The benefits of multi-rail payments

In the evolving landscape of digital transactions, B2B platforms, including neobanks, marketplaces, and specialized apps, are in a constant quest to enhance their financial offerings. A standout solution in this quest is the adoption of multi-rail payment solutions, a strategy pivotal for driving efficiency and growth in B2B commerce.

The essence of multi-rail payment solutions

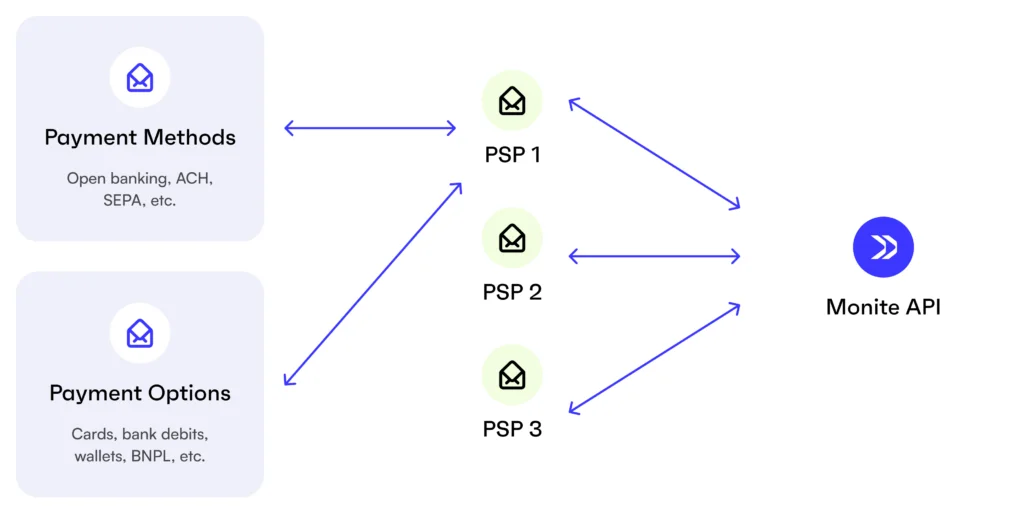

At the core, multi-rail payment solutions represent a holistic approach to digital transactions. Unlike single-provider models, multi-rail systems integrate various payment methods and channels, offering a versatile and robust solution for modern businesses.

Advantages of multi-rail systems in B2B transactions

- 1. Diverse Payment Options: They cater to global market demands by providing a wide range of payment methods, enhancing customer satisfaction and reach.

- 2. Streamlined Integration: With simplified API connectivity, these solutions offer ease of integration, crucial for small and medium-sized businesses.

- 3. Cost-Efficiency: By pooling multiple payment solutions, multi-rail systems reduce operational costs, providing an economical alternative for businesses.

- 4. Enhanced Reliability: The redundancy built into these systems ensures uninterrupted transaction processes, building trust and consistency.

- 5. Revenue Growth Opportunities: The comprehensive nature of these solutions opens new avenues for revenue, especially for platforms looking to expand their service offerings.

- 6. For an in-depth look at how multi-rail open banking enhances embedded finance offerings, check out our detailed blog post here

Enhancing merchant services

Consider an accounting platform that integrates a multi-rail payment system to serve its SMB clients. This integration not only complements its core services but also opens new revenue streams and increases customer retention by offering a more complete financial solution.

Overcoming traditional payment limitations

Traditional single-provider payment systems often fall short in meeting the diverse needs of modern businesses. Multi-rail solutions address these gaps by offering a more adaptable and comprehensive service, thereby enhancing the value proposition of B2B platforms to their clients.

A seamless integration experience

The integration of multi-rail systems with existing financial tools and platforms is seamless, ensuring consistency in data management and user experience. This ease of integration is supported by Monite’s robust API, which connects multiple payment players efficiently.

The future of B2B payments is a multi-rail approach

Looking ahead, the adoption of multi-rail payment solutions is set to reshape the B2B payment landscape. These solutions position B2B platforms to excel in an increasingly digital economy by offering flexibility, cost-effectiveness, and enhanced reliability. The potential in this market is substantial. In the U.S. alone, the total addressable market for B2B payments is estimated to be between 25 to 27 trillion dollars. Currently, embedded payments, a key component of multi-rail solutions, constitute about 5% of this market, approximately 2.6 trillion dollars. Over the next five to six years, this sector is expected to grow upwards of 7 trillion dollars, marking a 170% increase. This growth trajectory highlights the significant opportunity for B2B platforms integrating multi-rail payment solutions.

Embrace the multi-rail payments revolution

In summary, multi rail payment solutions signify a strategic move towards creating payment systems that are prepared for future use cases. For B2B platforms looking to improve their services and achieve long-term growth, adopting multi-rail payments is a crucial strategy.

For a deeper exploration of multi-rail payment solutions and their impact on your business, visit Monite’s Payment Solutions.