It’s all about getting paid

for B2B platforms

Gain insights in the significant challenges SMEs face with getting paid. Explore their current solutions and how you can solve their problems incorporating AR functionality within your platform.

Getting paid fast is essential for a small business to stay financially healthy. In B2B transactions, getting paid can be a real challenge due to extended payment terms. Since payments are often delayed, it becomes challenging for SMEs to keep track of who owes them money and when to expect it.

People start businesses with the aim of generating profits – which means that making money and getting it in the bank is one of the key ongoing tasks they have to deal with. The method through which business owners can receive their payment can vary depending on the nature of their business.

| Payment type | Description | Pain level |

|---|---|---|

| Online payments/checkout | e.g. online subscriptions or buying something on the website and paying for it with a credit card | Low – business is paid at the moment of purchase |

| Offline payment/checkout | e.g. buying something in a store with cash or card | Low – business is paid at the moment of purchase |

| Invoicing | Sending the invoicing for services done/to be done with 0-90/other days payment terms | High – 86% of invoices are paid late affecting SME cashflow |

10 years ago the picture would have looked different – even online payments were hard. Today, there’s an abundance of players to plug in online checkouts into your website. These ranges from turnkey solutions like Shopify or Wix to versatile providers like Stripe and Checkout, as well as industry-specific options like Squire or Motive.

Offline payments have improved significantly as well. What once was a game-changer with square, now there are multiple providers such as SumUp, Zettle, Lightspeed, and other new & traditional players. There are also verticalized specialists like Toast, offering a POS sytem tailored to the specific needs of their business type they focus on.

In recent decades, we saw payments moving online, becoming more lean and automated. Yet for many B2B transactions and for some B2C transactions payments have not improved that much – mainly because the process remained largely untouched when it comes to B2B transactions.

A simplified B2B process looks like this:

- Send the invoice to the client with a grace period of 30/60/90/more days

- Wait for the invoice to be paid

- Chase the payment if it’s not paid (potentially forever)

In the process above, businesses heavily depend on their clients paying the invoice on time. Unfortunately, clients often prove to be inefficient in this regard — they lose invoices, forget about them, or intentionally delay payment to hold on to their cash for as long as possible.

The process of chasing down these overdue payments is mostly manual and incredibly furstrating. It also poses a significant risk to particularly small businesses. These typically lack substantial cash reserves, so if several payments are delayed, it can seriously impact their financial stability and force them into a situation where they need to seek a loan or another financial solution.

Worst of all – many of these businesses aren’t aware they’re falling into this financial trap. Most of them lack real-time visibility into their cash flow. On one hand, they struggle to keep track of which invoices are overdue or about to become overdue. On the other hand, they only see the amount in their bank accounts and remain unaware of the outstanding obligations to their suppliers — leaving them in the dark about their true financial position.

Real-time cashflow simplified:

- Money in bank accounts

- − Outstanding obligations (salaries, payments to suppliers, expenses, etc.)

- + Expected revenue (invoices that are becoming due & other payments)

Revenue collection – biggest pain for SMEs

Revenue collection is one of the biggest pains SMEs have. The numbers below shed some light on the scale of this problem for businesses.

- 87% of SMEs are consistently paid late, disrupting cash flow and limiting opportunities to reinvest revenue

- 48% of SMEs suffer from losing invoice payments or missing payments, directly resulting in loss of revenue

- 50% of SMEs spend 7+ hours per week chasing late payments, distracting employees from their core business operations

- 12% of SMEs hire someone to chase late payments full-time, wasting resources on FTEs that could be strategically invested in staff who drive business growth

- 3.6 h/week wasted on average on manual payment tracking reconciliation, leading to unnecessary costs and potential inaccuracies due to human error

- 71% of SMEs have disconnected invoicing and accounting systems, resulting in excess manual work and a lack of real-time financial insight

Accounts Receivable process explained

Accounts Receivable (AR) is about handling outstanding invoices and payments. Small businesses specifically struggle with this due to the absence of specialized software that's within budget and is easy to use. Introducing AR automation can streamline the process, making it more efficient and cost-effective.

Simply put, accounts receivable (AR) process is the systematic management of outstanding invoices and payments owed to a company by its customers.

