Unlock new revenue streams by embedding

invoicing

Add invoicing, bill pay, B2B payments and cash flow analytics to your product. Customize using API building blocks. Go live with 2 developers in 4 weeks.

Get demoBacked by founders & execs of

Trusted by many B2B platforms

Earn 2-5x more per user

It takes up to 2 years and $3-5 million to automate

finance in-house. Go live with 2 developers in 4 weeks.

01

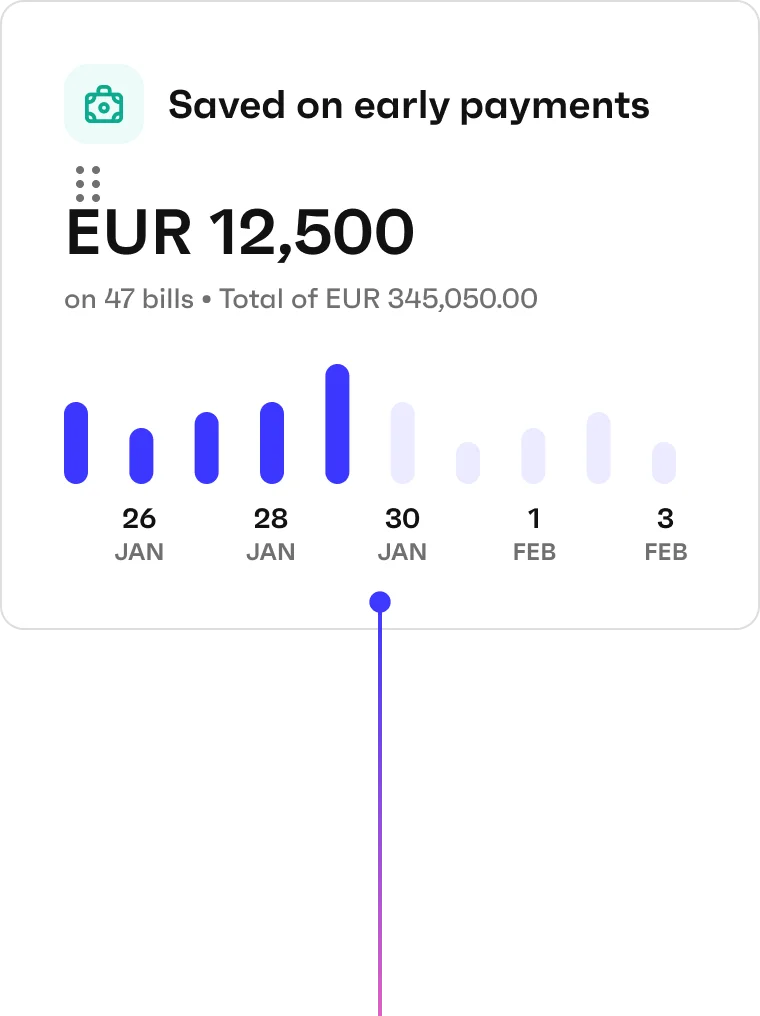

Grow revenue per user 2-5x

- Earn an additional $10-200 per user/mo in SaaS fees

- Expand your revenue and TAM with payments, earning 0.1-2% on each transaction made within your platform

- Get commissions on financial services: BNPL, factoring & more

02

Increase product stickiness

- Become a one-stop-shop for your SMBs. Offer valuable services that make it much harder to switch to a competitor

- New functionality used daily – higher WAU/MAU

- Get more users on your platform – expand your reach to new teams at your SME clients

03

Attract more users

- Win over customers from competitors without new marketing expenses. Create a network effect with an all-in-one offering

- Set your brand apart. Expand your offering to become the go-to player for your industry

