Guides Archives | Page 2 of 3 | Monite

Embedded finance can help you leapfrog competitors fast – here’s how to approach it

October 18, 2022

As fintech, SaaS, and B2B platforms scale, a key product challenge is how to add new functionality that makes your platform stickier and provides your business with more opportunities for upsell and customer acquisition.

Aside from what you build in-house, the standard approach is to discuss internally what you need, assign resources and expectations, and then go out to the market and speak to a third party for a particular functionality or project.

But actually, for a number of reasons, it may be a better approach to talk to third parties early – even as you are still defining the scope of the project. In this post we are going to look at why this is important in the scoping phase, and help you think out of the box and to get a wider view of how you can leverage embedded finance for maximum advantage.

Solutions are more powerful than products, products are more powerful than features

Let’s take a look at an example. Say you assign a project to look at an accounts payable product, with the idea of enabling SME customers to collect, review, and approve invoices via API.

You look at what kinds of resources you need, how it fits in with and complements your existing product roadmap, what kinds of upsell opportunities you may have for your SME clients, and so on. You then have a specific focus in mind when you look at potential embedded finance partners.

But once you start your discussions, you may find that there are not only unforeseen questions, but also complementary products you can add for a fraction of extra resources, which can deliver multiples of value on your original plan. For example, if you want to provide an accounts payable product, it would be extremely convenient for your customers if you could add an invoicing product to go with it. And if you were to offer customers an invoicing product, it would make sense to enable invoices to be paid with an integrated payments solution, also.

Bundling these products into an integrated solution has several obvious benefits:

- It increases retention, since your customers have less need to shop around.

- It increases upsell opportunities, since your existing customers can add new products.

- It attracts new customers, since the new functionality makes your platform more compelling.

And beyond these obvious benefits are a number of less obvious ones, which can unlock more value for your platform:

- You can provide forecasting decisions thanks to better data.

- You can lower the cost of doing business even as you increase your functionality, since you are investing in multiple solutions.

- With the right partner you are not only buying for today, but also for new embedded products you can add in the future.

In fact, carefully partnering with the right embedded finance provider can take you a step closer to becoming a full operating system for your SME customers.

You can go bigger than you think, earlier than you realize, without draining resources

The time to think of adding incremental value to your platform through buying or building individual embedded finance products is over. In fact, you may be positively surprised at the potential to add multiples of value for your SME customers with end-to-end solutions or product suites, rather than only individual products.

However, it is also important to note that embedded finance is at an inflection point. B2B platforms no longer need to invest large amounts of resources into building financial automations. The winners of tomorrow are already embedding financial automations today, and the pace of innovation is set to accelerate.

With a partner such as Monite, you can focus on building what makes you best in class, while our embedded automations can help you become all in one. With the right partner you can build a combination of deep and wide super app functionality that can enable you to leapfrog competitors, faster and with far fewer resources than you may imagine.

Cloud Billing API integration for banks and fintechs

September 1, 2022

More and more businesses want to have their invoicing processes as touchless and automated as possible. While some might go for a standalone Cloud Billing API provider, many more would prefer to have their billing needs covered by their bank.

What is Cloud Billing API?

Using a compliant Cloud Billing API, businesses seeking to automate their Accounts Receivable operations can create and manage regular and e invoices, thus reducing invoice mismatches and other risks. Cloud Billing API integrations translate to significant savings in terms of time and headcount needed to manage all outgoing invoices. After all, a comprehensive invoicing or billing API solution can enable businesses to:

- Send quotes and electronic invoices

- Issue compliant reminders

- Track unpaid invoices

- And more

To truly automate not just billing, but also other Accounts Receivable and Accounts Payable functions, SMEs often find themselves using multiple apps, APIs and platforms. With Monite, banks and financial platforms can help their clients automate the majority of AR, AP and Payments functions.

Neobanks are already offering billing functionality

The Fintech space is becoming more and more competitive, with platforms and neobanks offering advanced solutions for automating AR and AP functions. Some bigger names that already offer their customers billing include Oxygen, Tide, Qonto, and Spenda, among others.

Additional revenue with Cloud Billing API

By integrating Monite’s Invoicing API, banks and financial platforms can earn additional revenue via two streams:

- SaaS fees. Business customers can be charged a fee for getting access to billing. By providing billing as a core functionality of a higher-tier plan, there is an additional incentive for customers to upgrade.

