By Bill Cooper (U.S. Sales Lead at Monite)

Vertical SaaS apps are continuously evolving to meet the growing demands of businesses. One key trend gaining momentum is the shift toward embedded financial operations. By integrating features like automated invoicing and payables into their platforms, SaaS providers can simplify their clients’ financial processes, improve their customer’s cash flow, and drive their own revenue growth. In this blog post, we will explore the benefits of embedding invoicing and payables automation and how it can revolutionize your platform.

Understanding the Shift Towards Embedded Financial Operations

The landscape of vertical SaaS applications is undergoing a transformative shift, propelled by increasing demands for more nuanced, industry-specific functionalities. This evolution is markedly noticeable in the financial operations domain, where the integration of automated invoicing and payables is becoming a pivotal strategy for SaaS providers. This shift is not merely a trend but a response to their customer’s desire for comprehensive, streamlined financial management tools within the platforms they already use.

As businesses grapple with the complexities of managing their financial workflows, the appeal of having invoicing and payables automation embedded directly into their operational software is undeniable. This integration offers a seamless, efficient approach to financial management, eliminating the need for separate systems and the inherent friction they bring. The result is a cohesive, user-friendly experience that significantly enhances operational efficiency.

For the providers, it presents an opportunity to deepen their product’s value proposition, embedding themselves more integrally into their customers’ operational workflow. For businesses, the allure lies in the simplification and automation of critical financial processes, which directly contributes to improved accuracy, time savings, and more strategic cash flow management.

This evolution underscores a broader trend in the SaaS industry: the move towards more holistic, all-encompassing solutions addressing specific, often complex business needs. By adopting automated invoicing and payables, SaaS platforms are not just adding a feature; they are fundamentally rethinking how financial operations can be optimized to support business growth and resilience. This shift is a clear indication of the industry’s trajectory towards more integrated, efficient, and user-focused solutions, setting a new standard for what businesses can expect from their operational software.

The Value Proposition of Embedding Invoicing and Payables

At the heart of modern business operations lies the quest for efficiency and accuracy – two pivotal factors automated invoicing and payables automation address head-on. By embedding these functionalities into your platform, you offer businesses a streamlined pathway to managing their financial operations, effectively turning a complex process into a seamless part of their daily routine. The integration of these services goes beyond mere convenience; it represents a fundamental shift in how businesses approach their financial workflows.

Embedded payables and automated invoicing stand out as tools of empowerment for businesses, offering them unparalleled control over their financial landscape. This control comes from enhanced visibility into every transaction and payment cycle, enabling businesses to make informed decisions about their cash flow and financial planning. Such visibility is not just about knowing where funds are at any given moment; it’s about understanding the financial health of the business in real-time, allowing for strategic adjustments on the fly.

Imagine having a customer’s client book a consulting session via your app. It blocks their calendar, schedules reminders, triggers email notifications for session prework, and more. Now imagine your customer is able to take a deposit at the time of appointment scheduling, or automatically trigger an invoice for the session after it is completed. That invoice contains a payment link for your customer’s customer. As a result, they are paid faster and no one has to key an invoice into a system, print an invoice, mail a check, etc. Easier workflows and improved cash flow through your application. You’ve just made your customer’s business life easier and improved their financial standing.

Moreover, the automation aspect cannot be overstated. By automating routine financial tasks, such as invoice creation, payment reminders, reducing days outstanding, or automatically taking advantage of payment terms, companies can significantly reduce the time spent on manual data entry and the errors often accompanying it. This shift allows employees to redirect their focus toward more strategic activities contributing to business growth, rather than being bogged down by administrative tasks.

The integration of invoicing and payables automation into a SaaS platform does more than streamline operations; it introduces a level of precision and efficiency that was previously unattainable without investment into a custom built accounting software system, or an ERP system beyond the financial reach of many small and mid-size businesses. This not only enhances the operational capacity of businesses but also strengthens their financial integrity. In an environment where every transaction and financial decision can be the difference between growth and stagnation, the value of embedding these automated financial services into your platform cannot be overstated. This strategic integration represents a forward-thinking approach to financial management, positioning your platform as an indispensable tool in the modern business ecosystem.

Expanding Your Revenue Streams with Embedded Financial Services

Vertical SaaS companies have three options when it comes to revenue growth:

- Grow Your User Base – While this sounds like the easiest solution, this is what you have been doing since the day you launched your MVP. However, if this is your approach, you need to grow your customer base while ensuring you have no one opt out of your platform to ensure the growth you need.

- Increase Your Fees – This is the shortest path to more revenue, but this can impact your customer retention. Higher fees can make your customers wonder about the benefits of using your platform. They might go elsewhere for your services.

- Additional Features and Functionality – This is where you can grow your customer base, increase your fees (for new functionality), and expand your overall marketshare with something new your business can offer existing and potential customers.

Embedded financial tools help your business customers run their business better. Every business pays invoices (AP) and every customer needs to bill their customers (AR), regardless of industry, geography, etc.

When you add invoicing and payables automation into your platform, you unlock untapped potential for revenue diversification for your company. This will increase the value of your platform to your addressable market but also positions you as a vital partner in your clients’ pursuit of financial efficiency and control. Helping your SMB clients with their cash flow makes your platform a cornerstone of their business.