- Upsell your current users, so you can invest more into growth

Works best for

-

NeoBanks

-

Vertical SaaS

-

FinTech SaaS

-

Marketplaces

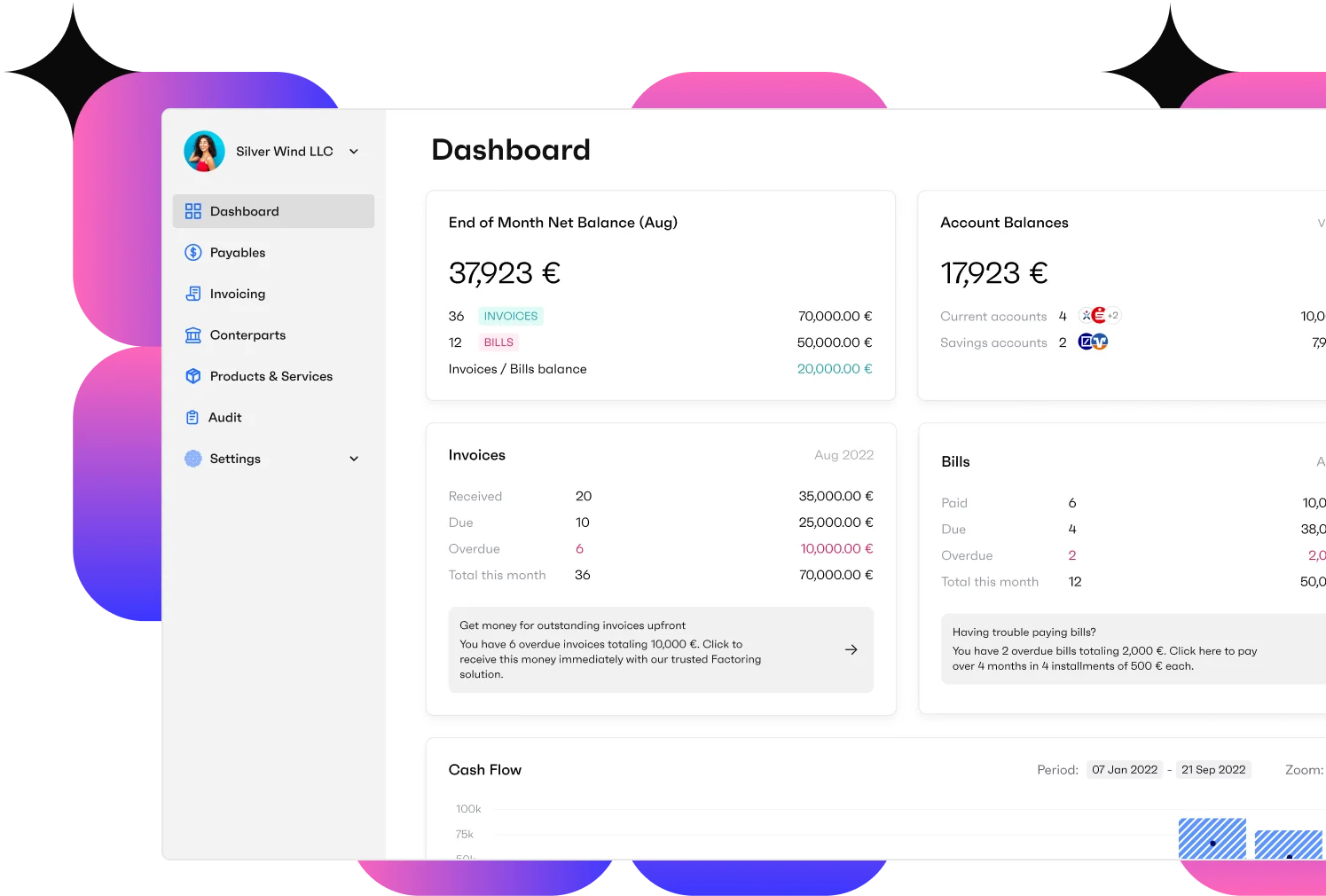

Embeddable workflows

Features that match