A simple AR process starts after service is performed or goods are delivered:

- Invoice is issued

- Invoice is paid

- Payment is reconciled

- Data is transmitted into accounting ledger

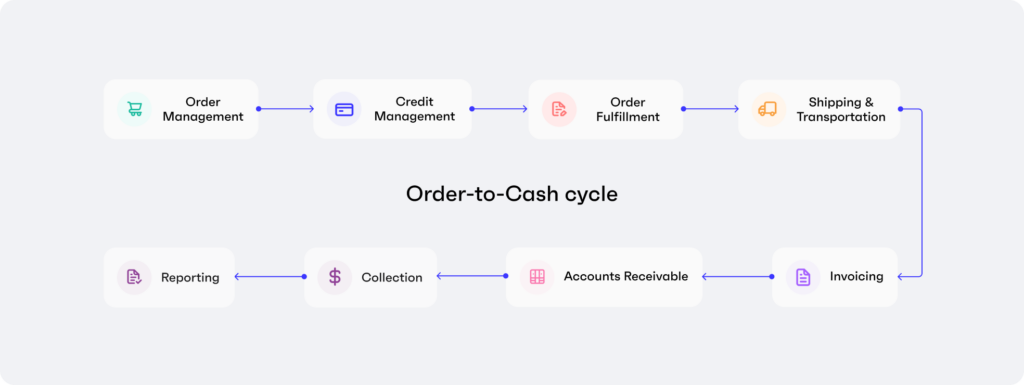

The above is just a simplification – in real life, the Accounts Receivable process is more complex than that. The full process is called Order-to-Cash – also referred to as O2C, OTC, or the quote-to-cash cycle.

A company’s business transaction begins with receiving orders from customers and performing the required services. After the work is done, they invoice the customers and then receive payment. The O2C cycle starts when an order is placed and ends when the payment is received & recorded in the general ledger.

Accounts Receivable (AR) Automation alleviates the pain

Managing orders, offers, and invoices easily becomes a nightmare for small businesses without extensive finance teams. As a result, these businesses often struggle to properly keep track of sent invoices and their due dates – meaning they fail to send timely reminders and run into serious issues with collecting payments.

Most SMEs don’t use specialized software for invoicing. Instead, they rely on basic accounting tools, Microsoft Word and Excel, or even create one-off invoices in free online applications. This makes it hard to automate payments with – for instance, payment links and payment reminders.

The reason why businesses don’t use specialized software is simple — many find it impractical to use specialized software for a different operation in their business. Doing so would require them to adopt a multitude of tools, each catering to a specific area – making it too complex and expensive.

Nevertheless, SMEs would greatly benefit from Accounts Receivable Automation software, but then added within the platform they’re using every day for their business. They’d only pay a slightly higher bundled price, without needing to add or learn a new tool, while solving one of their key painpoints: collecting revenue.

AR impacts cash flow

Today’s status quo brings another challenge to SMEs. Due to the lack of proper insight or automation, business owners don’t know when they should take action regarding debt collection or consider services like factoring.

To make matters worse, hardly any invoicing or accounting tools offer a seamless integration with cash advance, factoring, or debt collection services. Instead, each of these services operate in silos: invoicing software is solely for creating and sending invoices, while factoring/cash advance providers function separately and require a business to register. In the end, uploading invoices requires many manual steps.

Invoicing → Revenue management

It becomes obvious that SMEs require more than just invoicing to address their “get paid fast” challenges; they need full revenue management functionality.

The difference between the two becomes very apparent if we look at the scope of the two solutions.

| Invoicing | Revenue management |

|---|---|

| Customer & product management | Customer & product management |

| Send offers | Send offers |

| Send invoices | Send invoices |

| Send data to accounting systems | Send data to accounting systems |

| – | Payment links |

| – | Payment reminders |

| – | Dunning mechanism |

| – | Cash advance & working capital |

| – | Factoring capability |

| – | Debt collection capability |

| – | Predictive cashflow analytics |

Today, there are almost no systems in the market that offer a full revenue manage capability. While many offer invoicing software, there is a significant gap when it comes to a complete system for revenue collection. We believe this is where the opportunity is.

Why offer Revenue Management to your business clients?

SMEs struggle with revenue collection but find standalone AR Automation solutions costly and complex. Platforms that integrate AR Automation into their existing services can enhance value, become primary B2B payment providers, and attract more users, following the success of companies like Toast and Brex.

