run the company. Does she really want to add one more and then change your processes that require learning a new platform and training your team, all while paying $50-300 per month? Many would likely argue that this doesn’t seem appealing.

What most SMEs prefer is to get AP Automation within the platform they use every day – e.g. neobank, vertical SaaS, or something else. They’re used to the software, they use it to manage the business anyway, and now they can switch from Excel to a new feature in the existing platform – a lot easier for them than buying and learning new software.

In general, most businesses want one platform to combine all of their business processes – it’s easy, efficient, and inexpensive compared to using 5-7 different tools. In response to this, many neobanks, vertical SaaS players, and Accounting platforms have started becoming “super-apps” – becoming one-stop-shop solutions for their users. This wave is just starting, but there are already champions we see in some segments of the market. For example, Toast – a platform for restaurant owners, or Brex, offering a comprehensive corporate expense management system for startups and scale-ups.

Why should you consider offering AP Automation to your business clients as a platform?

Well, there are several compelling reasons why platforms choose to embrace AP Automation and evolve into super-apps.

Offering AP Automation to your business clients allows you as a platform to:

- Enhance Product Value and offer better spend management and savings to your customers

- Increase share of wallet by becoming the primary payment provider

- Increase Revenue per user

- Differentiate from competition

- Attract new users by offering a new service

- Leverage data & insights to upsell financial and other products

Being in the flow of B2B payments to your clients is key to great customer monetization. Toast, for example, drives over 80% of its revenue from payments, despite being primarily a restaurant management software. However, it’s the software that enables you to monetize payments and drives usage in the first place.

Similarly, if you offer AP & AR Automation to users, you basically become their cash-flow management platform, meaning you can monetize:

- All incoming payments (AR) – Payment links, bank transfers, card payments, etc.

- All outgoing payments (AP) – Single & bulk payments, bill pay w/credit card, and more

- Cash-flow gaps – Working capital optimization solutions, business loans, etc.

How can you monetize AP Automation functionality?

Platforms can monetize AP Automation functionality via SaaS fees (extra fee or premium plan) and payment fees (e.g. % of each transaction). Given the high costs of this functionality in the market, platforms can easily earn 3-5x ARPU on businesses using their AP module.

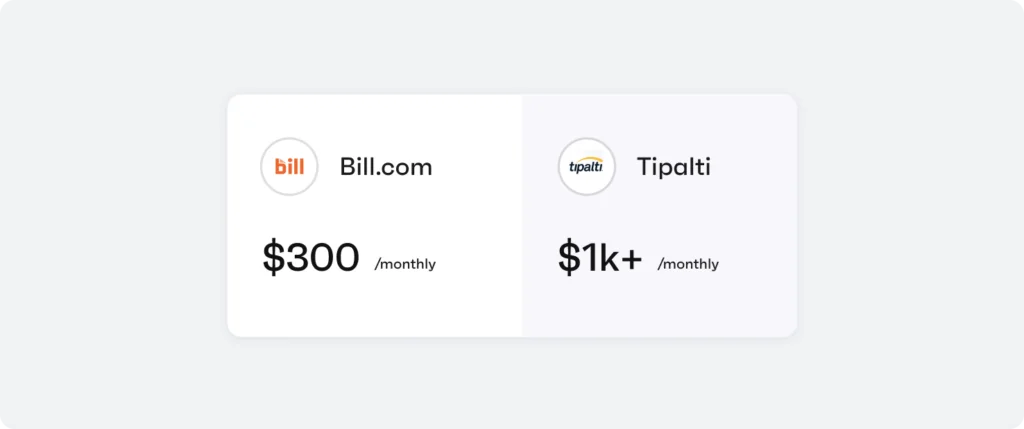

AP Automation is one of the most expensive software solutions on the market. The likes of Bill.com can easily cost $300/mo, and we are talking only basic AP Automation functionality for a smaller company. More comprehensive Procure-to-Pay solutions like Stampli or Tipalti can easily cost $1k/mo+. These platforms also monetize payments on top of SaaS fees, with payment fees often being hefty and containing a lot of hidden charges (e.g. fees for currency conversion).

When you offer AP Automation software piece to your clients, you want to mimic the existing market model and monetize both SaaS fees and payments.