Small and medium businesses are using everything from ledger notebooks to spreadsheets to standalone software packages to SaaS accounting software programs.

Accounts Payable Automation in Small Business by Monite

The question for Vertical SaaS providers is HOW to add this functionality to your business. You’ve focused on becoming the best provider for the businesses you serve, making their unique processes streamlined to make their business more efficient. Now you need to consider how you can help make their business’s finance operations more efficient without changing your strategic focus or product road map.

This is where a company like Monite can help you. The industry’s only “plug and play” API solution that is completely white labeled. You get complete control over the look and feel of the embedded application. The result is compliant invoicing, payment rails, invoice reminders, and payment approval workflows, looking like you’ve spent months or years developing this solution, live for your customers to use in a matter of weeks.

Keep your focus on your strategic initiatives and current product roadmap while 2-3 developers launch embedded invoicing and bill payment functionality that unlocks revenue for you, while making your platform more attractive to your customers.

Case Studies: Success Stories of Embedded Payables Integration

Exploring the real-world impact of incorporating embedded payables and automated invoicing into platforms reveals some compelling success stories underscoring the transformative power of these integrations. One remarkable example involves a digital marketing agency that leveraged embedded payables to streamline its vendor payments. By doing so, the agency not only cut down on administrative overhead by 25% but also enhanced its relationship with suppliers through timely, accurate payments. The ripple effect was a notable improvement in service delivery to their clients, fueled by more efficient and reliable backend operations.

[Automation in finance teams results in cheaper and more efficient financial processes.]

Another case worth highlighting is an e-commerce platform that adopted automated invoicing to simplify its billing process. This move resulted in a striking 35% reduction in the time taken to close monthly financial cycles, alongside a marked decrease in billing discrepancies. This efficiency gain translated directly into better cash flow management, giving the company a stronger financial footing to pursue new growth opportunities with confidence.

These narratives are more than just numbers; they illustrate a clear path to operational excellence and financial robustness for businesses that embrace embedded financial operations. The experiences of these companies illuminate the profound effect that such integrations can have, not just on the operational workflows but also on the broader business ecosystem, fostering stronger, more productive relationships with vendors, improving service delivery, and ultimately contributing to a healthier bottom line.

Implementing Embedded Financial Operations: A Five Step Guide

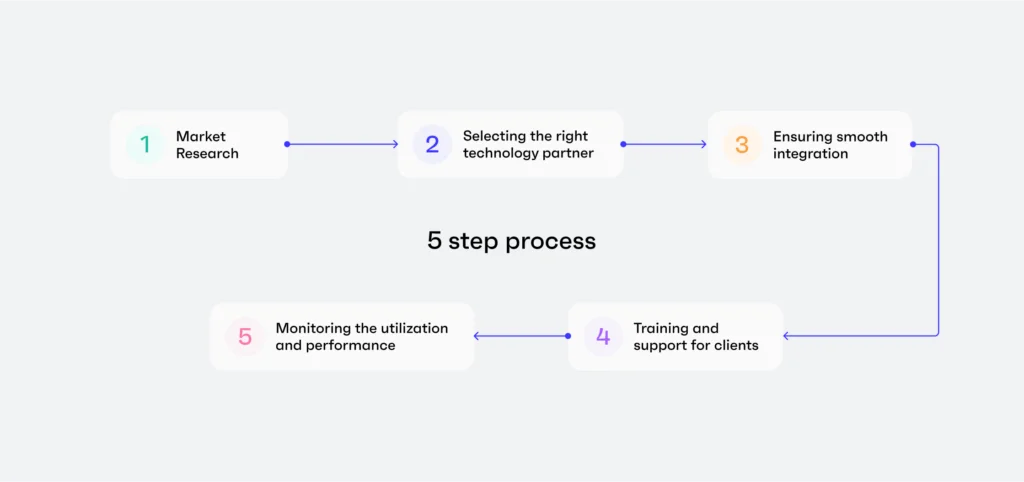

Embarking on the journey to integrate invoicing and payables automation within your platform can be a transformative move, propelling both your value proposition and market positioning. The pathway to seamlessly embedding these financial operations is grounded in a strategic approach, tailored to both your platform’s capabilities and your client’s nuanced needs. Here’s how to navigate this integration effectively:

- Conduct a thorough market analysis to pinpoint the specific financial operations your target audience struggles with. This insight will guide the customization of your embedded financial services to ensure they address real and pressing needs.

- Select a technology partner offering robust and scalable automated invoicing and payables solutions. The right partner should not only align with your platform’s technical requirements but also share your vision for simplifying financial operations for businesses.

- Ensure the integration process is smooth and intuitive, minimizing disruption to your platform’s existing user experience. Seamless integration is key to encouraging adoption and maximizing the utility of the new features for your clients.

- Develop comprehensive training materials and offer dedicated support channels to assist your clients in navigating the new financial tools. Empower them with knowledge and support to leverage these features fully, optimizing their financial workflows.

- Continuously monitor the utilization and performance of the embedded financial operations. Solicit feedback from your users to refine and enhance the functionality over time. This iterative approach ensures that your platform remains responsive to the evolving needs of your client base, solidifying your role as a critical tool in their financial management toolkit.

By adhering to these steps, you position your platform at the forefront of the shift towards more integrated financial operations, offering unparalleled value to your clients and setting the stage for sustained growth and innovation.