- Processing fees. It is also possible to earn commissions on every invoice payment made through a link.

You can estimate your potential earnings from offering Cloud Billing API via our AR automation calculator.

Want to learn how Cloud Billing API can grow your business? Get in touch with Monite today.

API Invoice Processing solution – AP Automation

August 29, 2022

In this article, we at Monite explain what AP automation is, how companies can develop their own solution, and how they can benefit from it.

What is AP Automation?

Accounts payable automation (AP automation, for short) is the process of digitally handling incoming invoices that saves time and costs and decreases human error rates. Other upsides of AP automation include improved transparency, and the mitigation of fraud risks and non-compliance issues.

Companies with sizeable accounting departments benefit from AP automation solutions, which can be provided by a bank, neobank, payments platform or Fintech SaaS provider.

Should Fintechs develop their own AP processing solutions?

For Fintech companies looking to build the next Super App, developing an AP automation solution in-house can look like the logical next step. However, building a sophisticated AP automation tool comes with its own setbacks. Rarely can a Fintech startup afford to allocate enough capacity to build and maintain a solution that provides a seamless experience for its clients.

Unfortunately, without significant investment (that could be used on developing core functionality), a home-built AP solution will be subpar. Even worse, it might not really pay off, as limited functionality means limited revenue opportunities.

Companies wishing to save their engineering talent and money can opt for an API invoice processing solution.

What are the benefits of an API invoice processing solution?

Integrating an API-based AP automation solution saves time and costs that would otherwise be spent on both development and maintenance. In addition to direct savings, it also opens new revenue opportunities.

Monite Accounts Payable API was built with Fintech companies in mind. It basically allows clients to process (collect, review, approve and pay) incoming supplier invoices without ever leaving the payment provider’s environment.

What can Monite API invoice processing solution do?

As you can learn from our API documentation, Monite AP automation API can take handle the entire invoice processing cycle. Thanks to its Invoice Recognition API and other features, it can:

- Collect invoices. Users can upload or email invoices (case by case or in batches)

- Review invoices. Users can annotate, ask colleagues for additional information

- Approve invoices. The approval flow can be customized by the client

- Pay invoices. Payments can be pre-prepared

- Reconcile invoices. All payments-related documents can be easily exported

- Analyze AP payments. Users can get a full overview of suppliers and paid invoices

E-invoice API integration for banking and financial platforms

August 24, 2022

E-invoicing API integration can unlock additional revenue streams and help neobanks and financial platforms take another step towards becoming true Super Apps.

What is e-invoicing?

Electronic invoicing (also known as E-invoicing) is a form of invoicing, when the client is presented not with a paper or scanned invoice but with an E-invoice.

An e invoice follows a predefined, standardized format. All data (e.g. PO number, VAT number, and so on) is provided in a structured way, and the e invoice can be automatically imported and processed by the purchasing organization’s AP system. E-invoicing systems commonly use electronic data interchange (EDI) and XML formats to make data exchange easier.

While e invoicing itself has been on the market for at least 30 years, its adoption varies from market to market. For example, across the European Union, E-invoicing has been standardized since 2020.

What are the benefits of the E-invoice API?

The integration of API for e invoicing is a suitable solution for banks and other financial platforms that do not want to waste time on building their own E-invoicing system. By using a compliant e invoicing API solution, neobanks, banks and other financial services providers can allow their business clients to:

- Mitigate the risks associated with fraud and tax leakage

- Save money and resources that would be wasted on manual invoicing

- Reduce invoice mismatches

- Unlock additional benefits like easy tax claims

The benefits of Monite e invoicing API

With Monite e invoice API, it is easy to aggregate electronic invoices from multiple countries and ensure that all related flows (like reconciliation or accounting export) are in line with e invoicing requirements of any given market.

E-invoicing API is only one part of making finance and payments operations easier for clients. With Monite, in addition to helping clients automate Accounts Receivable functions (E-invoice API covers a part of it), financial platforms can also help clients automate Accounts Payable functions.