- SaaS fees – add AP to a premium package or charge a separate fee for AP functionality

- Payment fees – get markup from payments your clients process

SaaS fees

The market tells us SMEs value AP Automation functionality – but that doesn’t mean you want to price like Bill.com or a similar player. Remember – for those companies AP Automation is the only thing they do – which means they also miss out on a lot of clients for whom this is very expensive.

Being a one-stop-shop solution with AP Automation included allows you to offer more competitive prices to users – e.g. you could save them 2-5x compared to a standalone player.

- Adding AP into a premium package – this means quite a hefty de-facto discount on AP Automation functionality as you’d only be able to attribute a fraction of the premium plan price to AP. It is the best strategy if your premium package is high price and produces a high ROI overall – then discounting AP functionality will pay off

- Pricing AP Automation as an extra feature – this is the best strategy for most cases, making your revenue from AP easy to track and attribute. For clients, it means they’re taking it and using it when they need it – while in a bundle they could get the bundle, but not need AP.

Payment fees

Payment processing costs money – and businesses are used to that. Moreover, they’re usually happy to pay extra for automation, convenience, and speed. When it comes to AP Automation, having payments as a part of your flow is invaluable – as it saves your clients a lot of time.

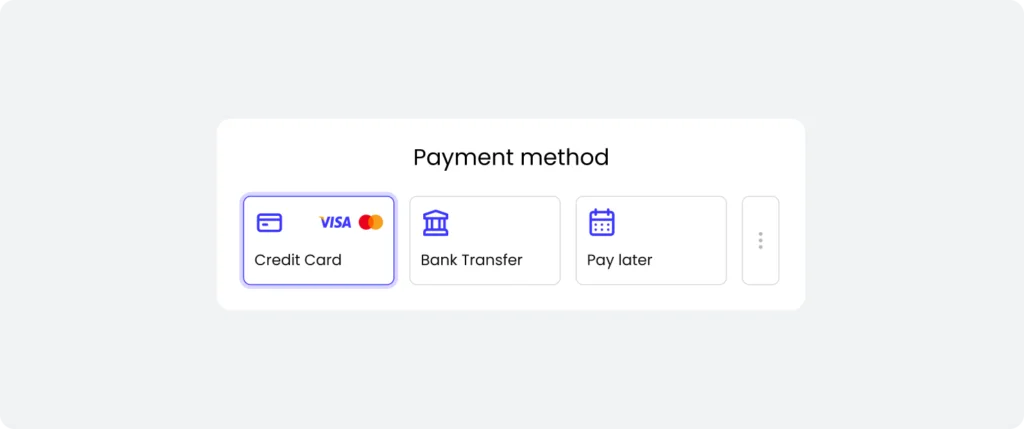

Here are the main payment methods you can monetize:

- SEPA – from €0.05 per payment and €9.50 for each active account. SEPA direct debit is the go-to method for B2B payments in Europe. It’s widely accepted and cost effective.

- ACH – up to $4.50 or 1% of the payment. For each user you can charge up to $ per month, plus a one-time fee of $5. ACH stands out as the go-to payment method for most B2B transactions in the US.