SMEs are struggling with revenue collection and need help. They are increasingly open to using AR Automation software. BUT -it’s expensive and complex to implement a standalone solution.

As mentioned, most SMEs prefer to manage their revenue within the platforms they use daily, such as neobanks, vertical Software as a Service (SaaS) providers, or other tools they’re already familiar with. Since they’re accustomed to these software platforms already to manage their business, it’s much easier to switch from Word/Excel than to buy and learn new software.

In general, most businesses want one platform to run their business – it’s easy, efficient, and inexpensive compared to using 5-7 different tools. In response to this many neobanks, vertical SaaS players, and others are expanding their financial offering, aiming to become super-apps. This wave is just starting, but there are already champions we see in some segments of the market – for example, Toast in the restaurant industry, or Brex in the scale-ups ecosystem.

Now, you might be wondering, what’s in it for you? Well, there are numerous reasons why platforms start offering AP Automation to become the one-stop-shop solution for their customer.

Offering AR Automation to your business clients allows you as a platform to:

- Offer higher product value

- Become the core B2B payments provider to your clients

- Increase engagement, retention, and loyalty

- Increase revenue per customer – with SaaS & payments fees

- Attract more users as your offering becomes more compelling

- Surpass competition – hard to get clients who do AR with a competitor

We want to highlight one point here – being in the flow of B2B payments to your clients is key to great customer monetization.

Toast, for example, drives over 80% of their revenue from payments. However, it’s the software that enables you to monetize payments and drives the usage in the first place. So if you offer AP & AR Automation to users, you basically become their cashflow management platform, meaning you can monetize:

- All incoming payments (AR) – Payment links, BNPL for the end client, invoice factoring and more

- All outgoing payments (AP) – Single & bulk payments, BNPL, bill pay w/credit card, scheduled payments and more

- Cashflow gaps – Working capital optimization through financing, business loans, etc.

How can you monetize Revenue Management functionality?

You can charge for the software, transaction payments, and financial services to monetize revenue management. If you offer AR Automation as part of a one-stop solution, you can help your clients save costs. In addition, you can also earn payment fees (e.g. % of each transaction) from payment methods used to collect invoice revenue, potentially generating significant margins.

The best way to monetize revenue management functionality is to take a revenue cut from multiple sources – a fee for the software itself, payment fees for processing transactions, and financial service fees for features like cash advance or factoring.

Invoicing tools typically charge a basic monthly fee – ranging from free to $100s per month – depending on the level of automation, sophistication and their market positioning. Additionally, those that are payment-enabled can also monetize payments, attaching payment links to invoices, taking a cut when the user is paid. Depending on the client base, revenue from payment fees can account for up to two-thirds of the platform’s total revenue.

If you’d offer the full revenue management, you can potentially increase your earnings up to 2-5x the monthly + payment fees combined.

So when you offer Revenue Management software to your clients, you can monetize through:

- SaaS fees – Add AR to a premium package or charge a separate fee for AR functionality

- Payment fees – Get a % for each invoice paid with a payment link

- Financial services revenue – Get a % of each invoice that was used for cash advance, factoring, or debt collection

SaaS fees

Even though AR Automation functionality is adding a ton of value, you can’t offer it for a similar price like Radius or other competitors in the space. These companies specialize exclusively in AR Automation, so they can’t reduce their prices. As a result, they might lose potential clients who find their services too costly.

Being a one-stop-shop solution with AR Automation included allows you to offer more competitive prices to users – you could save them 2-5 times the costs compared to a standalone player.

- Adding AR into a premium package – this means quite a substantial de-facto discount on AR Automation functionality since only a fraction of the premium plan’s price can be attributed to AR. This approach is most effective when your premium package is already highly priced and produces high ROI – then discounting AR functionality will pay off

- Pricing AR Automation as an extra feature – this is the best strategy for most cases, as it simplifies revenue tracking and attribution to AR. For clients, this means they can use AR functionality when they need it, rather than being tied to a bundle that may include services they don’t require

Payment fees

Almost any payment these days costs money – and businesses are used to that. Moreover, they’re usually happy to pay extra for automation, convenience, and speed. When it comes to AR Automation, having payments as a part of your flow is invaluable – it helps your clients get paid faster and solves the reconciliation pain – as in that case payment is auto-connected to the invoice.