top industry players

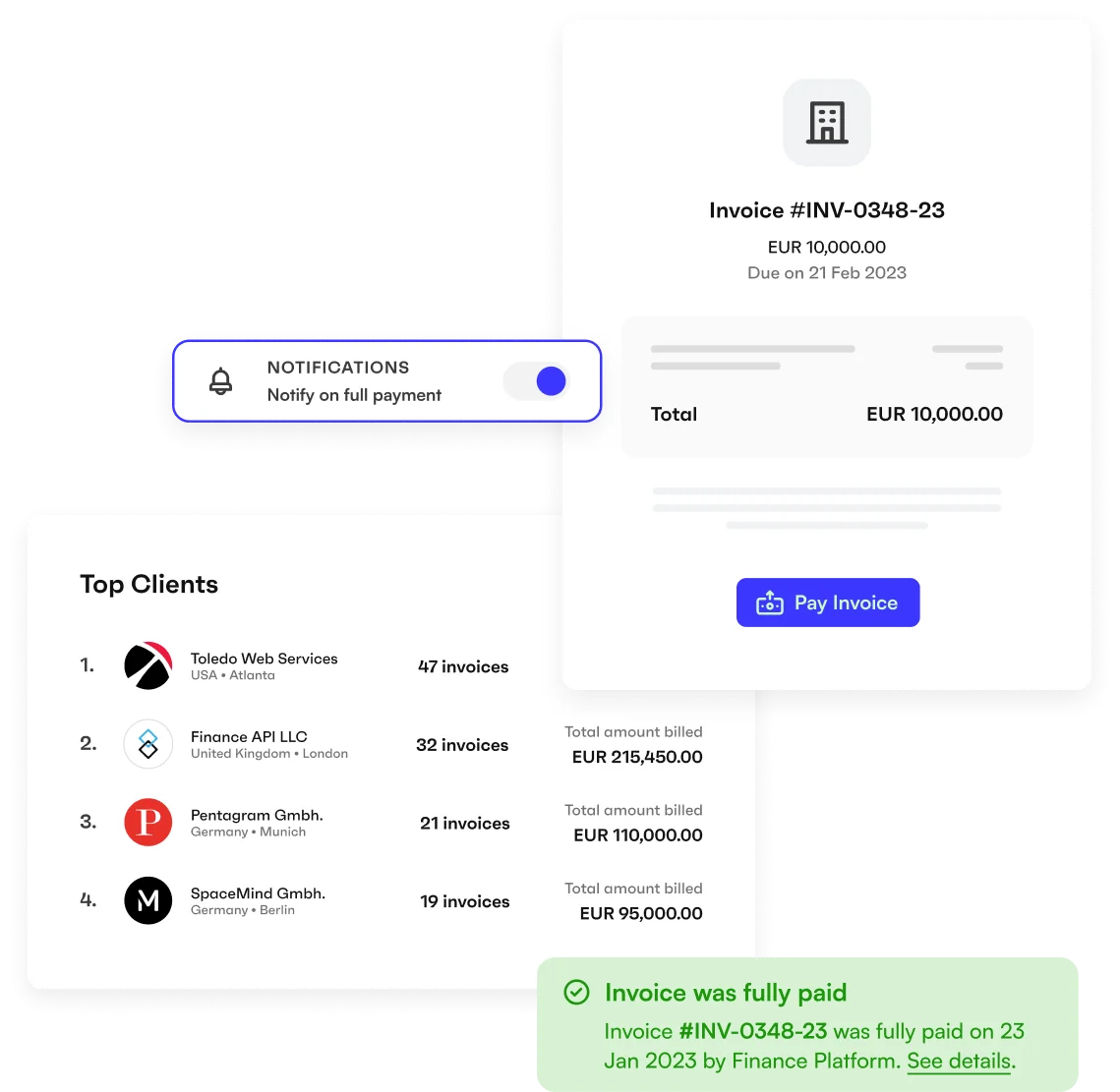

Invoicing & getting

paid fast

90% of SMBs struggle to get paid on time, chasing an invoice payment for X days on average.

Monite lets your customers:

