Guides Archives | Monite

Revolutionize Your Platform with Invoicing and Payables Automation

June 7, 2024

By Bill Cooper (U.S. Sales Lead at Monite)

Vertical SaaS apps are continuously evolving to meet the growing demands of businesses. One key trend gaining momentum is the shift toward embedded financial operations. By integrating features like automated invoicing and payables into their platforms, SaaS providers can simplify their clients’ financial processes, improve their customer’s cash flow, and drive their own revenue growth. In this blog post, we will explore the benefits of embedding invoicing and payables automation and how it can revolutionize your platform.

Understanding the Shift Towards Embedded Financial Operations

The landscape of vertical SaaS applications is undergoing a transformative shift, propelled by increasing demands for more nuanced, industry-specific functionalities. This evolution is markedly noticeable in the financial operations domain, where the integration of automated invoicing and payables is becoming a pivotal strategy for SaaS providers. This shift is not merely a trend but a response to their customer’s desire for comprehensive, streamlined financial management tools within the platforms they already use.

As businesses grapple with the complexities of managing their financial workflows, the appeal of having invoicing and payables automation embedded directly into their operational software is undeniable. This integration offers a seamless, efficient approach to financial management, eliminating the need for separate systems and the inherent friction they bring. The result is a cohesive, user-friendly experience that significantly enhances operational efficiency.

For the providers, it presents an opportunity to deepen their product’s value proposition, embedding themselves more integrally into their customers’ operational workflow. For businesses, the allure lies in the simplification and automation of critical financial processes, which directly contributes to improved accuracy, time savings, and more strategic cash flow management.

This evolution underscores a broader trend in the SaaS industry: the move towards more holistic, all-encompassing solutions addressing specific, often complex business needs. By adopting automated invoicing and payables, SaaS platforms are not just adding a feature; they are fundamentally rethinking how financial operations can be optimized to support business growth and resilience. This shift is a clear indication of the industry’s trajectory towards more integrated, efficient, and user-focused solutions, setting a new standard for what businesses can expect from their operational software.

The Value Proposition of Embedding Invoicing and Payables

At the heart of modern business operations lies the quest for efficiency and accuracy – two pivotal factors automated invoicing and payables automation address head-on. By embedding these functionalities into your platform, you offer businesses a streamlined pathway to managing their financial operations, effectively turning a complex process into a seamless part of their daily routine. The integration of these services goes beyond mere convenience; it represents a fundamental shift in how businesses approach their financial workflows.

Embedded payables and automated invoicing stand out as tools of empowerment for businesses, offering them unparalleled control over their financial landscape. This control comes from enhanced visibility into every transaction and payment cycle, enabling businesses to make informed decisions about their cash flow and financial planning. Such visibility is not just about knowing where funds are at any given moment; it’s about understanding the financial health of the business in real-time, allowing for strategic adjustments on the fly.

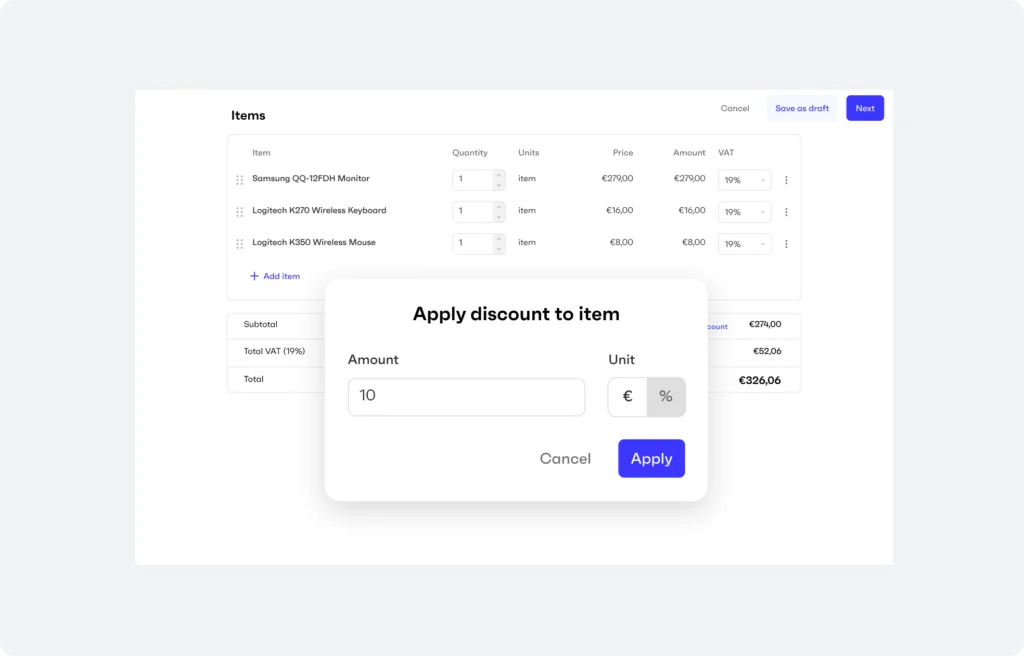

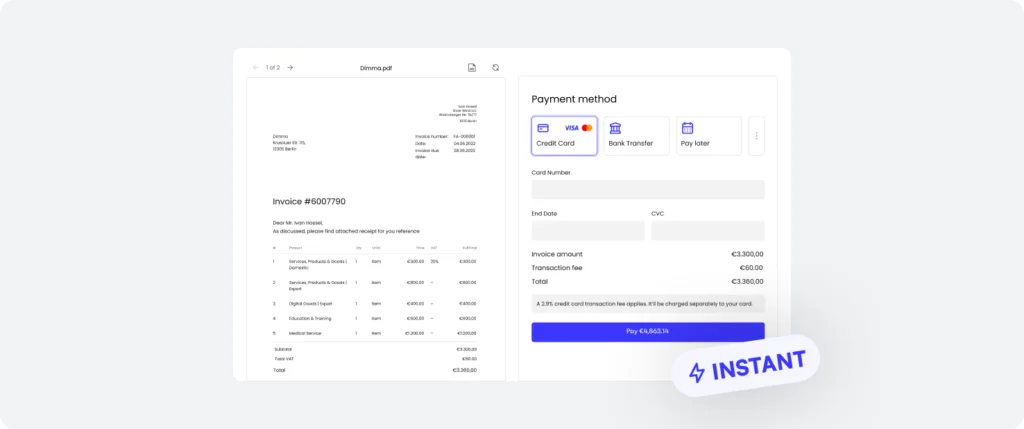

Imagine having a customer’s client book a consulting session via your app. It blocks their calendar, schedules reminders, triggers email notifications for session prework, and more. Now imagine your customer is able to take a deposit at the time of appointment scheduling, or automatically trigger an invoice for the session after it is completed. That invoice contains a payment link for your customer’s customer. As a result, they are paid faster and no one has to key an invoice into a system, print an invoice, mail a check, etc. Easier workflows and improved cash flow through your application. You’ve just made your customer’s business life easier and improved their financial standing.

Moreover, the automation aspect cannot be overstated. By automating routine financial tasks, such as invoice creation, payment reminders, reducing days outstanding, or automatically taking advantage of payment terms, companies can significantly reduce the time spent on manual data entry and the errors often accompanying it. This shift allows employees to redirect their focus toward more strategic activities contributing to business growth, rather than being bogged down by administrative tasks.

The integration of invoicing and payables automation into a SaaS platform does more than streamline operations; it introduces a level of precision and efficiency that was previously unattainable without investment into a custom built accounting software system, or an ERP system beyond the financial reach of many small and mid-size businesses. This not only enhances the operational capacity of businesses but also strengthens their financial integrity. In an environment where every transaction and financial decision can be the difference between growth and stagnation, the value of embedding these automated financial services into your platform cannot be overstated. This strategic integration represents a forward-thinking approach to financial management, positioning your platform as an indispensable tool in the modern business ecosystem.

Expanding Your Revenue Streams with Embedded Financial Services

Vertical SaaS companies have three options when it comes to revenue growth:

- Grow Your User Base – While this sounds like the easiest solution, this is what you have been doing since the day you launched your MVP. However, if this is your approach, you need to grow your customer base while ensuring you have no one opt out of your platform to ensure the growth you need.

- Increase Your Fees – This is the shortest path to more revenue, but this can impact your customer retention. Higher fees can make your customers wonder about the benefits of using your platform. They might go elsewhere for your services.

- Additional Features and Functionality – This is where you can grow your customer base, increase your fees (for new functionality), and expand your overall marketshare with something new your business can offer existing and potential customers.

Embedded financial tools help your business customers run their business better. Every business pays invoices (AP) and every customer needs to bill their customers (AR), regardless of industry, geography, etc.

When you add invoicing and payables automation into your platform, you unlock untapped potential for revenue diversification for your company. This will increase the value of your platform to your addressable market but also positions you as a vital partner in your clients’ pursuit of financial efficiency and control. Helping your SMB clients with their cash flow makes your platform a cornerstone of their business.

Small and medium businesses are using everything from ledger notebooks to spreadsheets to standalone software packages to SaaS accounting software programs.

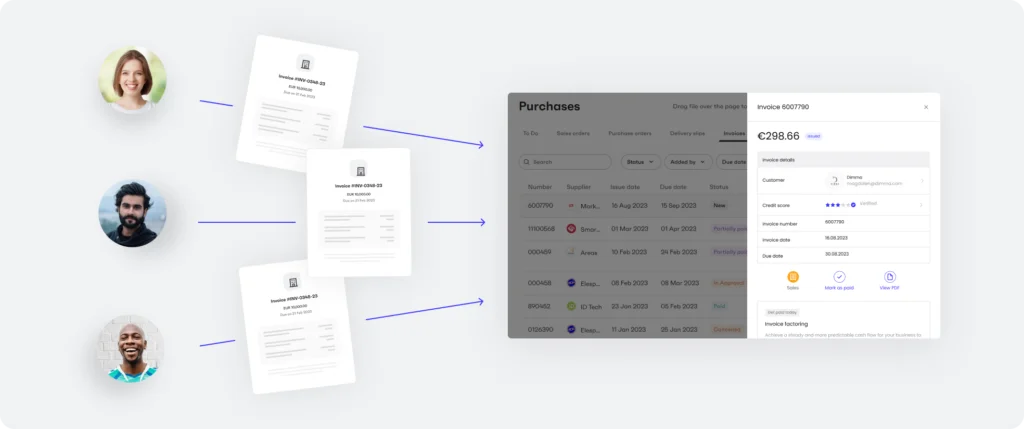

Accounts Payable Automation in Small Business by Monite

The question for Vertical SaaS providers is HOW to add this functionality to your business. You’ve focused on becoming the best provider for the businesses you serve, making their unique processes streamlined to make their business more efficient. Now you need to consider how you can help make their business’s finance operations more efficient without changing your strategic focus or product road map.