Here are the main payment methods you can monetize

- SEPA: Possible margins from €0.05 per payment and €9.50 for each active account. SEPA direct debit is a widely accepted and cost-effective method for B2B payments in Europe

- Cards: Margins of up to 0.4% of the payment. Card payments are widely accepted, making them one of the most convenient and common methods for transactions in today’s digital economy

- ACH: Margins go up to $4.50 or 1% of the payment. For each user, you can profit up to $8 per month, along with a one-time fee of $5. ACH is the preferred payment method for most B2B transactions in the US

- Buy Now Pay Later: Ranging from 2% to 8% for installments over 3, 6, and 12 months, respectively. This allows your clients to settle an invoice 30/60/90 days or even later past the due date

- Partial Payments: Ranging from 1% (for a 30-day term) to 4% (for a 90-day term). This option enables your clients to break down payments into smaller, more manageable installments

- Bulk Invoice Payments: The profit margins are in line with ACH, multiplied by the number of invoices paid. Your client can select multiple invoices to pay in one go, with support in the US provided by the ACH network

How hard is it to build AR Automation functionality?

To create a best-in-class AR Automation product, it's essential to provide all of the core functionalities. In addition, having accounting integrations seamlessly synchronized, ensuring regional tax compliances and adding integrated payments is what makes building AR automation complex.

Core AR Automation functionality

To develop a complete AR automation product that works smoothly, you need a robust set of core functionalities to bring it all together.

Data integration and extraction

- Data pull from accounting systems

- Customers database with flexible fields

- Products and services database

- Data push into accounting systems

- Conflict resolution capability

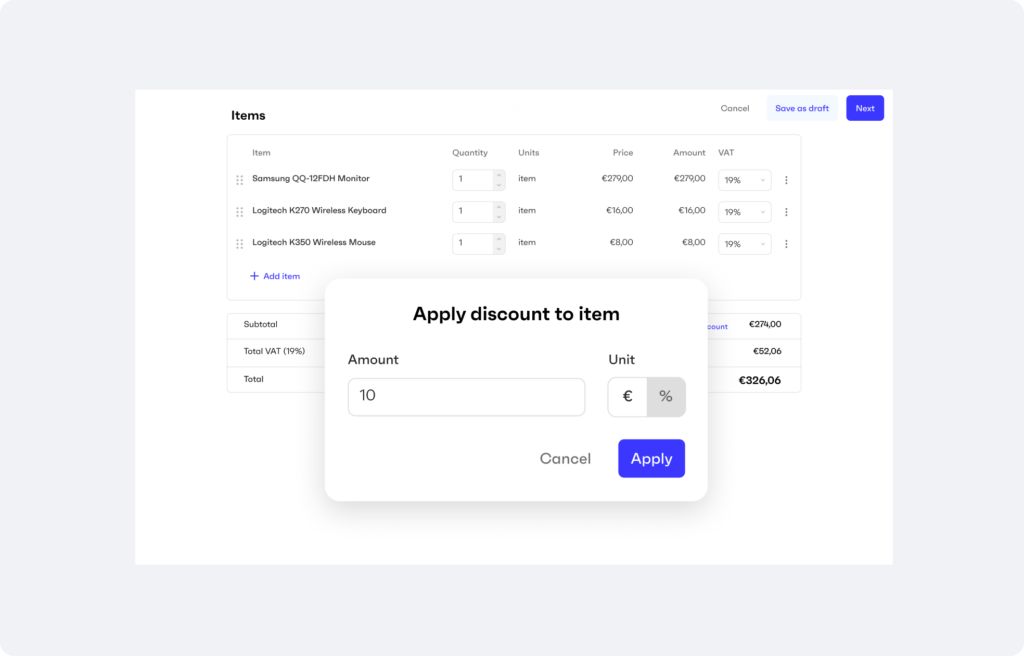

Customization and structuring

- Support for custom payment terms – per counterpart, project, or more

- Discounts management – per item, invoice, project, etc.