Monite offers not only fully compliant e invoicing API, but also a range of other functions that can help a bank, neobank or financial platform to become a true Super App for businesses. Additional benefits financial platforms can offer to their clients with Monite include:

- Setting up and receiving online payments

- Setting up automated and compliant reminders

- Auto-mapping invoices to payments & export for accounting purposes

Signing up in Monite means that you don’t have to spend engineering hours on building solutions in-house or waste your budget on multiple APIs from different providers.

Get in touch for a demo today.

Online Invoicing API meets Invoice Generator API

August 10, 2022

Invoice Generator API is the next big step for the simpler world of automated document processing.

What is an Online Invoicing API?

With the help of Online Invoicing API, companies can generate and manage invoices based on various input data. SMEs and large corporates can save time and resources by automating the generation and processing of invoices. Online Invoicing API is the first step in offering comprehensive Accounts Receivable automation. With a compliant Online Invoicing API, it is possible to send custom quotes & invoices, issue reminders, review unpaid invoices, and auto-reconcile invoices.

Unfortunately, only a handful of banks and Fintech companies provide their customers with this functionality. This leaves SMBs in a situation where they have to seek out standalone online invoicing solutions. In fact, an average SMB has to use 40+ apps to manage finances and operations, while much of that functionality could be provided by a single platform via API integrations.

Why should banks and fintechs integrate Invoice Generator API?

Banks and B2B-focused fintechs that do not provide their customers with advanced Accounts Receivable automation solutions (based on Online Invoicing API, Invoice Generator API, etc.), miss out on many opportunities. First, they become less competitive, as other companies add such functionality. Second, they lose additional income streams that come with AR automation.

How does Monite Invoice Generator API work?

Banks, neobanks and fintech providers can streamline and automate the invoice generation process for clients with the help of Monite. Invoice Generator API integrations can create counterparts that represent customers, add products that will be listed in the invoice, add additional invoice data, get the applicable VAT rate, and more.

In other words, Monite’s Invoice Generator API can integrate a comprehensive PDF conversion system with existing applications. Using the integration, users can configure delivery method, payment schedule and other settings before they generate the invoice.

Is Monite’s solution better than a free invoice API?

While a free invoice API can suit a smaller operation (a company or person seeking to automate their invoicing procedures), integrating a public API into a financial services platform would lead to security and non-compliance issues. Monite’s compliant Online Invoicing API is safe, secure, reliable and built with the highly regulated area of Finance in mind.

Multi-rail payment solutions results in growth for B2B Platforms

August 10, 2022

The benefits of multi-rail payments

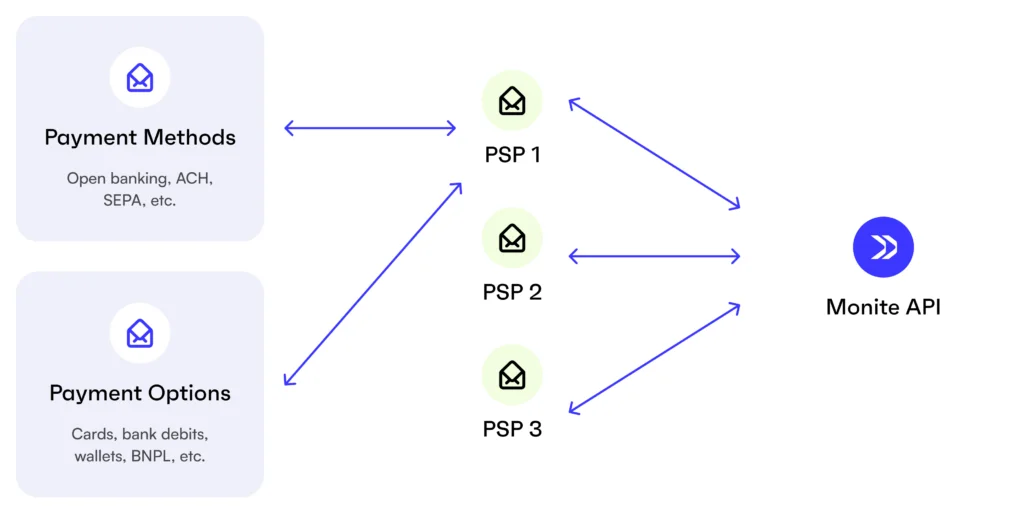

In the evolving landscape of digital transactions, B2B platforms, including neobanks, marketplaces, and specialized apps, are in a constant quest to enhance their financial offerings. A standout solution in this quest is the adoption of multi-rail payment solutions, a strategy pivotal for driving efficiency and growth in B2B commerce.