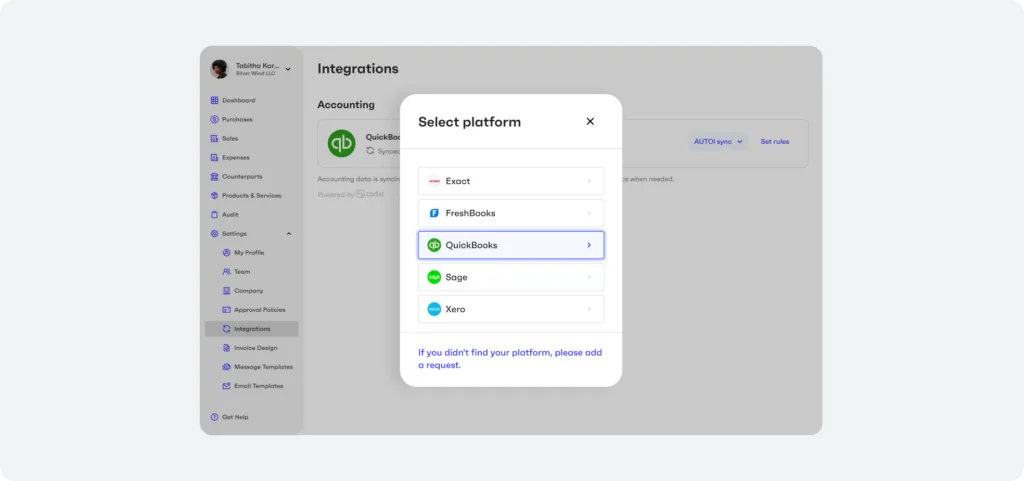

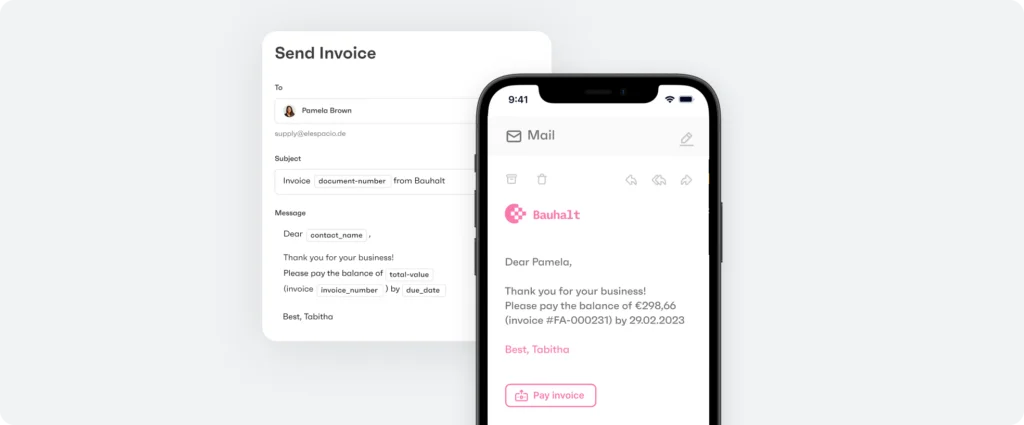

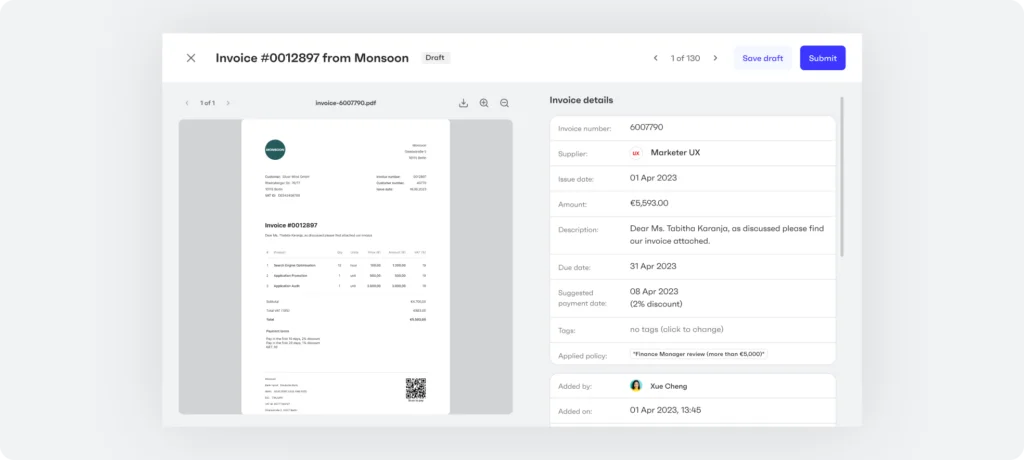

This is where a company like Monite can help you. The industry’s only “plug and play” API solution that is completely white labeled. You get complete control over the look and feel of the embedded application. The result is compliant invoicing, payment rails, invoice reminders, and payment approval workflows, looking like you’ve spent months or years developing this solution, live for your customers to use in a matter of weeks.

Keep your focus on your strategic initiatives and current product roadmap while 2-3 developers launch embedded invoicing and bill payment functionality that unlocks revenue for you, while making your platform more attractive to your customers.

Case Studies: Success Stories of Embedded Payables Integration

Exploring the real-world impact of incorporating embedded payables and automated invoicing into platforms reveals some compelling success stories underscoring the transformative power of these integrations. One remarkable example involves a digital marketing agency that leveraged embedded payables to streamline its vendor payments. By doing so, the agency not only cut down on administrative overhead by 25% but also enhanced its relationship with suppliers through timely, accurate payments. The ripple effect was a notable improvement in service delivery to their clients, fueled by more efficient and reliable backend operations.

[Automation in finance teams results in cheaper and more efficient financial processes.]

Another case worth highlighting is an e-commerce platform that adopted automated invoicing to simplify its billing process. This move resulted in a striking 35% reduction in the time taken to close monthly financial cycles, alongside a marked decrease in billing discrepancies. This efficiency gain translated directly into better cash flow management, giving the company a stronger financial footing to pursue new growth opportunities with confidence.

These narratives are more than just numbers; they illustrate a clear path to operational excellence and financial robustness for businesses that embrace embedded financial operations. The experiences of these companies illuminate the profound effect that such integrations can have, not just on the operational workflows but also on the broader business ecosystem, fostering stronger, more productive relationships with vendors, improving service delivery, and ultimately contributing to a healthier bottom line.

Implementing Embedded Financial Operations: A Five Step Guide

Embarking on the journey to integrate invoicing and payables automation within your platform can be a transformative move, propelling both your value proposition and market positioning. The pathway to seamlessly embedding these financial operations is grounded in a strategic approach, tailored to both your platform’s capabilities and your client’s nuanced needs. Here’s how to navigate this integration effectively:

- Conduct a thorough market analysis to pinpoint the specific financial operations your target audience struggles with. This insight will guide the customization of your embedded financial services to ensure they address real and pressing needs.

- Select a technology partner offering robust and scalable automated invoicing and payables solutions. The right partner should not only align with your platform’s technical requirements but also share your vision for simplifying financial operations for businesses.

- Ensure the integration process is smooth and intuitive, minimizing disruption to your platform’s existing user experience. Seamless integration is key to encouraging adoption and maximizing the utility of the new features for your clients.

- Develop comprehensive training materials and offer dedicated support channels to assist your clients in navigating the new financial tools. Empower them with knowledge and support to leverage these features fully, optimizing their financial workflows.

- Continuously monitor the utilization and performance of the embedded financial operations. Solicit feedback from your users to refine and enhance the functionality over time. This iterative approach ensures that your platform remains responsive to the evolving needs of your client base, solidifying your role as a critical tool in their financial management toolkit.

By adhering to these steps, you position your platform at the forefront of the shift towards more integrated financial operations, offering unparalleled value to your clients and setting the stage for sustained growth and innovation.

The Growing Challenge of AP and AR for SMBs

April 26, 2024

Small businesses face tough challenges with managing money they owe (AP) and money owed to them (AR). These tasks are key for keeping a steady cash flow, staying liquid, and keeping good relationships with suppliers and customers. But, handling AP and AR, especially the old-fashioned way or with outdated tools, really stretches a business’s resources thin.