- Labeling & categorization for project management and more

Compliance

- VAT & tax compliance service

- Compliance system for document templates

- e-Invoicing compliance for applicable markets

- Functionality to issue compliant quotes

Invoice creation

- Ability to convert quotes to invoices manually/automatically

- Invoice creation functionality

- Credit notes issuing functionality

Payment processing

- Invoice payment links

- Basic payment reconciliation logic

- Advanced reconciliation options – partial payments, currency conversion, cash payments, and more

- Advanced KYC/KYB aligned across payment providers

Additional features

- Connectors to financial products like cash advance

- Data-driven upsell of financial products

- Accounting categories coding system

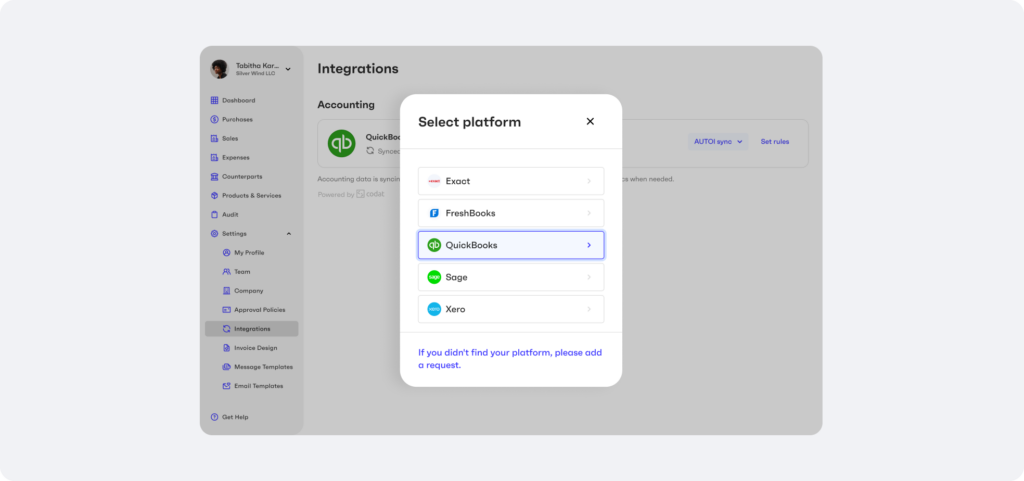

Accounting integration

To effectively implement AR Automation for clients, a seamless accounting synchronization is crucial. This often involves a complicated process, including the development of multiple API connections, data processing logic, conflict resolution mechanisms, and more.

In the AR process, one of the first steps your client would take is transferring data from their accounting systems into the platform. However, creating these integrations is more challenging than it might initially appear.

Small and medium-sized enterprises (SMEs) use a diverse range of accounting systems – there is not a single dominant platform. So it may as well be that you need to integrate with 15+ accounting systems to fully serve your customer base effectively.

Each accounting system has its unique way of handling data, ledger management and other functions. This means that there’s no one-size-fits-all approach to integrating accounting systems; each requires a tailored approach with customization. While integrators like Codat or Rails are available to streamline this process and save time, they’re expensive and often lack essential features such as data model standardization, API versioning and conflict resolution capabilities.

- Standardizing Data – accounting platforms vary significantly in how they manage data, containing numerous data types, each with its specific nuances. For example, different regions use distinct date formats and their own terminologies. A standardization layer is necessary to address these variations to make sure data is consistent across your platform

- Standardizing APIs – in a typical integration development scenario, you would have to handle your development processes separately for each accounting platform. However, for a more efficient approach, when dealing with 15+ integrations in parallel, it’s essential to build an standardization layer. This will streamline the process, making it much more straightforward as you’ll only need to interact with a single API, eliminating the need to make individual updates for each accounting platform

- Standardizing Configurations – the last piece where standardization is required is in how one change to synchronization, authorization or alert functions will be applied across all of your integrations

- Conflict resolution – an even more challenging aspect of accounting integrations is how to solve conflict resolution when data between two or more connected systems aren’t aligned. To address this well, you need a system capable of identifying these disparities.

For example:

- Imagine that someone manually entered information into two connected systems, now there are records with different ID numbers. You now need to find a way to merge these two records.

- Another common issue is when one system lacks data that is required by the other. You’d need to find a clever solution looking at common data points to send the right data from one to the other system.