The essence of multi-rail payment solutions

At the core, multi-rail payment solutions represent a holistic approach to digital transactions. Unlike single-provider models, multi-rail systems integrate various payment methods and channels, offering a versatile and robust solution for modern businesses.

Advantages of multi-rail systems in B2B transactions

- 1. Diverse Payment Options: They cater to global market demands by providing a wide range of payment methods, enhancing customer satisfaction and reach.

- 2. Streamlined Integration: With simplified API connectivity, these solutions offer ease of integration, crucial for small and medium-sized businesses.

- 3. Cost-Efficiency: By pooling multiple payment solutions, multi-rail systems reduce operational costs, providing an economical alternative for businesses.

- 4. Enhanced Reliability: The redundancy built into these systems ensures uninterrupted transaction processes, building trust and consistency.

- 5. Revenue Growth Opportunities: The comprehensive nature of these solutions opens new avenues for revenue, especially for platforms looking to expand their service offerings.

- 6. For an in-depth look at how multi-rail open banking enhances embedded finance offerings, check out our detailed blog post here

Enhancing merchant services

Consider an accounting platform that integrates a multi-rail payment system to serve its SMB clients. This integration not only complements its core services but also opens new revenue streams and increases customer retention by offering a more complete financial solution.

Overcoming traditional payment limitations

Traditional single-provider payment systems often fall short in meeting the diverse needs of modern businesses. Multi-rail solutions address these gaps by offering a more adaptable and comprehensive service, thereby enhancing the value proposition of B2B platforms to their clients.

A seamless integration experience

The integration of multi-rail systems with existing financial tools and platforms is seamless, ensuring consistency in data management and user experience. This ease of integration is supported by Monite’s robust API, which connects multiple payment players efficiently.

The future of B2B payments is a multi-rail approach

Looking ahead, the adoption of multi-rail payment solutions is set to reshape the B2B payment landscape. These solutions position B2B platforms to excel in an increasingly digital economy by offering flexibility, cost-effectiveness, and enhanced reliability. The potential in this market is substantial. In the U.S. alone, the total addressable market for B2B payments is estimated to be between 25 to 27 trillion dollars. Currently, embedded payments, a key component of multi-rail solutions, constitute about 5% of this market, approximately 2.6 trillion dollars. Over the next five to six years, this sector is expected to grow upwards of 7 trillion dollars, marking a 170% increase. This growth trajectory highlights the significant opportunity for B2B platforms integrating multi-rail payment solutions.

Embrace the multi-rail payments revolution

In summary, multi rail payment solutions signify a strategic move towards creating payment systems that are prepared for future use cases. For B2B platforms looking to improve their services and achieve long-term growth, adopting multi-rail payments is a crucial strategy.

For a deeper exploration of multi-rail payment solutions and their impact on your business, visit Monite’s Payment Solutions.

Invoice Recognition and Invoice OCR API

August 4, 2022

Many businesses use Optical Character Recognition (OCR) solutions for their financial and administrative processes. The technology can convert text images from scanned/photographed documents into characters, using a process called dematerialization.

OCR can help automate invoice processing by aiding data extraction. Without this technology, digitalization is limited, because it still requires manual effort, therefore higher resource costs. I.e. accounts payable could send a digital invoice via email to approvers, but processing would still require manual data entry. OCR solved this problem. While OCR invoice processing has transformed the AP workflow and digitized invoice processing, OCR on its own has limitations.

Why OCR Isn’t Enough

Retrieving data from an invoice is one thing, placing data into the correct fields within an accounts payable system is another, especially when payees and vendors use different formats and software. OCR can extract data but it won’t intuitively know what it means. You need a system that can dependably transfer the data from the invoice to the software system with no oversight.

To resolve that, companies may try to use an OCR provider with high recognition success rates. The truth, however, is that no provider is good enough on its own – the confidence scores come back too low to rely on them for even a semi-automated flow. The only way to solve this is to combine the power of multiple OCR solutions and use them on top of each other to improve the confidence score.