Common Pain Points in Accounts Payable and Receivable

Accounts Payable Challenges

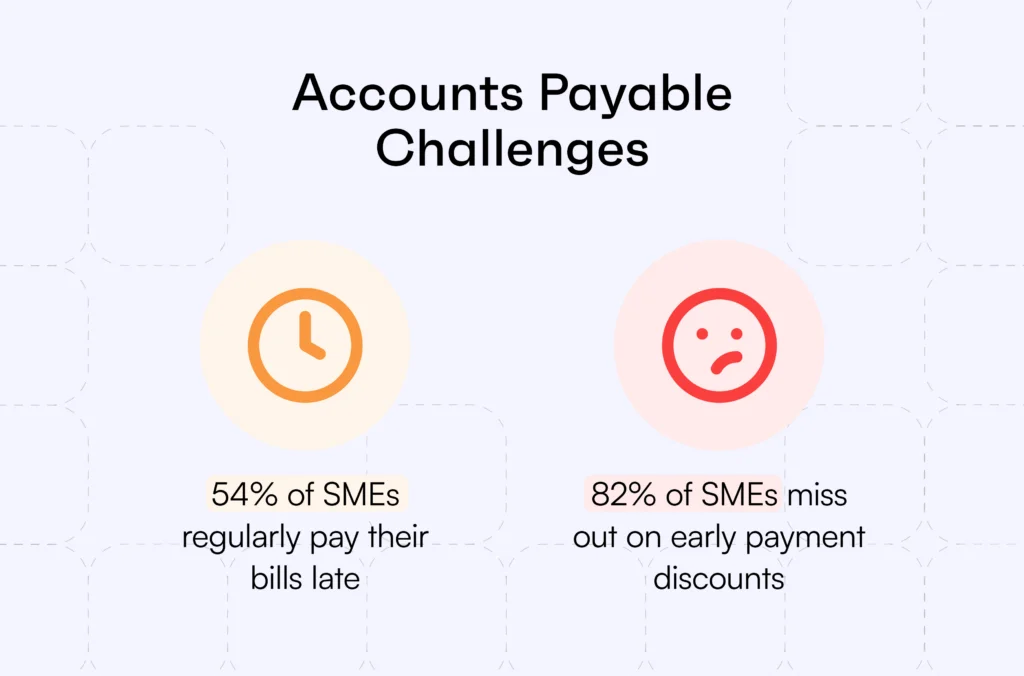

- Inconsistent Invoice Formats and Approvals: 54% of SMEs regularly pay their bills late, partly due to inconsistent invoice formats and the cumbersome process of chasing approvals. This inefficiency is reflected in 47% of invoice approvals running late, leading to strained relationships with suppliers and additional costs

- Financial Impacts: The average cost per processed invoice is estimated at $15, contributing to excessive handling costs. Moreover, 82% of SMEs miss out on early payment discounts, impacting profitability. The lack of visibility into outstanding liabilities (experienced by 34% of businesses) leads to missed payments, late fees, and poor cash flow management.

Accounts Receivable challenges

- Delayed Payments: A staggering 87% of businesses report being paid after their invoice due date, with sectors like marketing, advertising, and construction experiencing significant delays. The delay can extend up to 30 days beyond the invoice due date for larger businesses.

- Cost and Time of Chasing Payments: Businesses spend considerable resources on payment follow-up tasks, with over half dedicating 4 hours or more each week. This not only represents a financial burden but also a significant opportunity cost, diverting time from revenue-generating activities.

These challenges highlight the need for small businesses to streamline their financial operations. Using technology to automate and integrate AP and AR can help improve efficiency, cut costs, and better manage finances.

Why AP and AR Are Not Solved With Current Solutions

Even with tools like Bill.com and Tipalti, small businesses still find AP and AR tough. These systems might be too complex for small teams without a finance expert. Also, small businesses often can’t afford these solutions, don’t know how to use them, or don’t want to change their current methods. As a result, they end up using Excel and emails to manage finances, chase payments, and get approvals, which isn’t efficient.

How Fintech and SaaS Platforms Should Be Addressing SMB’s Needs

Fintech and SaaS platforms, including Neobanks, should tailor their offerings specifically for small businesses by integrating financial tools directly into the workflows these companies already use. This would eliminate the need for additional training or resources to manage accounts payable and receivable processes.

By automating invoicing, payments, and providing real-time financial insights, these platforms can offer significant value. Small businesses are not necessarily looking to purchase new solutions but are open to investing more in their core SaaS tools if these provide additional value and streamline their financial operations.

Why solving AP and AR challenges leads to automated B2B payments

Solving AP and AR challenges is essential for unlocking automated B2B payments. The real value in B2B transactions isn’t just in transferring funds but in streamlining the entire process that leads up to the payment. This includes managing invoices, approvals, and other preparatory steps efficiently. By focusing on these workflows, businesses can significantly improve efficiency and accuracy in their financial operations, leading to a more automated and seamless B2B payment process. This approach not only addresses the immediate challenges but also paves the way for innovative payment solutions tailored to the unique needs of businesses.

Real-World Applications: Success Stories from leaders in specific verticals

Leaders in niche verticals, like ServiceTitan and Jobber, showcase real-world success stories in addressing AP and AR challenges. ServiceTitan, leveraging digital transformation and private equity interest, reported $577M in revenue in 2023 by offering comprehensive solutions for trades. Jobber, targeting a similar market with a more affordable CRM, achieved $150M in revenue. These successes highlight the impact of tailored fintech solutions in streamlining financial operations for small businesses, demonstrating the potential for efficiency gains and cost savings in specialized markets.

Summary: The Problems Are Huge and an opportunity for B2B platforms

The struggle with AP and AR management poses both a significant challenge and a golden opportunity for B2B platforms. Yet, the evolving landscape of fintech and vertical SaaS is offering solutions, notably through Monite’s Accounts Payable and Accounts Receivable infrastructure.

Monite’s infrastructure helps B2B platforms speed up the building of Invoicing and Bill pay workflows. Since our platform is API first, our ready made modules such as accounting integrations and multi-payment rails are flexible. You can choose to add them and connect through our API or choose to implement your own solutions.

Enhancing OCR accuracy and speed in AP automation

March 7, 2024

The importance of OCR in Accounts Payable automation

Optical Character Recognition (OCR) technology is vital in automating Accounts Payable (AP) processes, transforming how companies handle invoice processing by converting diverse document types into editable and searchable data.

This technology’s significance is underscored by the fact that today, more than 60% of companies have embraced OCR tools to varying degrees within their accounts payable process. The implementation of this technology offers a multitude of benefits, elevating the efficiency and accuracy of accounts payable processes to new heights.

This blog discusses strategies to enhance OCR accuracy and speed in AP automation, with a particular focus on automating invoice capture and optimizing routing based on job alignment.

Understanding and using OCR technology in AP automation

OCR technology plays a critical role in AP automation, primarily used for extracting text from invoices and other financial documents. This technology excels in converting images of typed, handwritten, or printed text into machine-encoded text, which significantly streamlines the data entry process. By moving away from traditional manual methods, OCR-driven automation marks a substantial advancement in efficient invoice management.

Acting as the backbone of digital invoice processing, OCR technology scans and recognizes characters in documents, transforming them into digital formats. This process effectively eliminates the need for manual data entry, consequently reducing human errors and substantially boosting processing speed. Therefore, integrating OCR into AP systems is a pivotal step toward achieving enhanced operational efficiency and accuracy in financial transactions.

Key challenges in OCR accuracy and speed

Despite OCR’s advantages, several challenges can impede its performance. The most common issues include variability in document formats, low-quality images, and complex document layouts, which can significantly affect OCR’s accuracy and processing speed. Addressing these challenges is crucial for optimizing the efficiency of AP automation.

Strategies for enhancing OCR performance in AP systems

The path to enhancing OCR performance lies in a blend of technological advancements and strategic process optimization. Automation plays a pivotal role in this endeavor, offering significant improvements in both accuracy and speed. We discuss a couple of ways to improve:

- Automating invoice capture

One of the most effective strategies for improving OCR accuracy involves automating the invoice capture process. This entails developing systems capable of handling a broad spectrum of invoice formats and layouts, ensuring accurate data capture regardless of the document’s source. Automating invoice capture not only improves accuracy but also significantly reduces the time and resources spent on manual data processing.

- Optimizing OCR with advanced algorithms and AI

Another key strategy is the integration of advanced algorithms and Artificial Intelligence (AI) with OCR technology. AI models, when trained to recognize and interpret various invoice formats, provide a substantial boost to OCR’s capability. They enable the technology to adapt to different fonts, styles, and layouts, enhancing both the accuracy and efficiency of the OCR process in AP systems.

- Routing invoices based on job alignment for efficiency

Efficiently routing invoices based on job alignment further enhances the performance of OCR in AP systems. This strategy involves establishing rules within the AP system to automatically direct invoices to the appropriate department or personnel. The routing is determined based on job or project details captured by the OCR, thereby streamlining the approval and payment process.

The future of OCR technology in AP automation

Looking forward, the landscape of OCR technology in AP automation is set for significant advancements. The continued evolution of AI and machine learning promises OCR systems that are faster, more accurate, and highly adaptable to the dynamic needs of businesses.

However, building OCR technology from scratch is a complex and time-intensive endeavor. Developing an efficient OCR system requires substantial investment in machine learning and algorithm optimization. The accuracy and efficiency of the system improve progressively with use and refinement.

This ongoing development of OCR technology is critical, as it becomes an integral component of AP automation, driving efficiency and accuracy in financial operations. For many businesses, particularly those without extensive resources in machine learning and data processing, leveraging advanced OCR solutions developed by specialists like Monite is a strategic move. This approach bypasses the complexities of building from scratch while gaining access to cutting-edge technology.

Conclusion

OCR is nowadays a critical element in AP automation, expected by modern businesses for its efficiency. However, crafting a high-performance OCR system, particularly for industries with complex needs like construction, is challenging and resource-intensive.

Choosing a ready-made, customizable OCR infrastructure is a strategic move. It not only saves development time but also provides access to expertise that’s otherwise almost impossible to recruit for. This approach allows B2B platforms to focus on core activities while leveraging expert solutions to help build their Bill Pay products, ensuring efficiency, accuracy, and scalability.

For more insights on implementing advanced OCR technology for your AP product, read the possibilities of building on top of infrastructure for Accounts Payable.

Revolutionizing invoice management in construction B2B SaaS with AP automation

February 1, 2024

Understanding AP automation in construction

In the competitive landscape of Construction B2B SaaS, efficient management of financial transactions is pivotal. Accounts Payable (AP) Automation is transforming the way companies handle invoice management, particularly in niches with unique billing and compliance demands. This post explores the transformative impact of AP automation, bringing unparalleled benefits to the construction industry.

Automated data capture: a game changer in construction billing

In construction, where every material, labor hour, and equipment rental counts, automated data capture through AP automation is revolutionizing billing processes. It eliminates the traditional pitfalls of manual data entry, reducing errors and ensuring precision in financial records—a crucial factor in an industry where accuracy is paramount.