Developing such an integration typically requires a year of dedicated effort from a senior developer. The workload is evenly split, where half of the time would be allocated on solving the standardization issue, and the other half focused on a solution for conflict resolution. This shows how complex building a best-in-class accounting integration system can be.

Regional tax compliance

Invoicing is usually highly regulated by tax authorities and there are a lot of requirements regarding document format, mandatory fields, VAT rate assignments, and more. Adhering to these regulations is necessary for all documents – ranging from invoices to delivery notes – otherwise, they might be inadmissible for tax purposes.

Developing and implementing compliance logic and engine can be one of the most challenging aspects of establishing a robust AR product. These engines must operate across multiple geographical regions, accommodate various business types, and address numerous edge cases.

This is where Monite comes in. Our solution comes with regional tax compliance included, covering document formats, VAT logic and more. Essentially, it’s a plug-and-play system.

Payments

The AR process is largely to collect money from customers. That is why a robust payment infrastructure is required to support this.

Payment links

The most basic version of to get paid is by attaching a payment link to every invoice that goes out or sending the link through email or text. While many invoicing solutions only offer payment options with cards or local methods (e.g. iDEAL, Bancontact, Cartes Bancaire, over 50% of invoice payments are still processed through ACH/SEPA banking networks. That’s why we emphasize the importance of incorporating ACH/SEPA payments within payment links – next to cards and local payment methods.

To design and offer a strong payment links product, platforms need to:

- Run a provider analysis and select providers for each payment type

- Integrate these selected providers

- Streamline an onboarding flow that satisfies all of the due diligence required from the payment providers

- Create a payment page product that consolidates multiple providers into a single interface

- Establish a reconciliation mechanism for each payment option

Financing options

For a comprehensive revenue collections process, it’s also crucial to provide solutions like factoring and cash advances. This by itself requires a wide set of logic and functionalities that contextualize the offering of these financial services and present the right offers and the right time to the right customer.

Also, financing products are usually very focused on a specific region (e.g. UK vs US) or business type (eCommerce vs Construction company), meaning that you will need to build a layer to connect multiple providers.

To offer robust financial services upsell functionlity, platforms need to:

- Build a universal connections layer

- Run provider search per end client type & region

- Select and integrate multiple providers

- Design custom logic how to offer financing options to clients

- Create a unified data collection process for credit underwriting

- Create reconciliation mechanism for each financing option

- Design all the flows related to financial products

KYC/KYB for payments

To use payment links or any other payment services, those sending invoices are typically required to complete a basic KYC/KYB (Know Your Customer/Know Your Business) process mandated by the payment provider. Often, different payment providers are used for different payment methods. This means that the client needs to undergo multiple KYC/KYB processes in order to use payment links. During this procedure, they are often required to provide information that platforms partially already have the initial onboarding. Such complexity can easily affect the adoption rate for payment links or other payment options.

To make this process smooth, Monite offers a unified onboarding product that allows platforms to:

- Do one KYC/KYB process that covers all providers simultaneously

- Store the data for future KYC/KYB processes – so no re-collection is needed

- Use all their existing customer data & ask only for missing fields

So what’s the alternative?

Strategy 1: Building Your Own AR Automation

You can either build AR Automation in-house, which takes a lot of time and money and might not be as competitive as specialized providers, or you can consider acquisitions as a quicker way to add invoicing automation, though it can be expensive.

There are a few large players that invested millions in building their Invoicing module in-house – e.g. Revolut or Oxygen. For players this size when the market offers cheap capital it’s a possible solution if they see AR capability as a core one for their strategy.

Finance automation products are complex to build – especially because they require covering a lot of edge cases. This is why to build a robust AR Automation solution you’ll likely need:

- 10-28 months of time – depending on the scope you want to build, level of expertise and agility in your team

- $600k to $9mn budget – depending on the type of end client and breadth of the solution

- $300-900k – annual maintenance and additional development costs

- A specialized product squad:

- Product people with AR Automation expertise – very hard to find

- Devs with expertise in payments/similar areas – creative thinkers who know how to take care of many edge cases

- UX designers – who built workflow products before and know how to make them very easy to use

What’s important to remember here though are two things:

- In-house built for super-apps is rarely competitive compared to a specialized provider – e.g. like Invoice2go

- Building in-house means not only building cost – but also continuous investment to maintain the product and grow its competitiveness as compared to vertical specialists

As a result, in-house builds take long and require a large investment.