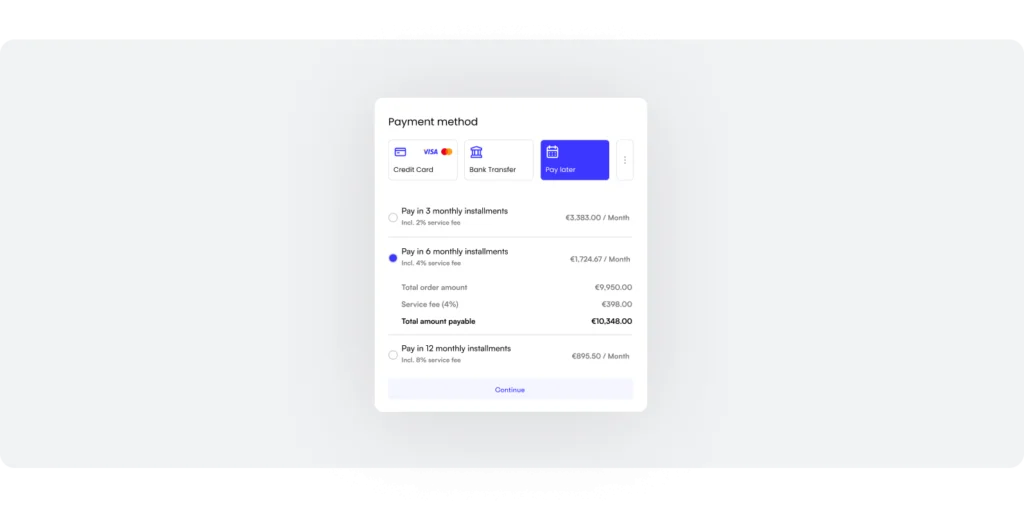

- Buy Now Pay Later – from 2 to 4 and 8% in installments for 3, 6 and 12 months respectively per payment. This allows your clients to pay an invoice 30/60/90 days or more past due date.

- Partial payments – from 1% (30 days term) to 4% (90 days term)%. Allows your clients to split up the payment into smaller manageable payments.

- Bulk invoice payments – margins are those of ACH multiplied by the amount of invoices paid. Your client can select multiple invoices to pay in one go supported in the US by the ACH network.

How hard is it to build AP Automation functionality?

Core AP Automation functionality

To craft a smooth AP Automation workflow that works seamlessly and sets up apart, you’ll need a solid set of core functionalities to make it all come together.

Below are some of the key categories:

Data Integration and Extraction:

- Data pull from ERP/Accounting system

- Counterparts database

- Mailboxes for invoices

- Dynamic invoice tables with filters

Document Processing:

- Robust OCR engine, ideally with daisy-chaining and ML mechanism designed for AR/AP

- Invoice validation mechanism

Approval Workflow:

- Approval rules builder with flexible parameters

- Approval workflow engine

- Approval/commentary notifications system

Payment Processing:

- Payment release system with integrated ACH/SEPA, card, and other rails

- Bulk payments and partial payments

- Payment reconciliation logic

Data Integration and Reporting:

- Accounting categories coding system

- Data push into accounting systems

- Conflict resolution capability

- Audit trail

Additional Features:

- Customizable reporting and analytics

- Supplier/vendor portal for self-service

- Compliance and regulatory features

- User roles and permissions management

Accounting Integration & Data sync (must-have)

To implement AP Automation successfully for clients, accounting synchronization is a necessity. Enabling this is usually extremely complex and requires building multiple API connections, data processing logic, conflict resolution engines, and more.

In the accounts payable process, one of the final steps involves transferring data into various accounting systems, but building these integrations can be more challenging than it seems.

SMEs use many different accounting systems, so to fully serve your customer base effectively with automated accounts payable (AP), you often need to integrate with 15+ accounting systems, which is a significant challenge.

Each accounting system has their way of looking at the data, running a ledger, etc. This means that there is no standard way to integrate an accounting system, each would need a specific approach and customization. While integrators like Codat or Rails are available to simplify the process, and can save you time, they tend to be expensive and still lack certain essential features, such as data model unification, API versioning, and functionalities like conflict resolution.

- Data Standardization – accounting platforms vary significantly in how they handle data. They contain numerous data types and thousands of fields, each with its own nuances. For instance, different regions use different date formats and terminologies. A standardization layer is needed to handle these variations and ensure consistent data retrieval.

- API Standardization – when you build integrations individually, you’ll need to manage development separately for each accounting platform. However, using an integration platform with a standardization layer simplifies this process. Your developers can work with a single API, eliminating the need to keep up with updates for each accounting platform’s API.

- Configuration Standardization – when you make changes to how synchronization, authorization, or alert rules work, you want these changes to apply effortlessly across all your integrations with just one action.

Conflict resolution

One of the trickiest parts of accounting integrations is solving conflicts. This happens when data doesn’t match up between two connected systems. To handle this, you need a smart system that can spot these differences. Here are 2 examples:

- Imagine someone manually entered information into both systems that are supposed to work together, but now they have different ID numbers. To make these systems work smoothly, you have to combine these conflicting pieces of information.

- Another common issue is when one system is missing data that the other system needs. Finding a good way to fix this is really important for keeping everything working well together.

Building such an integration is no small feat. It typically demands a year of dedicated work from one senior developer. The workload is split almost evenly, with half the time devoted to standardization and the other half focused on building the conflict resolution functionality. This highlights the considerable time and effort required for this complex task.