Customization: meeting the specific needs of construction

Each construction project comes with its unique set of requirements. In this industry, managing finances and complying with unique billing requirements are critical challenges. Here’s how AP automation is proving to be an indispensable tool for construction software SaaS companies:

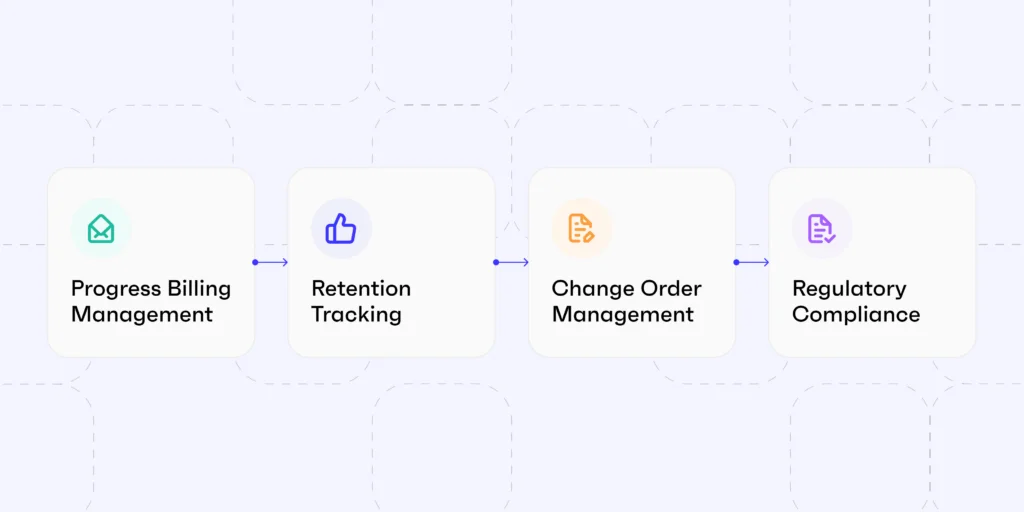

Progress billing management: AP automation adeptly handles progress billing, a common practice in construction where payments are linked to project milestones. It tracks work progress, ensuring that billing aligns accurately with completed stages, and streamlines the approval process for each payment.

Retention tracking: Construction contracts often include retention clauses, where a part of the payment is held until project completion. AP automation efficiently tracks these amounts, releasing payments when due and ensuring adherence to contract terms.

Change order management: Given the dynamic nature of construction projects, change orders are frequent. AP automation simplifies managing these changes, ensuring proper documentation, approval, and billing.

Regulatory compliance: The construction sector is heavily regulated. AP automation aids in ensuring that payments to subcontractors and suppliers are compliant with various regulations, mitigating the risk of penalties.

Lien waiver management: To protect against claims, construction companies often require lien waivers from subcontractors before payment. AP automation streamlines this process, managing and tracking waivers to ensure they are in place before releasing funds.

Material and equipment billing: With AP automation, billing for various materials and equipment, including rentals and supplies from different vendors, is accurately tracked and managed, ensuring timely payments.

Subcontractor payment management: The complexity of managing multiple subcontractor payments is significantly reduced with AP automation, which handles invoices, contract compliance, and payment scheduling efficiently.

Job costing integration: Integrating with job costing systems, AP automation offers real-time insights into project expenses against budgets, aiding in effective financial management.

Enhanced audit and reporting capabilities: AP automation provides a robust audit trail for transactions, simplifying the compilation of reports and compliance with auditing requirements.

Handling multi-entity and multi-currency transactions: For construction firms operating internationally, AP automation simplifies handling transactions in multiple currencies and across different legal entities, managing currency conversions, and regional compliance.

By addressing these specific construction industry needs, AP automation not only enhances efficiency and accuracy but also ensures compliance in billing and payment processes, making it an indispensable tool for construction software SaaS companies.

Real-time processing for dynamic construction projects

The ability of AP automation to process invoices in real time is invaluable in the construction sector, where project timelines and financial flows are constantly evolving. This agility ensures that financial operations keep pace with the dynamic nature of construction projects.

Ensuring compliance in a highly regulated industry

The construction industry is heavily bound by regulations and standards. AP automation not only ensures accuracy in transactions but also aids in maintaining compliance with these stringent regulations, thereby safeguarding construction businesses from potential legal complications.

Strategic financial management: beyond invoice processing

In construction, where budget management and financial forecasting are critical, AP automation extends its utility beyond mere invoice processing. It integrates with job costing systems, offering real-time visibility into project expenses and aiding in strategic financial management and decision-making.

Conclusion

In conclusion, the integration of AP automation is essential for your customers in the construction sector. They face complex accounts payable processes that are too time-consuming and error-prone to manage manually. Attempting to build an AP automation system from scratch is a formidable challenge due to these specificities.

By leveraging a flexible infrastructure, your company can quickly develop a minimum viable product (MVP) and evolve it into a best-in-class Bill Payment solution. This approach not only saves time and resources but also significantly enhances the accuracy and efficiency of your customers’ financial operations. Learn more about how Monite can assist in building your build your Accounts Payable product.

Guide to Accounts Receivable Automation

October 26, 2023It’s all about getting paid

for B2B platforms

Gain insights in the significant challenges SMEs face with getting paid. Explore their current solutions and how you can solve their problems incorporating AR functionality within your platform.

Getting paid fast is essential for a small business to stay financially healthy. In B2B transactions, getting paid can be a real challenge due to extended payment terms. Since payments are often delayed, it becomes challenging for SMEs to keep track of who owes them money and when to expect it.

People start businesses with the aim of generating profits – which means that making money and getting it in the bank is one of the key ongoing tasks they have to deal with. The method through which business owners can receive their payment can vary depending on the nature of their business.

| Payment type | Description | Pain level |

|---|---|---|

| Online payments/checkout | e.g. online subscriptions or buying something on the website and paying for it with a credit card | Low – business is paid at the moment of purchase |

| Offline payment/checkout | e.g. buying something in a store with cash or card | Low – business is paid at the moment of purchase |

| Invoicing | Sending the invoicing for services done/to be done with 0-90/other days payment terms | High – 86% of invoices are paid late affecting SME cashflow |

10 years ago the picture would have looked different – even online payments were hard. Today, there’s an abundance of players to plug in online checkouts into your website. These ranges from turnkey solutions like Shopify or Wix to versatile providers like Stripe and Checkout, as well as industry-specific options like Squire or Motive.

Offline payments have improved significantly as well. What once was a game-changer with square, now there are multiple providers such as SumUp, Zettle, Lightspeed, and other new & traditional players. There are also verticalized specialists like Toast, offering a POS sytem tailored to the specific needs of their business type they focus on.

In recent decades, we saw payments moving online, becoming more lean and automated. Yet for many B2B transactions and for some B2C transactions payments have not improved that much – mainly because the process remained largely untouched when it comes to B2B transactions.

A simplified B2B process looks like this:

- Send the invoice to the client with a grace period of 30/60/90/more days

- Wait for the invoice to be paid

- Chase the payment if it’s not paid (potentially forever)

In the process above, businesses heavily depend on their clients paying the invoice on time. Unfortunately, clients often prove to be inefficient in this regard — they lose invoices, forget about them, or intentionally delay payment to hold on to their cash for as long as possible.

The process of chasing down these overdue payments is mostly manual and incredibly furstrating. It also poses a significant risk to particularly small businesses. These typically lack substantial cash reserves, so if several payments are delayed, it can seriously impact their financial stability and force them into a situation where they need to seek a loan or another financial solution.

Worst of all – many of these businesses aren’t aware they’re falling into this financial trap. Most of them lack real-time visibility into their cash flow. On one hand, they struggle to keep track of which invoices are overdue or about to become overdue. On the other hand, they only see the amount in their bank accounts and remain unaware of the outstanding obligations to their suppliers — leaving them in the dark about their true financial position.

Real-time cashflow simplified:

- Money in bank accounts

- − Outstanding obligations (salaries, payments to suppliers, expenses, etc.)

- + Expected revenue (invoices that are becoming due & other payments)

Revenue collection – biggest pain for SMEs

Revenue collection is one of the biggest pains SMEs have. The numbers below shed some light on the scale of this problem for businesses.

- 87% of SMEs are consistently paid late, disrupting cash flow and limiting opportunities to reinvest revenue

- 48% of SMEs suffer from losing invoice payments or missing payments, directly resulting in loss of revenue

- 50% of SMEs spend 7+ hours per week chasing late payments, distracting employees from their core business operations

- 12% of SMEs hire someone to chase late payments full-time, wasting resources on FTEs that could be strategically invested in staff who drive business growth

- 3.6 h/week wasted on average on manual payment tracking reconciliation, leading to unnecessary costs and potential inaccuracies due to human error

- 71% of SMEs have disconnected invoicing and accounting systems, resulting in excess manual work and a lack of real-time financial insight

Accounts Receivable process explained

Accounts Receivable (AR) is about handling outstanding invoices and payments. Small businesses specifically struggle with this due to the absence of specialized software that's within budget and is easy to use. Introducing AR automation can streamline the process, making it more efficient and cost-effective.

Simply put, accounts receivable (AR) process is the systematic management of outstanding invoices and payments owed to a company by its customers.

A simple AR process starts after service is performed or goods are delivered:

- Invoice is issued

- Invoice is paid

- Payment is reconciled

- Data is transmitted into accounting ledger

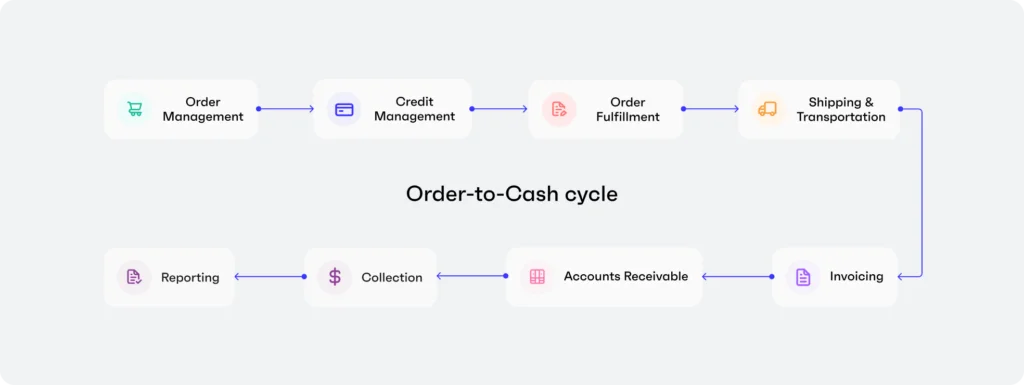

The above is just a simplification – in real life, the Accounts Receivable process is more complex than that. The full process is called Order-to-Cash – also referred to as O2C, OTC, or the quote-to-cash cycle.