M&A (Mergers & Acquisitions) is another route to add invoicing automation for your clients. It is very costly, but allows to go to market quicker and also grow your user base. For instance, SumUp, a leading European POS, acquired invoicing software Debitoor. Of course, this is an option for those who can afford an acquisition.

Strategy 2: Embedding AR Automation functionality

Monite, as an API-first player, offers flexible building blocks for AR Automation. This approach allows platforms to quickly add advanced AR Automation features, control the user interface, and expand modularly.

Up until 2022 M&A and building in-house were the only options. In 2022 a new market emerged in Embedded Finance – called Embedded ERP or Embedded AP/AR. We at Monite were the first international API-first player in the segment.

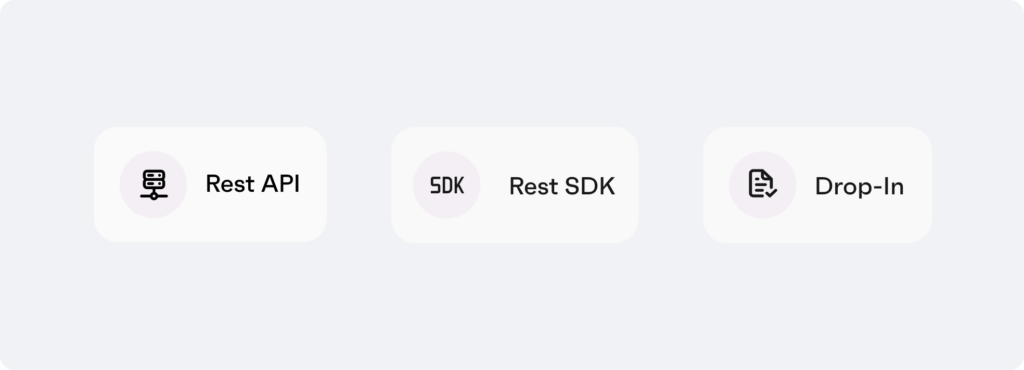

What we basically did is we built functionalities like Freshbooks and other AR Automation players – but we built them as flexible API blocks. This means that any platform can save 90-95% of development and maintenance costs and plug in those pieces in the way that works best for their clients in a couple of days. The backbone and all key functions are there, so all you need to do is to present the experience and interface that are optimal for your business users.

We made a $10mn+ investment to date into building a robust AR Automation solution, and we’re far from being done here. It’s expensive to build. The good news is that you don’t have to spend that money now – using our API you can go to market not with an MVP but with a product that is on the top players level and makes you very appealing compared to even specialists in the space.

3 great things to point out here

- User always sees your interface & thinks you built it – that’s because we’re API-first and you fully control UX/UI for the user, Monite is nowhere to be seen

- You can go live with 2 developers in 2 days to 2 weeks, and with a sub-$100k investment

- The solution is built modular like a big box of legos, allowing your more experienced partners to create value adding functionality on top of our core AR functionality, e.g. project management, budget management and analytics

What’s included in Monite API?

Monite provides a robust API that allows you to roll out a highly competitive AR Automation solution for your clients in just two weeks. Your users will have top-tier features, equivalent to or better than those offered by leading providers like Bill.com. These features are seamlessly integrated into your platform, branded under your name, and supported by our API.

Monite provides a developer-friendly API platform with a lot of different functionality that is essential to launch a competitive AR Automation product.

Platform

- Flexible API building blocks – all the functionality is built, you just decide how to plug it in and how you want it to work

- Fast back-end integration – ±1-2 days for a full backend integration

- Multiple options for frontend – pre-built frontend components (±2 days to integrate), SDKs (±1-2 weeks), or a fully custom built that you can do (usually ±3-6 weeks)

- Enterprise-grade security – API security is integrated across all layers of our platform, including internal development processes and partnerships with industry-recognized technology vendors

- Robust SLAs – dedicated to achieving the highest platform availability SLAs and have a proven track record of consistently meeting them

AR Automation functionality

- Data push and pull with accounting systems – we allow you to sync data from most major accounting systems. All it takes is for your users to authorize the connection. That way you can avoid starting from scratch and immediately make sense of historical data that is available while ensuring that all the invoices and transactions data will be automatically synced with the client’s accounting system

- Customers database – ability to create & store new clients and partners, comes with customizable fields and settings, e.g. preferred accounts, payment methods, and more

- Payment terms service – ability to set multiple payment terms based on conditions, customer, etc.