That is exactly what Monite did – we combine many OCR engines in one API. When an invoice comes in, we first use one engine to recognize and post-process data and assess the confidence score. If the score comes back too low, we use other engines one after another until we get to a high confidence score. Through machine learning, we achieve near 100% accuracy.

What is a document confidence score?

What is a document confidence score?

The document confidence score reflects the probability that the key invoice fields – e.g. numbers, addresses, amount due – were correctly captured.

To maximize recognition quality, we also use machine learning-based preprocessing – documents are cleaned up and brightened to remove unnecessary artifacts from the get-go. We also offer an extension with the ‘human check’ for complex cases. If the confidence score is low after all the engines, the invoice can be automatically sent for a manual review.

Monite’s solution automates many tasks that previously required manual processing, including transferring invoice information for payment processing, matching general ledger codes, or sending the invoice to the correct approver.

Monite for Invoice OCR API

Building multiple OCR integrations and other elements in-house is costly and time-consuming. That is why Monite created one API through which you can get the full functionality and value you need without spending a lot of time on development.

Monite Invoice API versus PayPal’s Invoice API. Which is best for financial platforms?

July 1, 2022

At first glance Monite Invoice API may look similar to the Invoice APIs PayPal and Stripe offer. However, there are not many similarities beyond being able to issue and send compliant invoices. Where PayPal Invoice API works best for small or new businesses that are just getting started, Monite Invoicing API is a solution geared primarily towards neobanks and fintech platforms. This is an important distinction to make, as, unlike Paypal Invoice API, Monite Invoice API can be monetized by platforms in a SaaS fashion.

A brief introduction to PayPal Invoice API

The PayPal Invoice API enables users to submit payment requests to clients using a customizable template, as well as track customer payment status and client interaction histories, and accept payments by credit and debit card, bank transfer, and mobile wallet.

Just like most of its competitors, PayPal Invoice API – which can be integrated across a variety of online applications – helps companies to automate their invoicing workflows by allowing them to take care of routine tasks like payment reconciliation and invoice collection.

Here is how it works. When a company or individual sends an invoice to a customer, it moves from draft to payable state. At that point, PayPal will email the customer a link to the invoice on the PayPal website. All the customer has to do is log in and pay the invoice with PayPal.

Who is PayPal Invoice API for?

As we’ve already mentioned, the PayPal Invoice API is best suited to small and new businesses, as well as freelancers and entrepreneurs. This is, in part, because it’s easy to set up and does not require users to sign any contracts or have much in the way of technical knowledge.

Similarly to Stripe and other direct competitors, PayPal is a popular choice among companies that only seek to issue compliant invoices or build a checkout process that’s convenient to their customers.

How is Monite’s Invoice API different from PayPal’s?

The key difference between the invoicing APIs of Monite and PayPal is that Monite is tailored specially to neobanks, fintechs, B2B SaaS companies, and other platforms. It also offers comprehensive, embedded Accounts Receivable automation, which allows platforms to provide their clients with extended AR functionality.

Furthermore, unlike PayPal, Monite has a team focused almost exclusively on the development of cutting-edge headless AR and AP automation solutions. This means that Monite can offer products of unmatched quality to platforms, enabling them to unlock additional revenue streams by providing their customers with exclusive functionalities.

What does Monite Invoice API offer?

Monite Invoice API covers a wider range of functionalities than PayPal’s. These include:

- Issuing and sending offers and quotes;

- Reconciling payments;

- Making custom-designed invoices with payments links;

- Sending compliant follow-ups;

- Exporting payments data to accounting systems;

- And more.

Monite Invoice API also offers multi-rail Open Banking solutions and supports foreign transfers.

How can platforms make money with Monite Invoice API?

Monite Invoice API brings convenience and hassle-free invoicing options to clients of neobanks that integrate it. They can issue and manage all invoices without leaving the platform to access a separate app that they would otherwise use for invoicing.

Now, how can platforms monetize this feature?

Here you have two complementary options: charging a monthly SaaS fee, or taking a commission on invoice payments. You can get a rough estimation oFor your convenience, you can get a rough estimation on how much you can potentially make in processing and subscription fees here.

If you have any other questions, please explore our blog or get in touch with us for a demo today!

Monite Invoice API versus Stripe Invoice API. What’s appropriate for your B2B platform?