A company’s business transaction begins with receiving orders from customers and performing the required services. After the work is done, they invoice the customers and then receive payment. The O2C cycle starts when an order is placed and ends when the payment is received & recorded in the general ledger.

Accounts Receivable (AR) Automation alleviates the pain

Managing orders, offers, and invoices easily becomes a nightmare for small businesses without extensive finance teams. As a result, these businesses often struggle to properly keep track of sent invoices and their due dates – meaning they fail to send timely reminders and run into serious issues with collecting payments.

Most SMEs don’t use specialized software for invoicing. Instead, they rely on basic accounting tools, Microsoft Word and Excel, or even create one-off invoices in free online applications. This makes it hard to automate payments with – for instance, payment links and payment reminders.

The reason why businesses don’t use specialized software is simple — many find it impractical to use specialized software for a different operation in their business. Doing so would require them to adopt a multitude of tools, each catering to a specific area – making it too complex and expensive.

Nevertheless, SMEs would greatly benefit from Accounts Receivable Automation software, but then added within the platform they’re using every day for their business. They’d only pay a slightly higher bundled price, without needing to add or learn a new tool, while solving one of their key painpoints: collecting revenue.

AR impacts cash flow

Today’s status quo brings another challenge to SMEs. Due to the lack of proper insight or automation, business owners don’t know when they should take action regarding debt collection or consider services like factoring.

To make matters worse, hardly any invoicing or accounting tools offer a seamless integration with cash advance, factoring, or debt collection services. Instead, each of these services operate in silos: invoicing software is solely for creating and sending invoices, while factoring/cash advance providers function separately and require a business to register. In the end, uploading invoices requires many manual steps.

Invoicing → Revenue management

It becomes obvious that SMEs require more than just invoicing to address their “get paid fast” challenges; they need full revenue management functionality.

The difference between the two becomes very apparent if we look at the scope of the two solutions.

| Invoicing | Revenue management |

|---|---|

| Customer & product management | Customer & product management |

| Send offers | Send offers |

| Send invoices | Send invoices |

| Send data to accounting systems | Send data to accounting systems |

| – | Payment links |

| – | Payment reminders |

| – | Dunning mechanism |

| – | Cash advance & working capital |

| – | Factoring capability |

| – | Debt collection capability |

| – | Predictive cashflow analytics |

Today, there are almost no systems in the market that offer a full revenue manage capability. While many offer invoicing software, there is a significant gap when it comes to a complete system for revenue collection. We believe this is where the opportunity is.

Why offer Revenue Management to your business clients?

SMEs struggle with revenue collection but find standalone AR Automation solutions costly and complex. Platforms that integrate AR Automation into their existing services can enhance value, become primary B2B payment providers, and attract more users, following the success of companies like Toast and Brex.

SMEs are struggling with revenue collection and need help. They are increasingly open to using AR Automation software. BUT -it’s expensive and complex to implement a standalone solution.

As mentioned, most SMEs prefer to manage their revenue within the platforms they use daily, such as neobanks, vertical Software as a Service (SaaS) providers, or other tools they’re already familiar with. Since they’re accustomed to these software platforms already to manage their business, it’s much easier to switch from Word/Excel than to buy and learn new software.

In general, most businesses want one platform to run their business – it’s easy, efficient, and inexpensive compared to using 5-7 different tools. In response to this many neobanks, vertical SaaS players, and others are expanding their financial offering, aiming to become super-apps. This wave is just starting, but there are already champions we see in some segments of the market – for example, Toast in the restaurant industry, or Brex in the scale-ups ecosystem.

Now, you might be wondering, what’s in it for you? Well, there are numerous reasons why platforms start offering AP Automation to become the one-stop-shop solution for their customer.

Offering AR Automation to your business clients allows you as a platform to:

- Offer higher product value

- Become the core B2B payments provider to your clients

- Increase engagement, retention, and loyalty

- Increase revenue per customer – with SaaS & payments fees

- Attract more users as your offering becomes more compelling

- Surpass competition – hard to get clients who do AR with a competitor

We want to highlight one point here – being in the flow of B2B payments to your clients is key to great customer monetization.

Toast, for example, drives over 80% of their revenue from payments. However, it’s the software that enables you to monetize payments and drives the usage in the first place. So if you offer AP & AR Automation to users, you basically become their cashflow management platform, meaning you can monetize:

- All incoming payments (AR) – Payment links, BNPL for the end client, invoice factoring and more

- All outgoing payments (AP) – Single & bulk payments, BNPL, bill pay w/credit card, scheduled payments and more

- Cashflow gaps – Working capital optimization through financing, business loans, etc.

How can you monetize Revenue Management functionality?

You can charge for the software, transaction payments, and financial services to monetize revenue management. If you offer AR Automation as part of a one-stop solution, you can help your clients save costs. In addition, you can also earn payment fees (e.g. % of each transaction) from payment methods used to collect invoice revenue, potentially generating significant margins.

The best way to monetize revenue management functionality is to take a revenue cut from multiple sources – a fee for the software itself, payment fees for processing transactions, and financial service fees for features like cash advance or factoring.

Invoicing tools typically charge a basic monthly fee – ranging from free to $100s per month – depending on the level of automation, sophistication and their market positioning. Additionally, those that are payment-enabled can also monetize payments, attaching payment links to invoices, taking a cut when the user is paid. Depending on the client base, revenue from payment fees can account for up to two-thirds of the platform’s total revenue.

If you’d offer the full revenue management, you can potentially increase your earnings up to 2-5x the monthly + payment fees combined.

So when you offer Revenue Management software to your clients, you can monetize through:

- SaaS fees – Add AR to a premium package or charge a separate fee for AR functionality

- Payment fees – Get a % for each invoice paid with a payment link

- Financial services revenue – Get a % of each invoice that was used for cash advance, factoring, or debt collection

SaaS fees

Even though AR Automation functionality is adding a ton of value, you can’t offer it for a similar price like Radius or other competitors in the space. These companies specialize exclusively in AR Automation, so they can’t reduce their prices. As a result, they might lose potential clients who find their services too costly.

Being a one-stop-shop solution with AR Automation included allows you to offer more competitive prices to users – you could save them 2-5 times the costs compared to a standalone player.

- Adding AR into a premium package – this means quite a substantial de-facto discount on AR Automation functionality since only a fraction of the premium plan’s price can be attributed to AR. This approach is most effective when your premium package is already highly priced and produces high ROI – then discounting AR functionality will pay off

- Pricing AR Automation as an extra feature – this is the best strategy for most cases, as it simplifies revenue tracking and attribution to AR. For clients, this means they can use AR functionality when they need it, rather than being tied to a bundle that may include services they don’t require

Payment fees

Almost any payment these days costs money – and businesses are used to that. Moreover, they’re usually happy to pay extra for automation, convenience, and speed. When it comes to AR Automation, having payments as a part of your flow is invaluable – it helps your clients get paid faster and solves the reconciliation pain – as in that case payment is auto-connected to the invoice.

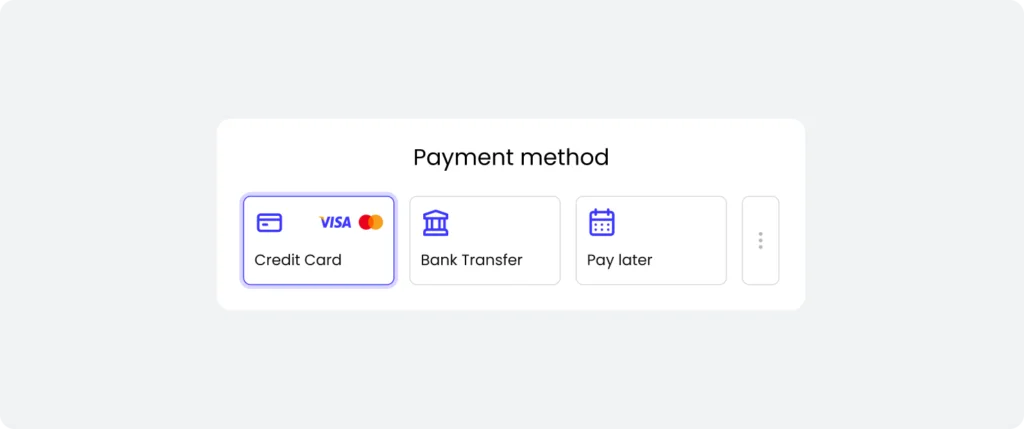

Here are the main payment methods you can monetize

- SEPA: Possible margins from €0.05 per payment and €9.50 for each active account. SEPA direct debit is a widely accepted and cost-effective method for B2B payments in Europe

- Cards: Margins of up to 0.4% of the payment. Card payments are widely accepted, making them one of the most convenient and common methods for transactions in today’s digital economy

- ACH: Margins go up to $4.50 or 1% of the payment. For each user, you can profit up to $8 per month, along with a one-time fee of $5. ACH is the preferred payment method for most B2B transactions in the US