Strategies to add AP Automation functionality

Strategy 1: Building Your Own AP Automation

Building AP Automation functionality in-house requires hiring a specialized team and committing to an investment of $1-2 million, along with 1-2 years of development time. Ongoing maintenance and development are necessary to remain competitive in this space.

There are a few large players that invested millions to build their AP Automation module in-house – e.g. Brex or Ramp. For players this size when the market offers cheap capital via VC or loans it’s a possible solution if they see the AP capability as a core functionality for their strategy.

Finance automation products are complex to build – especially because they are required to cover a lot of edge cases. This is why building a robust AP Automation solution likely requires something like:

9-28 months of time – depending on the scope you want to build, level of expertise and agility in your team

$500k+ budget – for the smallest build and up to €5-10mn for a robust capability

$200-800k – annual maintenance and additional development costs

A specialized product squad

- Product people with AP Automation expertise – very hard to find

- Devs with expertise in payments/similar areas – creative thinkers who know how to take care of many edge cases

- UX designers – who’ve built workflow products before and know how to make them very easy to use

What’s important to remember here though are two things:

- In-house built super-apps are rarely competitive when compared to a specialized provider – e.g. Bill.com

- Building in-house means not only building costs but also a continuous investment to maintain the product and grow its competitiveness as compared to vertical specialists

As a result, in-house builds typically come at a high cost and effort, requiring a large ongoing investment.

Another route to add AP Automation for your clients is via M&A (mergers and acquisitions). It is very costly, but theoretically, it can also allow you to go to market quicker and grow your user base. For instance, Toast, a leading platform for restaurants, acquired AP software xtraCHEF. Of course, this is an option for those who can afford an acquisition.

Strategy 2: Implementing an embedded AP Automation Solution

Monite invested over $10mn to make a robust AP Automation solution that you can use via an API. It is a fraction of the in-house building cost and takes 2 weeks to plug in with 2 developers. Monite’s solution includes robust AP functionality and accounting integrations. We handle all the building and maintenance costs, ensuring your solution remains competitive in the market.

Up until 2022 M&A and building in-house were the only options. In 2022 a new market emerged in Embedded Finance – called Embedded ERP or Embedded AR/AP. We at Monite were the first international API-first player in the segment.

What we effectively did was build functionalities like Bill/Stampli and other AP Automation players – but we built them as flexible API blocks with a focus on serving platforms first. This means that any platform can save 90-95% of development and maintenance costs and plug in those pieces in the way that works best for their clients with minimal integration effort. The backbone and all key functions are there, so all you need to do is to present the experience and interface that are optimal for your business users.

We made a $10mn+ investment to date into building a robust AP Automation solution, and we’re far from being done here. It’s expensive to build. The good news is that you don’t have to spend that money now – using our API you can go to market not with an MVP but with a top-tier product that makes your own offering even more appealing – compared to both competitors in the space and specialized AP Automation companies.

Two additional things to know:

- Your user always sees your interface and brand only – that’s because we’re API-first and you fully control UX/UI for the user, Monite is nowhere to be seen

- You can go live with two developers, in 2 days to 2 weeks, and with a sub-$100k investment.

What’s included in Monite API?

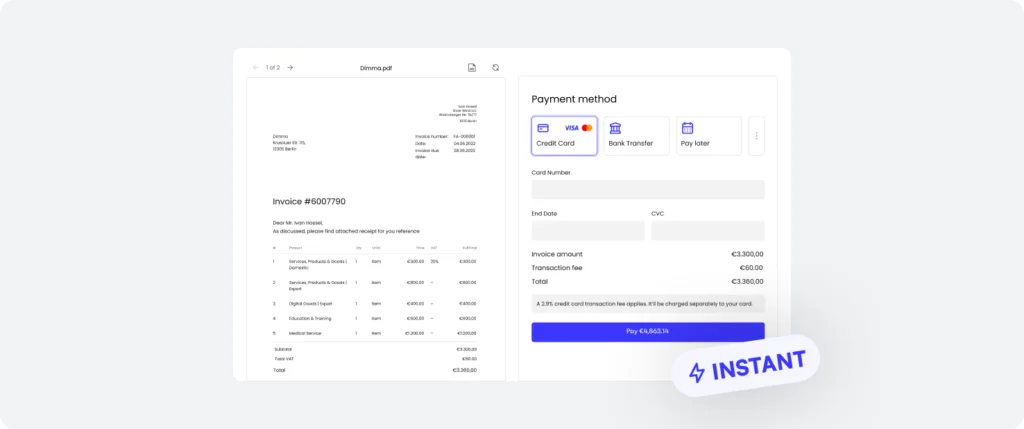

Monite provides a robust API that allows you to launch a very competitive AP Automation solution for your clients in 2 weeks. Users receive all the expected features – same or better than what they’d get from a leading provider like Bill.com – but within your interface and offered by your brand, supported by our API.