June 29, 2022

There are certain similarities in the way Monite Invoice API Stripe Invoice API operate. For one, both have been designed with the developer in mind and have extensive documentation. But there are more differences than similarities. While Stripe Invoicing API is meant to be used by businesses directly, Monite Invoice API is a solution for neobanks and fintech platforms. Let’s look into these differences more closely.

What is Stripe Invoicing API?

Stripe Invoicing API is a popular invoicing solution built on top of Stripe Payments that lets companies accept credit and debit cards, bank transfers, and mobile wallet payments. Like many other major API solutions for payments and finance, Stripe Invoice API can be easily integrated across many online applications.

With the help of Stripe Invoice API, businesses can automate their invoicing workflows and other Accounts Receivable processes. As such, it helps finance and operational teams save time on things like payment reconciliation and invoice collection.

Who is Stripe Invoicing API for?

Stripe Invoicing API is a good choice for online businesses that can integrate invoicing into their existing websites, apps, CRM systems, and so on. As such, Stripe Invoice API is a proper and viable solution for SMBs who want to, for example, streamline their online checkout process and issue compliant invoices.

How is Monite Invoicing API different from Stripe Invoicing API?

While Stripe Invoice API is meant for end users (for example, online merchants), Monite Invoicing API is designed with platforms (neobanks, fintechs, B2B SaaS players, etc.) in mind. Moreover, Monite offers a comprehensive Accounts Receivable automation solution that can be embedded in such a platform. By doing so, platforms can unlock invoicing and other AR functionality for thousands of clients.

Unlike Stripe (who has numerous products in the financial space), Monite is solely dedicated to building cutting-edge headless AR and AP automation solutions. By specializing in the field, the company’s team is putting all of its efforts into developing functionalities that neobanks and fintechs can offer to their clients and monetize.

What does Monite Invoicing API offer?

In addition to the issuance of compliant invoices, platforms that use Monite Invoicing API can cover a wider flow. Here are just some of the functions that can be offered to clients:

- Issuing and sending offers and quotes

- Creating custom-designed invoices with payment links

- Sending compliant automated follow-ups

- Reconciling payments

- Exporting payments data to accounting systems

In addition to that, Monite Invoice API fully supports open banking rails as well as foreign transfers.

How can platforms make money with Monite Invoice API?

With Monite Invoicing API, financial platforms can offer their clients the convenience of issuing and handling invoices without leaving the platform. This means that clients no longer need to maintain a separate app that can only do invoicing.

This functionality can be monetized via two different revenue streams that complement each other:

- SaaS fees. Platforms can charge their business customer a monthly fee for using invoicing

- Processing fees. Platforms can also earn a commission on invoice payments that are made through a link

How much could your platform make? Simply input the number of clients you service to get an estimate using our AR automation calculator.

Four reasons buying an embedded finance solution could be a huge win for your business

June 22, 2022

If you are a B2B business such as a neobank or marketplace, or build vertical-focused software solutions, today you have a massive opportunity to add financial automations to your core offering. Automations such as invoicing, accounts payable, expense management, and more help drive faster growth, build stickier customer relationships, and generate more revenue.

However, a critical decision you will need to make is whether to buy an existing solution or build something in-house. On the one hand, eager and talented tech teams may enjoy the challenge of solving some of these problems for your customers. But reality can be more complex than it appears. In this post, we will discuss the advantages of partnering with a specialist embedded finance solution, and share some context on challenges that come from building financial automations in-house.

Buying helps you avoid the 20% of complexity that is visible, and 80% that’s hidden

To start with, let’s take a look at the example of an invoicing automation tool. As invoices are standardized documents similar across most countries, it may appear to make sense to build it in-house.

However, a point that is not alway well understood is that finance automations contain an incredible amount of edge cases and hidden complexity. For example, in the case of invoices each country has its own compulsory information, custom formats and industry and/or country-specific layout requirements. Likewise, country-specific tax and/or regulatory information needs to be added.

The implication for invoices is that different tax and/or regulatory information needs to be added for every country, often in a specific place or in a certain order on the invoice. Your solution needs to recognize payments, partial payments, payment amounts that vary due to exchange rates, payment methods including cash or check, and so on.