- Add clients & products

- Send quotes

- Send invoices

- Get paid via link

- Overview invoices & statuses

- Send payment reminders

- See revenue analytics

- Integrate with 40+ accounting platforms

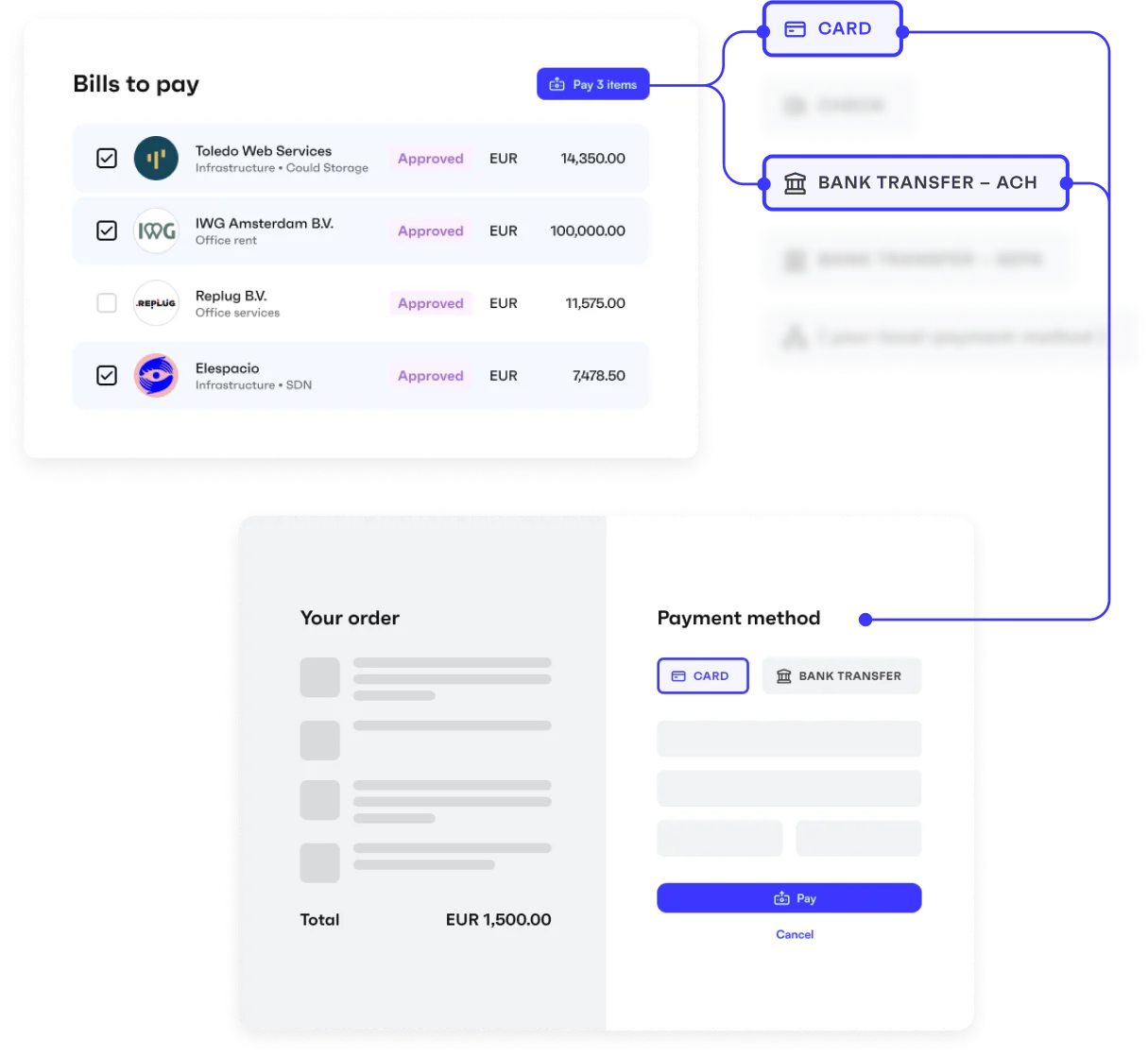

Pay bills & expenses

It usually takes 15-90 days for an SMB to pay a single invoice. Many use Excel and email to handle payables tasks, leading to debts, double payments, audit issues and overspending.

Monite lets your customers:

- Collect bills via email

- Overview payables & obligations

- Build & customize approval flows

- Add comments & to-dos for their team

- Approve bills in one click

- Perform single and bulk payments

- Analyze spending and debt analytics

- Integrate with 40+ accounting providers

Embeddable B2B payments

Someone else earns from your clients’

payments. Take this revenue back.

63% of SMBs struggle with payments, handling them by hand or using multiple providers for

banking, FX, cards, etc. Meanwhile, 90% would prefer a single solution for all of it.