- VAT service – ability to provide a list of applicable and compliant VAT rates based on the region, business and product type, and more

- Discounts service – an ability to add discounts on invoices, items, or other basis. Ability to add discounts based on specific rules to reflect promotions happening, and more

- International document compliance – compliant format for each document type based on the business location, tax regulation, and many other parameters

- Sending quotes – ability to send a commercial offer to clients. Quotes can be accepted online or replied to with comments for easy adjustment, and then edited for resending

- Quotes to invoice conversion – auto or manually convert accepted offers to invoices

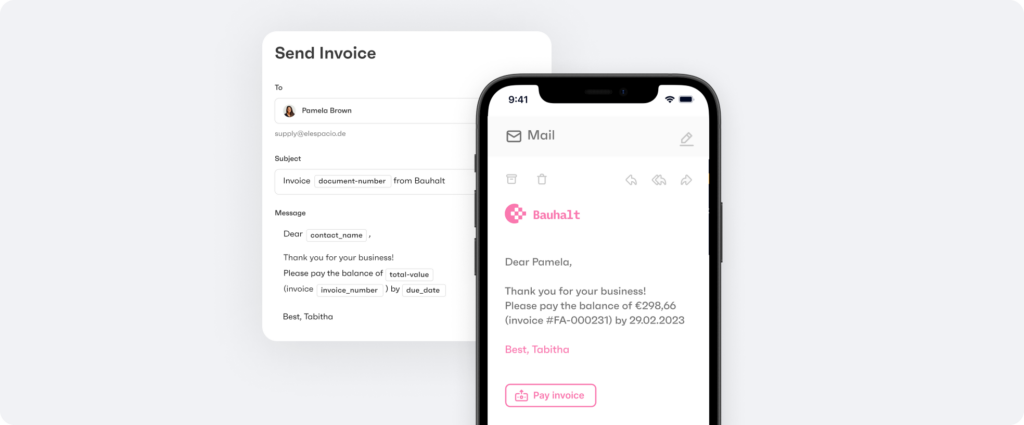

- Sending invoices – invoice clients with professional-looking invoices, including custom notes and any context needed around the deal

- Custom email design and copy – customize the email templates that the end clients will receive, connect your own email domain, and more

- Recurring invoices – send invoices on a specific cadence

- Compliant invoice editing – changing invoices in a compliant manner accepted by the tax authorities

- Self-invoicing – automatic invoicing issuing based on the work done – e.g. On behalf of contractor once the job has been submitted and approved

- Invoice payment links – ability for the end client to pay the invoice with card, ACH/SEPA or local payment methods

- Light & unified KYC – do one KYC for multiple payment methods, use your existing customers data to speed up the KYC process

- Payment reconciliation – connecting invoices to payments, auto-marking invoices paid

- Multi-payment support – ability to log multiple payments per invoice, including bank, cash, and other payments

- Support for partial payments – ability to recognize partial payments, including setting thresholds for currency conversion or bank fees difference when invoices appear e.g. 98% paid

- Compliant payment reminders – ability to set custom compliant reminders for unpaid invoices

- Compliant dunning process – sequence of steps allowing to then submit the invoice to a collections agency or similar

- Credit notes – ability to cancel invoices in a compliant way, while sending or just storing a cancellation note

- Data push into accounting systems – all the invoices and transactions data will be automatically synced with the client’s accounting system

- Conflict resolution capability – ability to find, flag, and resolve conflicts between the accounting system and your system. This is requires to perform automated two-way data syncs with accounting platforms – a must-have for any business

- Audit trail – full log of events and changes, which is required for most of internal/external audits and for finding errors

How to get started?

Learn more about our AR Automation solutions and features on our Accounts Receivable page.

A great way to get started is to get a demo of Monite – just request it via a link and we will find the time to connect you with one of our product experts.

As we continue the talks, we will help you build a business case and a revenue projection for AR Automation functionality. At the same time, we will provide all the necessary tech & product documentation, so you can assess the Monite API from the perspective of shipping the right value to your users.