Monite provides a developer-friendly API platform with a wide range of functionality that is essential to launching a competitive AP Automation product.

Platform

- Flexible API building blocks – all the functionality is built, you just decide how to plug it in and how you want it to work

- Fast back-end integration – ±1-2 days for a full backend integration

- Multiple options for frontend – pre-built frontend components (±2 days to integrate), SDKs (±1-2 weeks), or a fully custom built that you can do (usually ±3-6 weeks)

- Enterprise-grade security – API security is integrated across all layers of our platform, including internal development processes and partnerships with industry-recognized technology vendors.

- Robust SLAs – dedicated to achieving the highest platform availability SLAs and have a proven track record of consistently meeting them.

AP Automation functionality

- Data push and pull with accounting systems – we allow you to sync data from most major accounting systems. All it takes is for your users to authorize the connection. That way you can avoid starting from scratch and immediately make sense of historical data that is available while ensuring that all the invoices and transactions data will be automatically synced with the client’s accounting system

- Counterparts database – the ability to create and store new suppliers and partners, comes with customizable fields and settings, e.g. preferred accounts, payment methods, and more

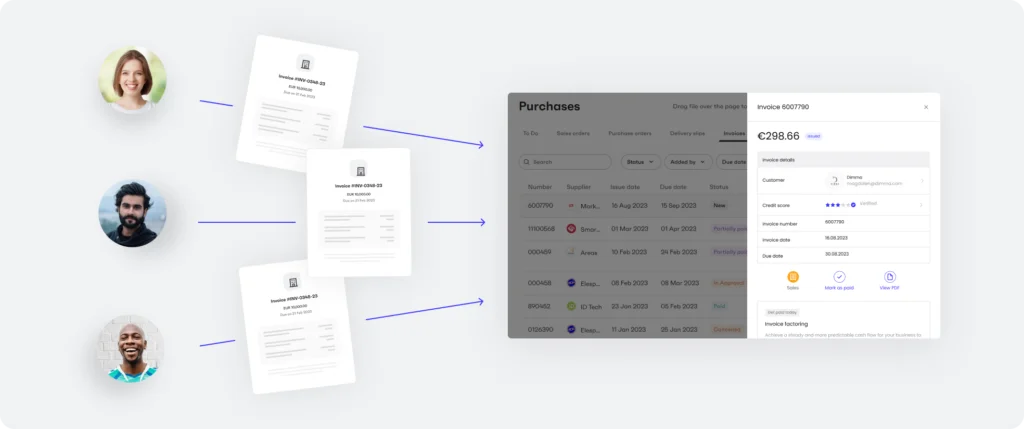

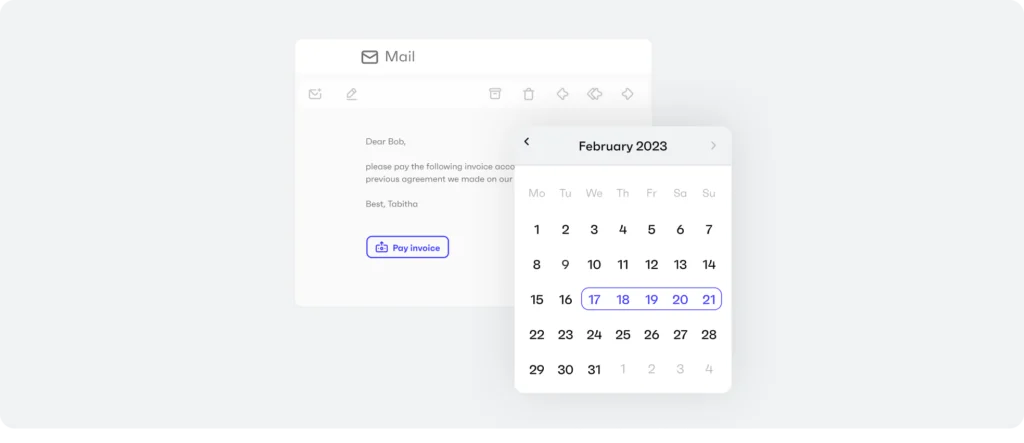

- Mailboxes for invoices – the ability to create forwarding addresses for invoices on a per-team/per-person/per-company/etc. basis, also using your domain. That way once the new invoice arrives to a person, they know where to forward it for AP processing. It can also be used to give this email to suppliers directly, so you avoid cluttering your own email