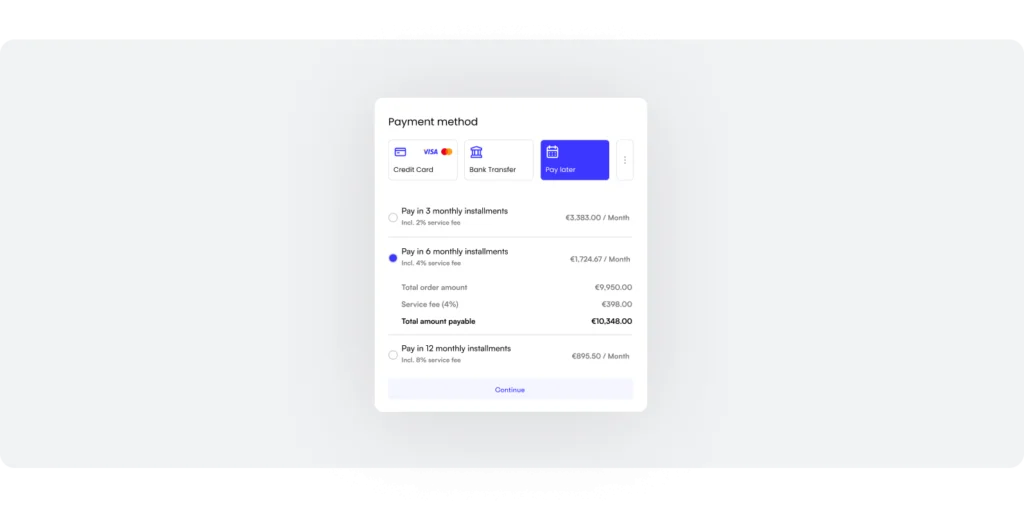

- Buy Now Pay Later: Ranging from 2% to 8% for installments over 3, 6, and 12 months, respectively. This allows your clients to settle an invoice 30/60/90 days or even later past the due date

- Partial Payments: Ranging from 1% (for a 30-day term) to 4% (for a 90-day term). This option enables your clients to break down payments into smaller, more manageable installments

- Bulk Invoice Payments: The profit margins are in line with ACH, multiplied by the number of invoices paid. Your client can select multiple invoices to pay in one go, with support in the US provided by the ACH network

How hard is it to build AR Automation functionality?

To create a best-in-class AR Automation product, it's essential to provide all of the core functionalities. In addition, having accounting integrations seamlessly synchronized, ensuring regional tax compliances and adding integrated payments is what makes building AR automation complex.

Core AR Automation functionality

To develop a complete AR automation product that works smoothly, you need a robust set of core functionalities to bring it all together.

Data integration and extraction

- Data pull from accounting systems

- Customers database with flexible fields

- Products and services database

- Data push into accounting systems

- Conflict resolution capability

Customization and structuring

- Support for custom payment terms – per counterpart, project, or more

- Discounts management – per item, invoice, project, etc.

- Labeling & categorization for project management and more

Compliance

- VAT & tax compliance service

- Compliance system for document templates

- e-Invoicing compliance for applicable markets

- Functionality to issue compliant quotes

Invoice creation

- Ability to convert quotes to invoices manually/automatically

- Invoice creation functionality

- Credit notes issuing functionality

Payment processing

- Invoice payment links

- Basic payment reconciliation logic

- Advanced reconciliation options – partial payments, currency conversion, cash payments, and more

- Advanced KYC/KYB aligned across payment providers

Additional features

- Connectors to financial products like cash advance

- Data-driven upsell of financial products

- Accounting categories coding system

Accounting integration

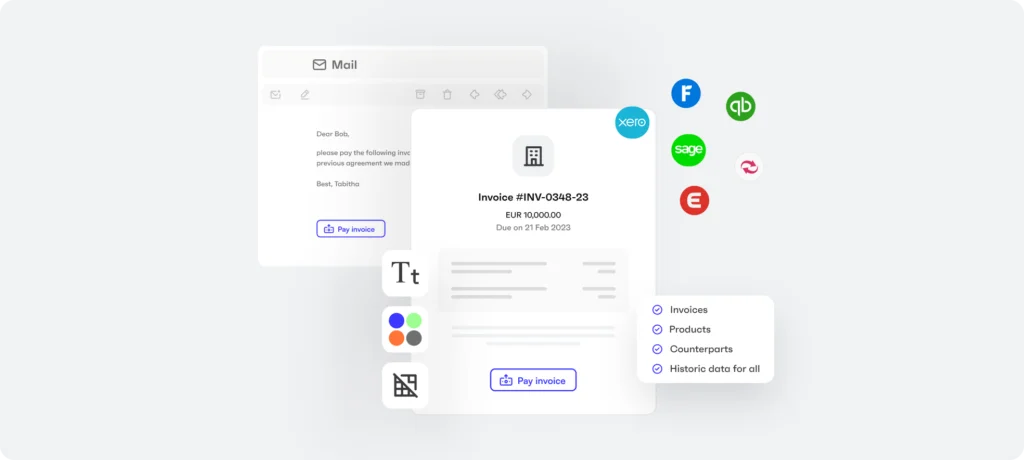

To effectively implement AR Automation for clients, a seamless accounting synchronization is crucial. This often involves a complicated process, including the development of multiple API connections, data processing logic, conflict resolution mechanisms, and more.

In the AR process, one of the first steps your client would take is transferring data from their accounting systems into the platform. However, creating these integrations is more challenging than it might initially appear.

Small and medium-sized enterprises (SMEs) use a diverse range of accounting systems – there is not a single dominant platform. So it may as well be that you need to integrate with 15+ accounting systems to fully serve your customer base effectively.

Each accounting system has its unique way of handling data, ledger management and other functions. This means that there’s no one-size-fits-all approach to integrating accounting systems; each requires a tailored approach with customization. While integrators like Codat or Rails are available to streamline this process and save time, they’re expensive and often lack essential features such as data model standardization, API versioning and conflict resolution capabilities.

- Standardizing Data – accounting platforms vary significantly in how they manage data, containing numerous data types, each with its specific nuances. For example, different regions use distinct date formats and their own terminologies. A standardization layer is necessary to address these variations to make sure data is consistent across your platform

- Standardizing APIs – in a typical integration development scenario, you would have to handle your development processes separately for each accounting platform. However, for a more efficient approach, when dealing with 15+ integrations in parallel, it’s essential to build an standardization layer. This will streamline the process, making it much more straightforward as you’ll only need to interact with a single API, eliminating the need to make individual updates for each accounting platform

- Standardizing Configurations – the last piece where standardization is required is in how one change to synchronization, authorization or alert functions will be applied across all of your integrations

- Conflict resolution – an even more challenging aspect of accounting integrations is how to solve conflict resolution when data between two or more connected systems aren’t aligned. To address this well, you need a system capable of identifying these disparities.

For example:

- Imagine that someone manually entered information into two connected systems, now there are records with different ID numbers. You now need to find a way to merge these two records.

- Another common issue is when one system lacks data that is required by the other. You’d need to find a clever solution looking at common data points to send the right data from one to the other system.

Developing such an integration typically requires a year of dedicated effort from a senior developer. The workload is evenly split, where half of the time would be allocated on solving the standardization issue, and the other half focused on a solution for conflict resolution. This shows how complex building a best-in-class accounting integration system can be.

Regional tax compliance

Invoicing is usually highly regulated by tax authorities and there are a lot of requirements regarding document format, mandatory fields, VAT rate assignments, and more. Adhering to these regulations is necessary for all documents – ranging from invoices to delivery notes – otherwise, they might be inadmissible for tax purposes.

Developing and implementing compliance logic and engine can be one of the most challenging aspects of establishing a robust AR product. These engines must operate across multiple geographical regions, accommodate various business types, and address numerous edge cases.

This is where Monite comes in. Our solution comes with regional tax compliance included, covering document formats, VAT logic and more. Essentially, it’s a plug-and-play system.

Payments

The AR process is largely to collect money from customers. That is why a robust payment infrastructure is required to support this.

Payment links

The most basic version of to get paid is by attaching a payment link to every invoice that goes out or sending the link through email or text. While many invoicing solutions only offer payment options with cards or local methods (e.g. iDEAL, Bancontact, Cartes Bancaire, over 50% of invoice payments are still processed through ACH/SEPA banking networks. That’s why we emphasize the importance of incorporating ACH/SEPA payments within payment links – next to cards and local payment methods.

To design and offer a strong payment links product, platforms need to:

- Run a provider analysis and select providers for each payment type

- Integrate these selected providers

- Streamline an onboarding flow that satisfies all of the due diligence required from the payment providers

- Create a payment page product that consolidates multiple providers into a single interface

- Establish a reconciliation mechanism for each payment option

Financing options

For a comprehensive revenue collections process, it’s also crucial to provide solutions like factoring and cash advances. This by itself requires a wide set of logic and functionalities that contextualize the offering of these financial services and present the right offers and the right time to the right customer.

Also, financing products are usually very focused on a specific region (e.g. UK vs US) or business type (eCommerce vs Construction company), meaning that you will need to build a layer to connect multiple providers.

To offer robust financial services upsell functionlity, platforms need to:

- Build a universal connections layer

- Run provider search per end client type & region

- Select and integrate multiple providers

- Design custom logic how to offer financing options to clients

- Create a unified data collection process for credit underwriting

- Create reconciliation mechanism for each financing option

- Design all the flows related to financial products

KYC/KYB for payments

To use payment links or any other payment services, those sending invoices are typically required to complete a basic KYC/KYB (Know Your Customer/Know Your Business) process mandated by the payment provider. Often, different payment providers are used for different payment methods. This means that the client needs to undergo multiple KYC/KYB processes in order to use payment links. During this procedure, they are often required to provide information that platforms partially already have the initial onboarding. Such complexity can easily affect the adoption rate for payment links or other payment options.

To make this process smooth, Monite offers a unified onboarding product that allows platforms to:

- Do one KYC/KYB process that covers all providers simultaneously

- Store the data for future KYC/KYB processes – so no re-collection is needed

- Use all their existing customer data & ask only for missing fields

So what’s the alternative?

Strategy 1: Building Your Own AR Automation

You can either build AR Automation in-house, which takes a lot of time and money and might not be as competitive as specialized providers, or you can consider acquisitions as a quicker way to add invoicing automation, though it can be expensive.

There are a few large players that invested millions in building their Invoicing module in-house – e.g. Revolut or Oxygen. For players this size when the market offers cheap capital it’s a possible solution if they see AR capability as a core one for their strategy.