As you expand, your team will need to consider how to handle different currencies and currency exchange rates, new writing systems such as Cyrillic, Arabic, or Chinese, and different formats such as pdfs or printed forms. There are an enormous amount of edge cases which will need to be solved for your invoicing solution to work reliably all the time, and even in the markets for which you have already built your solution, any change in regulations means more work for your team. And finally, it will need to be able to run accounting for all of this complexity.

The key thing to remember is that a large number of edge cases means building any financial automation is going to be much more complex than it may initially seem. In fact, according to our research, 80% of the complexity of any finance automation is invisible, meaning teams regularly under-estimate the resources they need by several orders of magnitude. Due to this, there is a big advantage in outsourcing this complexity to an embedded finance specialist.

Buying enables you to focus on your core business

Financial automations involve other people’s money, and that means understanding and being compliant with regulations, and ensuring your automation is highly reliable.

To meet these requirements, you need a complete team – product, compliance, and security, as well as developers. And you need to test features thoroughly before deploying, build in-house expertise around regulatory compliance, and so on.

In a competitive hiring market, this is a daunting, expensive task and that will act as a drag and distraction from focusing on what your business really excels at. Would you really hire a whole 2-3 squads for this when you need to ramp up core products as well?

But on a more positive note, the flipside is also true. If you buy rather than build, you can devote your valuable talent and resources to your core business, and accelerate on building your own unique advantages. On a 3-5 year time horizon, this can snowball into an enormous competitive advantage for your business as you are able to innovate faster, with lower overheads.

Buying enables you to unlock multiple revenue opportunities

The purchase and implementation cycle of a good embedded finance solution is typically much shorter than what it would take to build and ship a comparable financial automation in house – depending on how organized you are, as fast as a few weeks. And because embedded finance solutions are built by entire teams to cover use and edge cases of many clients, the functionality of a bought solution is also much richer than a comparable in-house solution. This has a number of catalysts for revenue growth, and means you can:

- Start to sell these features almost immediately, meaning you add a new revenue stream more quickly.

- Convert more customers thanks to better functionality. In fact, where an in-house solution might get a 1-2% conversion, an embedded solution powered by a player like Monite can reach 20-30% conversion – a 10x plus rate.

- Generate more revenue per customer thanks to the richer functionality.

- Earn on upsell of financial services such as factoring, BNPL, and so on.

- Attract completely new customers due to the increased functionality you are offering.

- Reduce churn by a large margin while increasing LTV for existing clients.

To summarize, the revenue opportunities of buying a solution can be far greater than simply a recurring fee for a new feature, and should not be underestimated.

Buying means you benefit from network effects

To briefly recap what a network effect is, it refers to the concept that an increased number of customers improves the value of a service.

In the case of your embedded finance partner, this means that every customer they add translates into more capital for them to build out new features, products, and integrations that benefit their entire customer base, including your business.

If you buy a solution today, you will already benefit from network effects. The fact that they have a team of engineers focused on building out features, product, and integrations for all their customers means that functionality and edge cases will be far better covered than anything you build in house. But not only will you benefit from the network effect of today, you are also going to benefit from every new customer who comes after you, who will in turn enable long term, accelerated innovation by your embedded finance partner.

Embedded finance is at an inflection point

Finally, perhaps the most exciting part of this story is where embedded finance is in terms of the vendor landscape. For this, we can look at an analogy with payments innovation.

A decade ago many tech teams would have built their own payments connections rather than risk outsourcing this business-critical function to a third party. After all, why would you trust this incredibly important function to a company you have no control over?

But over the last decade there has been an explosion in both the number and quality of payments APIs on the market. Today, it would be crazy to think that your in-house team could build payments connections that could compete with the reliability and functionality built by thousands of engineers and product experts at companies like Stripe, Mollie, or Adyen.

Embedded finance is at a similar inflection point to payments a decade ago. Companies such as Monite are accelerating innovation and building scalable products that will help a wide range of B2B tech and financial businesses to unlock new revenue streams, deliver a better customer experience, and double down on their own innovations.

A decade ago small, relatively unknown companies such as Uber, Shopify, and Etsy, partnered with the first wave of payments APIs on their way to building groundbreaking companies. And today, innovative companies – both new and established – will do the same with embedded finance APIs. Will you be among them?