- Dynamic invoice tables with filters – see all invoices in one place, sort/filter by many parameters, dynamic search, ability to create views based on invoice workflow, and more

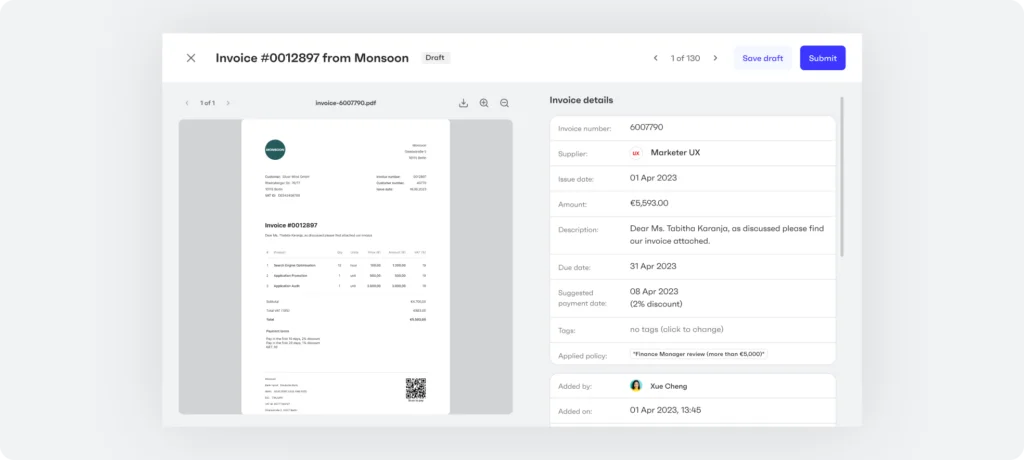

- Robust OCR engine – we use multiple OCR providers to guarantee the highest quality of recognition. We also use ML learning to improve accuracy using a gigantic dataset that flows through our system and apply OCR engines one after the other until the target quality of recognition is achieved

- Invoice validation mechanism – capability to make sure that invoice data is correct and actionable, that all the key fields needed for payment & accounting processing are in place

- Commenting & to-dos engine – ability to leave comments and assign to-dos for invoices – key to intra-company collaboration. This allows the approver to request a change (e.g. adjust the address on the invoice), while the document entry stays the same and just the new version of the document is being added

- Approval rules builder with flexible parameters – the ability to mimic companies’ approval policy, e.g. by department, cost center, purpose, city, team, person, amount, tag, and more

- Approval workflow engine – the ability to build multi-step approval flows with AND/OR logic, and more

- Approval/commentary notifications system – notifications for assigned to-do items, comments, and pending approvals

- Payment release system – functionality to pay invoices with ACH/SEPA open banking rails. In the future – with a card, BNPL, and other means

- Bulk payments and partial payments – the ability to pay invoices in part and in bulk

- Payment reconciliation logic – connecting documents to payments, marking invoices as paid, preparing the data for accounting push

- Manual payments log – ability to log payments manually, including cash & partial payments

- Accounting categories coding system – ability to suggest and assign GL categories in cases where it’s required for accounting system data push

- Data push into accounting systems – all the invoices and transactions data will be automatically synced with the client’s accounting system

- Conflict resolution capability – ability to find, flag, and resolve conflicts between the accounting system and your system. This is required to perform automated two-way data syncs with accounting platforms – a must-have for any business

- Audit trail – full log of events and changes, which is required for most of internal/external audits and for finding errors

How to get started?

Learn more about our AP Automation solutions and features on our Accounts Payable page.

Or get in touch and we will help you build a business case and a revenue projection for AP Automation functionality. At the same time, we will provide all the necessary tech & product documentation, so you can assess the Monite API from the perspective of shipping the right value to your users.