- Payment links

- Bill pay

Success cases

-

Neobanking platform for e-Commerce companies

Thanks to Monite, we enable our clients all across Europe to send compliant invoices and collect payments via payment links. At the same time, we enable our eComm customers to pay suppliers worldwide using Monite’s Accounts Payable functionalities and payment rails

Carlos, CEO

-

Global payrol solution & merketplace for freelancers

We let companies employ people & freelancers globally. With Monite, we are building a finance one-stop-shop for freelancers on our marketplace – so they can manage all their revenue, supplier payments, and more in one interface. Monite also powers up our marketplace payments

Collin, CEO

-

Processing documents, AR & AP via Monite

AR/AP are core to our product, so we looked at multiple providers as well as building in-house. We chose Monite due to their product depth, quality of APIs, and fast development. Working with Monite has been a breeze – a robust API platform, knowledgeable team, and quick support at all times

Jane, CPO

-

Business process automation platform for African SMEs

African businesses waste hundreds of hours on admin work, so we are building a platform to streamline their back office, accounting, and payments. We rely on Monite for core functionalities – Invoicing and Bill Pay. We love Monite’s great service, solid features, and easy-to-use SDKs

Steve, CEO

Become the one-stop-shop for your

industry before someone else does

Be the first-mover. Don’t play catch-up.

-

01

Finance is a pain

Today, SMBs handle finance manually, leading to lost time, money, cash flow and spending control.

-

02

5-7 tools are needed

It’s hard to automate everything. SMBs need to onboard 5-7 specialized tools for finance alone, which is too pricey and complex.

-

03

SMBs want an all-in-one solution

SMBs dream of automated finance management on the platform they use daily.

Once one software demonstrates its value, the customers want to consolidate around it for all its software needs – get a one-stop-shop

…and tens of other reasons

Successful one-stop-shops

-

Started as a POS for restaurants, now all-in-one tech stack for the entire industry

-

78%

of revenues and 97% of ross profit from financial services

-

114%

net retention rate and 18-month payback period.

-

-

Brex started as a credit cards provider for startups and became a one-stop-shop financial system for entrepreneurs

-

78%

of revenues and 97% of ross profit from financial services

-

114%

net retention rate and 18-month payback period.

-

How much more money

can you make with Monite?

Instantly calculate your possible revenue based on your user base

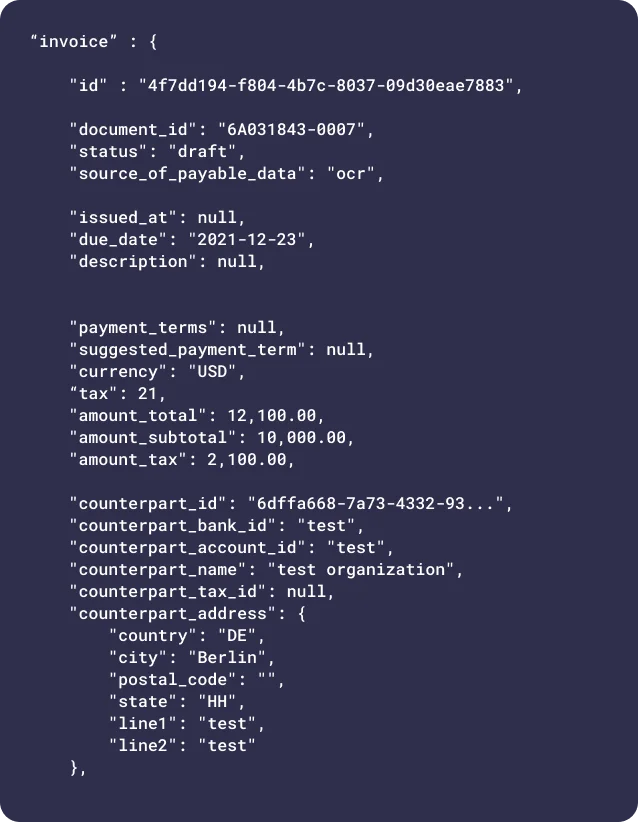

CalculateSave development

time with modular API

A single access point for various capabilities. Construct solutions of any complexity; test new features once we roll them out without the need to reintegrate.

-

Backend integration

2-5 days of work for 2 devs

-

Frontend integration

2-4 weeks with our SDKs; a bit longer if you use your own design system

-

Design

We provide a full guide to UX/UI for each feature and how to get users active

About Monite

Building the future of

financial services

-

Next-Gen CFOs Need Next-Gen Tools to Power Their Organizations

Learn more -

The definitive 100 pioneering digital procurement solutions

Learn more -

Why we pay for employee mentors

Learn more

By providing a tailored and efficient solution through its API-first finance workflows, Monite has the power to unlock an enormous opportunity for the B2B sector, both for SMBs and the platforms serving them, in a repeatable and durable way.

High priority for

your roadmap

Become a one-stop-shop before

your competitors do