Finance automation products are complex to build – especially because they require covering a lot of edge cases. This is why to build a robust AR Automation solution you’ll likely need:

- 10-28 months of time – depending on the scope you want to build, level of expertise and agility in your team

- $600k to $9mn budget – depending on the type of end client and breadth of the solution

- $300-900k – annual maintenance and additional development costs

- A specialized product squad:

- Product people with AR Automation expertise – very hard to find

- Devs with expertise in payments/similar areas – creative thinkers who know how to take care of many edge cases

- UX designers – who built workflow products before and know how to make them very easy to use

What’s important to remember here though are two things:

- In-house built for super-apps is rarely competitive compared to a specialized provider – e.g. like Invoice2go

- Building in-house means not only building cost – but also continuous investment to maintain the product and grow its competitiveness as compared to vertical specialists

As a result, in-house builds take long and require a large investment.

M&A (Mergers & Acquisitions) is another route to add invoicing automation for your clients. It is very costly, but allows to go to market quicker and also grow your user base. For instance, SumUp, a leading European POS, acquired invoicing software Debitoor. Of course, this is an option for those who can afford an acquisition.

Strategy 2: Embedding AR Automation functionality

Monite, as an API-first player, offers flexible building blocks for AR Automation. This approach allows platforms to quickly add advanced AR Automation features, control the user interface, and expand modularly.

Up until 2022 M&A and building in-house were the only options. In 2022 a new market emerged in Embedded Finance – called Embedded ERP or Embedded AP/AR. We at Monite were the first international API-first player in the segment.

What we basically did is we built functionalities like Freshbooks and other AR Automation players – but we built them as flexible API blocks. This means that any platform can save 90-95% of development and maintenance costs and plug in those pieces in the way that works best for their clients in a couple of days. The backbone and all key functions are there, so all you need to do is to present the experience and interface that are optimal for your business users.

We made a $10mn+ investment to date into building a robust AR Automation solution, and we’re far from being done here. It’s expensive to build. The good news is that you don’t have to spend that money now – using our API you can go to market not with an MVP but with a product that is on the top players level and makes you very appealing compared to even specialists in the space.

3 great things to point out here

- User always sees your interface & thinks you built it – that’s because we’re API-first and you fully control UX/UI for the user, Monite is nowhere to be seen

- You can go live with 2 developers in 2 days to 2 weeks, and with a sub-$100k investment

- The solution is built modular like a big box of legos, allowing your more experienced partners to create value adding functionality on top of our core AR functionality, e.g. project management, budget management and analytics

What’s included in Monite API?

Monite provides a robust API that allows you to roll out a highly competitive AR Automation solution for your clients in just two weeks. Your users will have top-tier features, equivalent to or better than those offered by leading providers like Bill.com. These features are seamlessly integrated into your platform, branded under your name, and supported by our API.

Monite provides a developer-friendly API platform with a lot of different functionality that is essential to launch a competitive AR Automation product.

Platform

- Flexible API building blocks – all the functionality is built, you just decide how to plug it in and how you want it to work

- Fast back-end integration – ±1-2 days for a full backend integration

- Multiple options for frontend – pre-built frontend components (±2 days to integrate), SDKs (±1-2 weeks), or a fully custom built that you can do (usually ±3-6 weeks)

- Enterprise-grade security – API security is integrated across all layers of our platform, including internal development processes and partnerships with industry-recognized technology vendors

- Robust SLAs – dedicated to achieving the highest platform availability SLAs and have a proven track record of consistently meeting them

AR Automation functionality

- Data push and pull with accounting systems – we allow you to sync data from most major accounting systems. All it takes is for your users to authorize the connection. That way you can avoid starting from scratch and immediately make sense of historical data that is available while ensuring that all the invoices and transactions data will be automatically synced with the client’s accounting system

- Customers database – ability to create & store new clients and partners, comes with customizable fields and settings, e.g. preferred accounts, payment methods, and more

- Payment terms service – ability to set multiple payment terms based on conditions, customer, etc.

- VAT service – ability to provide a list of applicable and compliant VAT rates based on the region, business and product type, and more

- Discounts service – an ability to add discounts on invoices, items, or other basis. Ability to add discounts based on specific rules to reflect promotions happening, and more

- International document compliance – compliant format for each document type based on the business location, tax regulation, and many other parameters

- Sending quotes – ability to send a commercial offer to clients. Quotes can be accepted online or replied to with comments for easy adjustment, and then edited for resending

- Quotes to invoice conversion – auto or manually convert accepted offers to invoices

- Sending invoices – invoice clients with professional-looking invoices, including custom notes and any context needed around the deal

- Custom email design and copy – customize the email templates that the end clients will receive, connect your own email domain, and more

- Recurring invoices – send invoices on a specific cadence

- Compliant invoice editing – changing invoices in a compliant manner accepted by the tax authorities

- Self-invoicing – automatic invoicing issuing based on the work done – e.g. On behalf of contractor once the job has been submitted and approved

- Invoice payment links – ability for the end client to pay the invoice with card, ACH/SEPA or local payment methods

- Light & unified KYC – do one KYC for multiple payment methods, use your existing customers data to speed up the KYC process

- Payment reconciliation – connecting invoices to payments, auto-marking invoices paid

- Multi-payment support – ability to log multiple payments per invoice, including bank, cash, and other payments

- Support for partial payments – ability to recognize partial payments, including setting thresholds for currency conversion or bank fees difference when invoices appear e.g. 98% paid

- Compliant payment reminders – ability to set custom compliant reminders for unpaid invoices

- Compliant dunning process – sequence of steps allowing to then submit the invoice to a collections agency or similar

- Credit notes – ability to cancel invoices in a compliant way, while sending or just storing a cancellation note

- Data push into accounting systems – all the invoices and transactions data will be automatically synced with the client’s accounting system

- Conflict resolution capability – ability to find, flag, and resolve conflicts between the accounting system and your system. This is requires to perform automated two-way data syncs with accounting platforms – a must-have for any business

- Audit trail – full log of events and changes, which is required for most of internal/external audits and for finding errors

How to get started?

Learn more about our AR Automation solutions and features on our Accounts Receivable page.

A great way to get started is to get a demo of Monite – just request it via a link and we will find the time to connect you with one of our product experts.

As we continue the talks, we will help you build a business case and a revenue projection for AR Automation functionality. At the same time, we will provide all the necessary tech & product documentation, so you can assess the Monite API from the perspective of shipping the right value to your users.

Guide to Accounts Payable Automation for Founders and Product Leaders

October 19, 2023Understand the key pains SMEs have in Accounts Payable (AP) area and how you can solve it for them by adding AP functionality inside your platform.

What are Accounts Payable?

Accounts Payable (AP) are expenses and invoices that are yet to be paid by a business – e.g. an unpaid supplier invoice. In B2B transactions, these invoices often come with payment terms, making transactions more complex and extended in nature, requiring extensive tracking and maintenance.

For anyone running a business, there is always the sales side of things and the spending side of things. The spending side includes multiple aspects that could generally be split up into

| ±20% of expenses | ±10% of expenses | ±70% of expenses |

|---|---|---|

| Expenses that are paid on the spot – e.g. buying construction materials in a store with a credit card | Reimbursable expenses – e.g. reimbursing a sales person for a flight they paid themselves | Expenses or invoices that are yet to be paid – e.g. paying suppliers for goods |

This last part is exactly what Accounts Payable are – these are basically all outstanding payments the business needs to make. Usually, it’s as simple as payments to suppliers.

So, why do Accounts Payable even exist? In B2B (business-to-business) transactions, payment terms are typically more complex than simply paying cash up-front. Most transactions involve getting goods first and then paying for them 30/60/90 days later. Unrealized payments flow in and out – which means accurate tracking and accounting require increased effort and specialized software.

A simple AP process consists of:

- Ordering goods

- Receiving an invoice

- Checking the invoice for accuracy

- Getting approval for payment

- Making a payment

- Reconciling a payment

- Submitting the data into the business’ accounting software

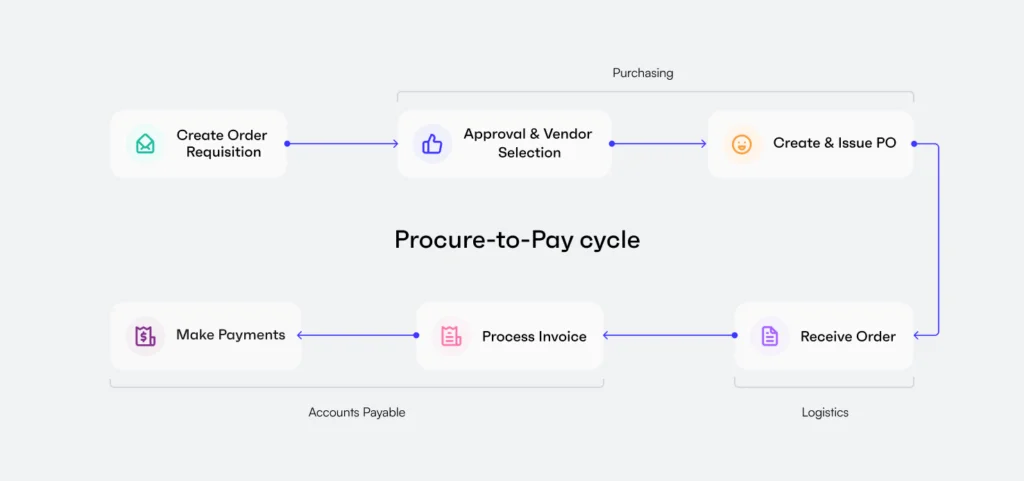

However, the above is just a simplification – in real life Accounts Payable process is often more complex than that. The full process is called Procure-to-Pay (P2P) – it is an end-to-end purchase process that includes order requisition, vendor selection, PO (purchase order) creation and submission to suppliers, receipt of goods/services, and processing of invoices for payments.

In simple terms, it’s exactly how real business works – it starts with vendor search and selection, then come purchase orders, and only then come invoices and payments, followed by reconciliation, accounting, and reporting.

Challenges in AP Management:

01

Lack of process:Many companies, especially SMEs, lack a well-established AP process, often resulting in a disorganized approach to financial management. A lack of unified tracking tools further complicates AP management.

02

Manual operations:Resource-intensive manual AP operations heavily rely on forms and spreadsheets, consuming substantial resources in terms of time, effort, and personnel. The manual nature of these processes increases the risk of errors and inefficiencies, leading to potential financial discrepancies, duplicate payments and losses.

03

Inadequate Approval Processes:The convoluted approval processes within many companies can be so intricate that even large corporations may inadvertently miss payments or fall victim to fraudulent activities. Even Finance teams at giants like Google and Facebook can be fooled by fraudulent invoices

How big is the struggle?

Account Payable and bill payments are an overlooked pain, many don’t realize how big it is. The numbers below shed some light on the scale of this problem for small businesses:

- $6-15 average cost per processed invoice depending on the SME size – SMEs waste tens of thousands of dollars per year on invoice processing.

- 82% of SMEs miss early payment discounts, resulting in lower margins and hurting the company’s cash position.

- 54% of SMEs pay their bills late regularly, due to inconsistent invoice formats and chasing approvals.

- Up to 10% in late payment fees, adding unexpected costs to the business.

- 47% of invoice approvals are slow, leading to suppliers being paid late and straining SME-vendor relationships.

- 23% of businesses lack visibility of outstanding liabilities, resulting in missed payments, late fees, and cash flow mismanagement.

How can AP Automation help?

In an effort to reduce the burden, SMEs are increasingly turning to specialized AP Automation software. Tech tools provide organizations with better control over their supplier relationships, payment processes, and the automation of critical internal tasks, leading to a wide range of significant advantages:

- Hundreds of Hours Saved: AP Automation software streamlines time-consuming manual tasks, freeing up valuable hours for your team to focus on strategic activities, innovation, and growth.

- Increased Process Efficiency: Automation enhances the efficiency of AP processes by reducing human error and expediting invoice processing and payment approvals.

- Reduction of Fraud and Inaccurate Invoices: Robust fraud detection algorithms and invoice validation mechanisms minimize the risk of falling victim to fraudulent activities or processing inaccurate invoices.

- Real-Time Visibility: Gain real-time insights into your financial transactions, supplier relationships, and payment statuses, allowing for informed decision-making and financial planning.

- Easy Compliance: Ensure compliance with financial regulations and company policies effortlessly through automated tracking and reporting, reducing the risk of costly errors or penalties.

- Better Visibility into Suppliers and Prices: AP Automation provides comprehensive supplier management tools, enabling you to evaluate supplier performance, negotiate better prices, and strengthen your supplier relationships.

- Better Spending Control: Tighten control over expenditures by setting spending limits, automating budget tracking, and gaining insights into spending patterns, ensuring financial responsibility across the organization.

- Avoidance of Late Payment Penalties: Eliminate late payment penalties by automating payment schedules and ensuring that payments are made on time, preserving your company’s financial reputation.

Why offer AP Automation to your business clients?

Businesses prefer to have a one-stop-shop solution to manage their business, so if they already manage a part of it with you, you might as well help them with AP Automation. Doing so enables you to earn more per client, drive more engagement, and become their core B2B payments provider – making you more competitive and allowing faster growth.

While AP Automation software is very useful, it’s expensive and requires integration into company’s processes, onboarding training, and more.

Also, a small business owner is already using a dozen tools to run the company. Does she really want to add one more and then change your processes that require learning a new platform and training your team, all while paying $50-300 per month? Many would likely argue that this doesn’t seem appealing.

What most SMEs prefer is to get AP Automation within the platform they use every day – e.g. neobank, vertical SaaS, or something else. They’re used to the software, they use it to manage the business anyway, and now they can switch from Excel to a new feature in the existing platform – a lot easier for them than buying and learning new software.

In general, most businesses want one platform to combine all of their business processes – it’s easy, efficient, and inexpensive compared to using 5-7 different tools. In response to this, many neobanks, vertical SaaS players, and Accounting platforms have started becoming “super-apps” – becoming one-stop-shop solutions for their users. This wave is just starting, but there are already champions we see in some segments of the market. For example, Toast – a platform for restaurant owners, or Brex, offering a comprehensive corporate expense management system for startups and scale-ups.

Why should you consider offering AP Automation to your business clients as a platform?

Well, there are several compelling reasons why platforms choose to embrace AP Automation and evolve into super-apps.

Offering AP Automation to your business clients allows you as a platform to:

- Enhance Product Value and offer better spend management and savings to your customers

- Increase share of wallet by becoming the primary payment provider

- Increase Revenue per user

- Differentiate from competition

- Attract new users by offering a new service

- Leverage data & insights to upsell financial and other products

Being in the flow of B2B payments to your clients is key to great customer monetization. Toast, for example, drives over 80% of its revenue from payments, despite being primarily a restaurant management software. However, it’s the software that enables you to monetize payments and drives usage in the first place.

Similarly, if you offer AP & AR Automation to users, you basically become their cash-flow management platform, meaning you can monetize:

- All incoming payments (AR) – Payment links, bank transfers, card payments, etc.

- All outgoing payments (AP) – Single & bulk payments, bill pay w/credit card, and more

- Cash-flow gaps – Working capital optimization solutions, business loans, etc.

How can you monetize AP Automation functionality?

Platforms can monetize AP Automation functionality via SaaS fees (extra fee or premium plan) and payment fees (e.g. % of each transaction). Given the high costs of this functionality in the market, platforms can easily earn 3-5x ARPU on businesses using their AP module.

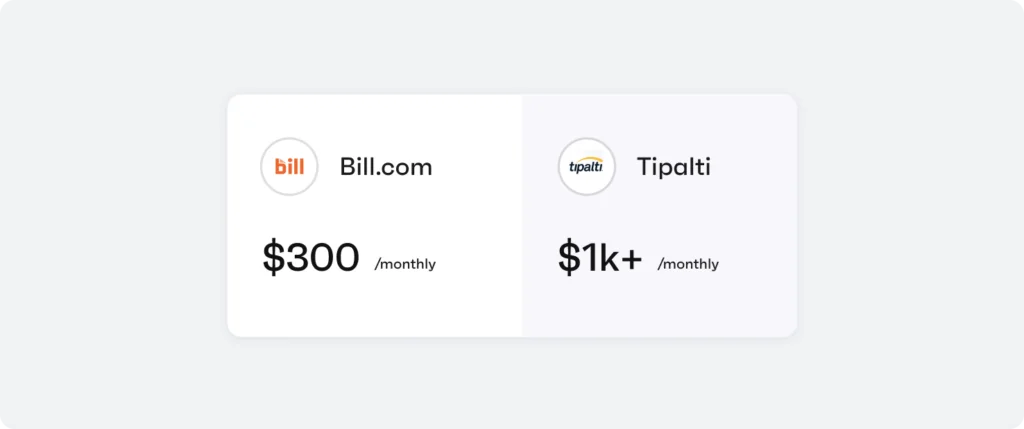

AP Automation is one of the most expensive software solutions on the market. The likes of Bill.com can easily cost $300/mo, and we are talking only basic AP Automation functionality for a smaller company. More comprehensive Procure-to-Pay solutions like Stampli or Tipalti can easily cost $1k/mo+. These platforms also monetize payments on top of SaaS fees, with payment fees often being hefty and containing a lot of hidden charges (e.g. fees for currency conversion).

When you offer AP Automation software piece to your clients, you want to mimic the existing market model and monetize both SaaS fees and payments.

- SaaS fees – add AP to a premium package or charge a separate fee for AP functionality

- Payment fees – get markup from payments your clients process

SaaS fees

The market tells us SMEs value AP Automation functionality – but that doesn’t mean you want to price like Bill.com or a similar player. Remember – for those companies AP Automation is the only thing they do – which means they also miss out on a lot of clients for whom this is very expensive.

Being a one-stop-shop solution with AP Automation included allows you to offer more competitive prices to users – e.g. you could save them 2-5x compared to a standalone player.

- Adding AP into a premium package – this means quite a hefty de-facto discount on AP Automation functionality as you’d only be able to attribute a fraction of the premium plan price to AP. It is the best strategy if your premium package is high price and produces a high ROI overall – then discounting AP functionality will pay off

- Pricing AP Automation as an extra feature – this is the best strategy for most cases, making your revenue from AP easy to track and attribute. For clients, it means they’re taking it and using it when they need it – while in a bundle they could get the bundle, but not need AP.

Payment fees

Payment processing costs money – and businesses are used to that. Moreover, they’re usually happy to pay extra for automation, convenience, and speed. When it comes to AP Automation, having payments as a part of your flow is invaluable – as it saves your clients a lot of time.

Here are the main payment methods you can monetize:

- SEPA – from €0.05 per payment and €9.50 for each active account. SEPA direct debit is the go-to method for B2B payments in Europe. It’s widely accepted and cost effective.

- ACH – up to $4.50 or 1% of the payment. For each user you can charge up to $ per month, plus a one-time fee of $5. ACH stands out as the go-to payment method for most B2B transactions in the US.

- Buy Now Pay Later – from 2 to 4 and 8% in installments for 3, 6 and 12 months respectively per payment. This allows your clients to pay an invoice 30/60/90 days or more past due date.

- Partial payments – from 1% (30 days term) to 4% (90 days term)%. Allows your clients to split up the payment into smaller manageable payments.

- Bulk invoice payments – margins are those of ACH multiplied by the amount of invoices paid. Your client can select multiple invoices to pay in one go supported in the US by the ACH network.

How hard is it to build AP Automation functionality?

Core AP Automation functionality

To craft a smooth AP Automation workflow that works seamlessly and sets up apart, you’ll need a solid set of core functionalities to make it all come together.

Below are some of the key categories:

Data Integration and Extraction:

- Data pull from ERP/Accounting system

- Counterparts database

- Mailboxes for invoices

- Dynamic invoice tables with filters

Document Processing:

- Robust OCR engine, ideally with daisy-chaining and ML mechanism designed for AR/AP

- Invoice validation mechanism

Approval Workflow:

- Approval rules builder with flexible parameters

- Approval workflow engine

- Approval/commentary notifications system

Payment Processing:

- Payment release system with integrated ACH/SEPA, card, and other rails

- Bulk payments and partial payments

- Payment reconciliation logic

Data Integration and Reporting:

- Accounting categories coding system

- Data push into accounting systems

- Conflict resolution capability

- Audit trail

Additional Features:

- Customizable reporting and analytics